ICRA: 20% of global oil and LNG is traded through Strait of Hormuz; the escalating tensions in conflict threatens global oil supply

FinTech BizNews Service

Mumbai, June 22, 2025: The Iran’s parliament has reportedly approved the closure of Strait of Hormuz today after the US air strike on its nuclear sites. Although the final decision to close Strait of Hormuz lies with the Iran’s National Supreme Security Council.

Meanwhile, the latest ICRA Report analyses the potential implications of escalating tensions in the Strait of Hormuz (SoH) on global energy markets and India’s economy. The report states that Strait of Hormuz conflict threatens global oil supply, and it may strain India’s current account.

Key findings:

· The Strait of Hormuz (SoH) is a key energy choke point through which almost 20% of global oil and LNG is traded.

· Any escalation in the conflict in the area could significantly impact global supplies and prices. Increase in crude oil and gas prices will be positive for the profitability of upstream companies even as marketing margins of downstream players are adversely impacted.

· Iran’s crude oil production is around 3.3 mbd, of which it exports 1.8-2.0 mbd. While Iranian oil and gas facilities have reportedly been attacked, the extent of damage is not clear. However, any disruption of Iranian production and supplies or a wider regional conflict impacting other large producers in the region could push energy prices higher.

· Crude oil imports from Iraq, Saudi Arabia, Kuwait and the UAE that pass-through SoH account for 45 50% of total crude imports by India. About 60% of the natural gas imports by India pass through SoH. At these elevated crude oil prices, while the profitability of upstream players will remain healthy and their capex plans will remain intact, the marketing margins of downstream players will be impacted along with the expansion of LPG under-recoveries.

· ICRA expects crude prices to average between $70-80/bbl for FY2026. A sustained flare-up in the conflict poses upside risks for our estimates of crude oil prices, and consequently of net oil imports and the current account deficit (CAD). A $10/bbl increase in the average price of crude oil for the fiscal will typically push up net oil imports by $13-14 billion during the year, enlarging the CAD by 0.3% of GDP.

If the price persists at the current levels, it may not lead to a material revision in our GDP growth forecast, which is currently pegged at 6.2% for the fiscal. However, a sustained rise from the current levels would weigh on India Inc.’s profitability and the extended uncertainty may further delay private capex, which could result in a downward revision in our GDP growth projections for the H2 FY2026.

The SoH is a major trade route from West Asia to the rest of Asia. It supports movement of around 20% of the world’s oil consumption, largely emanating from Saudi, UAE and Qatar.

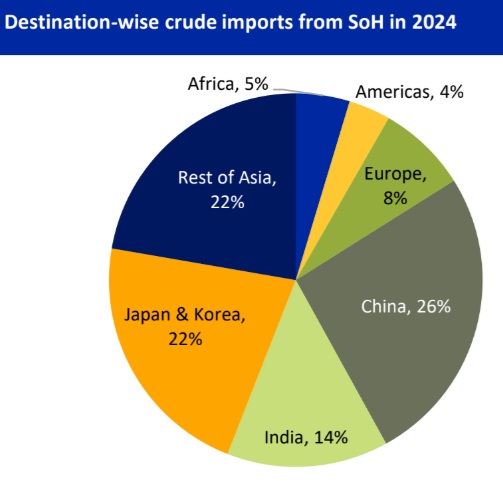

Of the around 20 mbd of oil supplied through the SoH, more than 80% is consumed in Asia, of which China, India, Japan and South Korea together account for around 65%.

Almost 45-50% of India’s crude imports are routed through SoH.

There are limited alternative options for the evacuation of crude from West Asia. Saudi Arabia and the UAE have pipelines in place with a surplus capacity of around 2.5-3.0 mbd, leaving a significant supply at risk, in case the conflict heightens.