June-24 trade deficit came at USD 21 bn; both exports and imports registered sequential declines

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking

YES Bank

Mumbai, July 15, 2024: India’s Trade Deficit for June came to USD 21 bn vs USD 23.8 bn in May with sequential declines reported in both exports and imports. On YoY basis, both exports and imports registered growth, though lower than the previous month. Non-oil exports were lower at USD 29.7 bn, in consonance with weakening macro data in major export destinations.

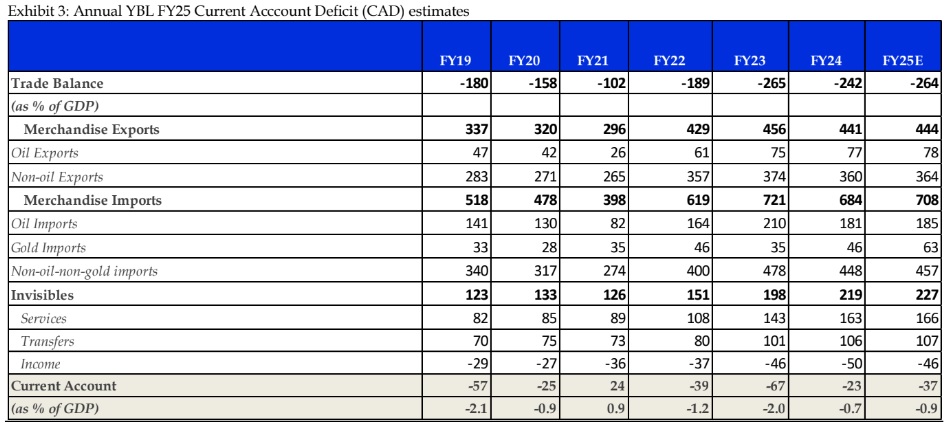

The sequential fall in imports was mainly on account of the decline in oil import bill to USD 15.1 bn (May: USD 19.9 bn) while gold imports held steady. A steady NONG imports indicate continuing robust domestic growth conditions. India’s services sector surplus came at USD 13.0 bn, similar to the last month. Incidentally, net services receipts were lower in Q1FY25 compared to Q4FY24. For FY25, we estimate the trade deficit at USD 264 bn, higher than USD 242 bn in FY24. CAD/GDP is estimated at 0.9% for FY25 while for Q1FY25 CAD/GDP is likely at 1%.

Exports fall on a sequential basis:

Headline exports at USD 35.2 bn, declined by 7.7% MoM, with non-oil exports declining by 5.3% MoM to USD 29.7 bn. Oil exports declined by

18.5% MoM to USD 5.5 bn vs USD 6.8 bn in May 2024. Of the total 31 items, 24 items registered sequential contraction. Within agriculture exports, tea (-2.9% MoM) and rice (-15.2% MoM) registered sequential dips. Importantly, engineering goods accounting for the highest share in exports declined by 6% MoM to USD 9.4 bn whereas electronic goods exports declined by 4.9% MoM to USD 2.8 bn. Labor intensive products such as plastic & linoleum, handicraft and carpets, gems and jewelry exports declined by 8.4% MoM, 10.1% MoM and 18.6% MoM, respectively.

Imports sequentially decline:

At USD 56.2 bn, imports declined by 9.3% MoM. Oil imports declined by 24.6% MoM to USD 15.1 bn vs USD 19.9 bn in May. Gold imports were steady at USD 3.1 bn (May: USD 3.3 bn), probably on account of stocking by jewellers ahead of the busy season and with expectations of further gains in global prices. Non-oil-non-gold (NONG) imports declined by 1.5% MoM to USD 38.1 bn. Within the NONG imports, chemical material & products (+0.4% MoM), leather & leather products (+8.9% MoM), wood & wood products (+2.7% MoM), machine tools (+0.2% MoM), electronic goods (+7.6% MoM) registered sequential increases whereas transport equipment and machinery & electrical equipment registered sequential drop. Within agricultural goods imports, vegetable oil (-2.0% MoM) and pulses (-1.2% MoM) registered sequential dips while fruits & vegetables (+7.2% MoM) registered a sequential rise.

Services balance remains nearly steady:

Services exports increased by 1.7% MoM to USD 30.3 bn. Last month’s services export figures were revised lower to USD 29.8 bn from USD 30.3 bn. We remain a bit cautious about the performance of services exports, considering the moderation seen in software exports growth. Software exports grew by 7.4% YoY in FY24 vs 21.3% YoY in FY23. For June 2024, services imports were at USD 17.3 bn (+3.3% MoM), leading to a net services surplus of USD 13.0 bn in June (USD 13.0 bn in May).

Overall, net services receivables at USD 39.7 bn in Q1 FY25 shows a moderate over USD 42.7 bn in Q4FY24.

CAD/GDP likely at 0.9% in FY25, Q1FY25 seen at 1.0%:

With both exports and imports registering sequential drops, trade deficit narrowed to USD 21 bn in June 2024. Having said, exports are holding up better than anticipated due to growth resilience of the major trading partners. For instance, exports to USA and EU grew by 14% YoY and 18% YoY in FY25TD.

However, it needs to be closely monitored to see if the momentum sustains considering the lagged impact of monetary policy tightening, political uncertainty in major economies etc. The factors governing the imports are a) sticky global oil price, b) higher gold imports on account of both volume growth and higher prices c) domestic growth momentum remaining strong that is likely helping steady NONG trends.

Factoring in June trade figures, trade deficit is likely to worsen to USD 64.2 bn in Q1FY25 (USD 50.9 bn in Q4FY24) with exports registering a sequential decline of 9.4% QoQ while imports picked up by 1.1% QoQ. We see some moderation in invisibles receipts for Q1FY25 too, on the back of weaker net services receipts. Overall, we expect Current Account Balances to turn back to a negative USD 9.5 bn in Q1FY25 from a surplus of USD 5.7 bn in the previous quarter. CAD/GDP in Q1FY25 is now expected at -1.0% of GDP.

For FY25, we estimate the trade deficit at USD 264 bn, higher than USD 242 bn in FY24. CAD/GDP is estimated at 0.9% for FY25 while for Q1FY25 CAD/GDP is likely at 1%.