Jio-bp Transportation Fuels Volumes Up Sharply by 35%, Supporting O2C EBITDA growth

FinTech BizNews Service

Mumbai, July 18, 2025: Reliance Industries Limited (RIL) today declared its CONSOLIDATED RESULTS FOR QUARTER ENDED 30TH JUNE, 2025.

Following is CONSOLIDATED RESULTS of RIL FOR QUARTER ENDED 30TH JUNE, 2025.

Highest-Ever Consolidated Quarterly EBITDA And Net Profit

Jio Surpasses 200 million 5G Subscribers, 20 million Home Connections

Jio Platforms EBITDA up 24% Y-o-Y at rs18,135 crore, Margin up 210 bps

Reliance Retail EBITDA up 13% Y-o-Y at Rs6,381 crore, Industry Leading EBITDA Margin

JioMart Quick hyper-local daily orders up 175% Y-o-Y and 68% Q-o-Q

Jio-bp Transportation Fuels Volumes Up Sharply by 35%, Supporting O2C EBITDA growth

JioHotstar Delivers Biggest Ever IPL, Averaged 460 million+ MAUs

Quarterly Performance (1Q FY26 vs 1Q FY25)

Gross Revenue increased by 6.0% Y-o-Y to Rs 273,252 crore ($ 31.9 billion)

o JPL revenue increased by 18.8% Y-o-Y due to strong subscriber growth across mobility and

homes, increased consumption and sustained positive momentum in digital services.

o RRVL revenue increased by 11.3% Y-o-Y. All segments performed well, with market leading

performance in grocery and fashion.

o Oil to Chemicals (O2C) revenue decreased by 1.5% Y-o-Y due to a fall in crude oil prices and lower

volumes on account of the planned shutdown. Segment revenues were supported by increased

domestic placement of transportation fuels through Jio-bp.

o Oil and Gas segment revenue decreased by 1.2% Y-o-Y mainly on account of lower sales volume

of KGD6 gas with natural decline in production, lower gas price for CBM and lower crude price

realisation. This was partly offset with improved KGD6 gas price realisation.

EBITDA increased by 35.7% Y-o-Y to Rs 58,024 crore ($ 6.8 billion).

o JPL EBITDA increased by 23.9% Y-o-Y driven by strong growth in ARPU and 210 bps margin

expansion led by operational efficiencies.

o RRVL EBITDA increased by 12.7% Y-o-Y led by strategic initiatives, operating leverage and cost

discipline.

o O2C EBITDA increased by 10.8% Y-o-Y due to favourable margin on domestic fuel retail,

improvements in transportation fuel cracks and PP, PVC delta. This was partially offset by lower

volumes on planned turnaround and decline in polyester chain margins.

o Oil and Gas segment EBITDA decreased by 4.1% Y-o-Y on account of lower revenues coupled

with increase in operating costs due to higher maintenance activities during the quarter.

o Other income includes Rs 8,924 crore, being proceeds of profit from sale of listed investments.

Depreciation increased by 1.8% Y-o-Y to Rs 13,842 crore ($ 1.6 billion).

Finance Costs increased by 18.9% Y-o-Y to Rs 7,036 crore ($ 820 million), largely due to

operationalisation of 5G spectrum assets.

Tax Expenses increased by 11.7% Y-o-Y at Rs 6,465 crore ($ 754 million).

Profit After Tax and Share of Profit/(Loss) of Associates & JVs increased by 76.5% Y-o-Y to Rs

30,783 crore ($ 3.6 billion).

Excluding proceeds of profit from sale of listed investments, EBITDA increased by 15% and PAT was

up 25% Y-o-Y.

Capital Expenditure for the quarter ended June 30, 2025, was Rs 29,875 crore ($ 3.5 billion).

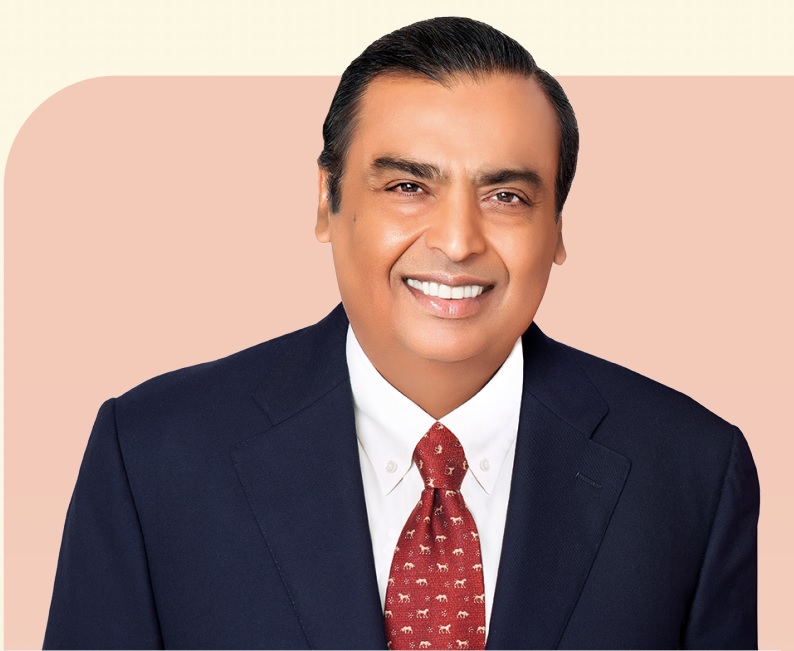

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance

Industries Limited said: “Reliance has begun FY26 with a robust, all-round operational and financial

performance. Consolidated EBITDA for 1Q FY26 improved strongly from a year-ago period, despite

significant volatility in global macros.

During the quarter, energy markets encountered heightened uncertainty, with sharp fluctuations in crude

prices. Our O2C business delivered strong growth, with thrust on domestic demand fulfillment and offering

value-added solutions through Jio-bp network. Performance was supported by improvement in fuel and

downstream product margins. Natural decline in KGD6 gas production resulted in marginally lower EBITDA

for Oil & Gas segment.

Retail’s business performance registered customer base expanded to 358 million, along with significant

improvement across operating metrics. We are focusing on strengthening the portfolio of own FMCG

brands, which resonate with the tastes of Indian consumers. Our Retail business continues to enhance its

ability to fulfill everyday as well as specialized needs of all customer cohorts, through a multi-channel

approach.

I am happy to share that Jio has scaled newer heights during the quarter including crossing 200 million 5G

subscribers and 20 million home connects. Jio AirFiber is now the largest FWA service provider in the

world, with a base of 7.4 million subscribers. Our Digital Services business consolidated its market position

with a robust financial and operational performance. Through its differentiated offerings across mobility,

broadband, enterprise connectivity, cloud and smart homes, Jio has positioned itself as the technology

partner of choice for Indian consumers.

Reliance’s Media business has emerged as a one-stop platform for entertainment, sports and news content

from all over the world. We will continue to enhance our suite of offerings across genres to cater to the

discerning Indian audience.

Reliance is committed to contribute to India’s growth this journey through inclusive growth, technological

innovation and leading energy transformation. The performance of our businesses and growth initiatives

gives me confidence that Reliance will continue its stellar track record of doubling every 4-5 years.”