Merchandise Trade Deficit In Q4:2023-24 Lower Than A Year Ago

Developments in India’s Balance of Payments during the Fourth Quarter (January-March) of 2023-24

FinTech BizNews Service

Mumbai, June 24, 2024: Preliminary data analysis on India’s balance of payments (BoP) for the fourth quarter (Q4), i.e., January-March 2023-24, are presented here:

Key Features of India’s BoP in Q4:2023-24

- India’s current account balance recorded a surplus of US$ 5.7 billion (0.6 per cent of GDP) in Q4:2023-24 as against a deficit of US$ 8.7 billion (1.0 per cent of GDP) in Q3:2023-241 and US$ 1.3 billion (0.2 per cent of GDP) a year ago [i.e., Q4:2022-23]2.

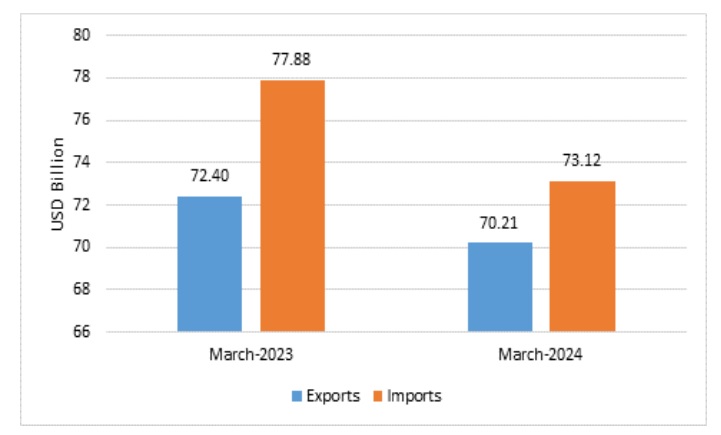

- The merchandise trade deficit at US$ 50.9 billion in Q4:2023-24 was lower than US$ 52.6 billion a year ago.

- Services exports grew by 4.1 per cent on a y-o-y basis in Q4:2023-24 on the back of rising exports of software, travel and business services. Net services receipt at US$ 42.7 billion was higher than its level a year ago (US$ 39.1 billion), which contributed to the surplus in the current account balance during Q4:2023-24.

- Net outgo on the primary income account, primarily reflecting payments of investment income, increased to US$ 14.8 billion from US$ 12.6 billion a year ago.

- Private transfer receipts, mainly representing remittances by Indians employed overseas, amounted to US$ 32.0 billion, an increase of 11.9 per cent over their level a year ago.

- In the financial account, net foreign direct investment flows were US$ 2.0 billion in Q4:2023-24 as compared with US$ 6.4 billion a year ago.

- Foreign portfolio investment recorded a net inflow of US$ 11.4 billion in Q4:2023-24 as against a net outflow of US$ 1.7 billion during Q4:2022-23.

- Net inflows under external commercial borrowings to India amounted to US$ 2.6 billion in Q4:2023-24 as compared with US$ 1.7 billion a year ago.

- Non-resident deposits recorded a higher net inflow of US$ 5.4 billion than US$ 3.6 billion in Q4:2022-23.

- There was an accretion of foreign exchange reserves (on a BoP basis i.e., excluding valuation effects) to the tune of US$ 30.8 billion in Q4:2023-24 as compared with an accretion of US$ 5.6 billion a year ago.

BoP during 2023-24

- India’s current account deficit moderated to US$ 23.2 billion (0.7 per cent of GDP) during 2023-24 from US$ 67.0 billion (2.0 per cent of GDP) during the previous year on the back of a lower merchandise trade deficit.

- Net invisibles receipt was higher during 2023-24 than a year ago, primarily on account of services and transfers.

- During 2023-24, portfolio investment recorded a net inflow of US$ 44.1 billion as against an outflow of US$ 5.2 billion a year ago.

- Net FDI inflow was US$ 9.8 billion during 2023-24 as compared with US$ 28.0 billion in 2022-23.

- In 2023-24, there was an accretion of US$ 63.7 billion to the foreign exchange reserves (on a BoP basis).

Table 1: Major Items of India's Balance of Payments |

(US$ billion) |

| January-March 2023 | January-March 2024 | 2022-23 | 2023-24 |

| Credit | Debit | Net | Credit | Debit | Net | Credit | Debit | Net | Credit | Debit | Net |

A. Current Account | 238.0 | 239.3 | -1.3 | 253.6 | 247.9 | 5.7 | 921.9 | 988.8 | -67.0 | 942.9 | 966.1 | -23.2 |

1. Goods | 115.8 | 168.4 | -52.6 | 121.7 | 172.5 | -50.9 | 456.1 | 721.4 | -265.3 | 441.5 | 683.5 | -242.1 |

Of which: | | | | | | | | | | | | |

POL | 23.9 | 50.8 | -26.9 | 22.2 | 49.6 | -27.4 | 97.5 | 209.4 | -111.9 | 84.2 | 179.6 | -95.5 |

2. Services | 85.8 | 46.8 | 39.1 | 89.4 | 46.7 | 42.7 | 325.3 | 182.0 | 143.3 | 341.1 | 178.3 | 162.8 |

3. Primary Income | 7.7 | 20.3 | -12.6 | 10.5 | 25.3 | -14.8 | 27.8 | 73.8 | -45.9 | 41.5 | 91.2 | -49.8 |

4. Secondary Income | 28.6 | 3.9 | 24.8 | 32.1 | 3.4 | 28.7 | 112.6 | 11.7 | 100.9 | 118.9 | 13.0 | 105.9 |

B. Capital Account and Financial Account | 153.4 | 152.5 | 0.9 | 248.1 | 254.4 | -6.2 | 702.9 | 634.9 | 68.0 | 850.3 | 827.8 | 22.5 |

Of which: | | | | | | | | | | | | |

Change in Reserve (Increase (-)/Decrease (+)) | 0 | 5.6 | -5.6 | 0.0 | 30.8 | -30.8 | 30.4 | 21.2 | 9.1 | 0.0 | 63.7 | -63.7 |

C. Errors & Omissions (-) (A+B) | 0.4 | 0.0 | 0.4 | 0.5 | 0.0 | 0.5 | 0.0 | 1.0 | -1.0 | 0.7 | 0.0 | 0.7 |