LME base metals extend gains today

Royce Vargheese Joseph,

Kaynat Chainwala,

Commodity Research,

Kotak Securities

Mumbai, 25 October, 2023: Market sentiments improved on China's stimulus plan and signs that the Israel-Hamas war will remain contained for the time being. Comex gold prices see some recovery after declining for last two sessions as US 10-year treasury yields retreated after breaching 5% on Monday for the first time in 16 years. The official Xinhua News Agency said Tuesday, China’s legislature approved a plan to raise the fiscal deficit ratio for 2023 to about 3.8% of GDP, well above the 3% set in March which the government has generally considered a limit for the nation LME base metals mostly extended gains as plan includes issuing additional sovereign debt worth 1 trillion yuan ($137 billion) in the fourth quarter to support disaster relief and construction.

Crude oil prices remained soft as the US and Saudi Arabia agreed to pursue diplomatic efforts to maintain stability across the Middle East, helping ease supply disruption concerns Today, markets keenly await German Ifo business climate, US new home sales and speech by ECB President Christine Lagarde.

Gold

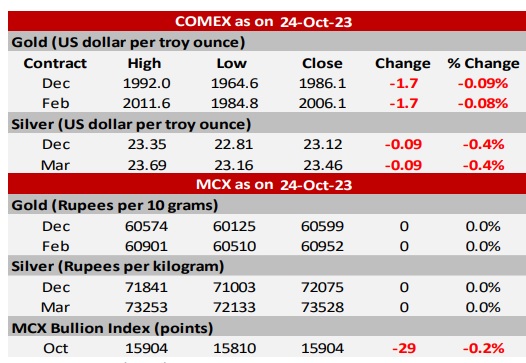

According to Royce Vargheese Joseph, Bullion & Energy, Kotak Securities, COMEX Gold prices marginally declined on Tuesday, easing from a three-month high notched during the previous week, as robust economic data from US boosted the greenback, while negotiations for hostage release prevented further escalation. Still a steady decline in US 10-year yields limited the downside in gold prices. Data released yesterday showed that the US private sector unexpectedly expanded during October, adding leeway for the Fed to maintain its terminal rate for longer to curb stubborn inflation. The S&P Global US Services PMI rose to a three month high of 50.9 in October, while Manufacturing PMI beats estimates and rose to 50. Higher real rates and lack of demand from the investment sector remains a major headwind for gold prices. On the economic data front, the ECB policy meeting, US Q3 GDP and PCE price index will be in spotlight. We expect prices to stay buoyed as ground reports suggest middle-east is preparing for a further escalation in the conflict.

Silver

COMEX Silver prices extended declines for the second straight day, tracking weakness in bullions, despite a recovery in base metals. Sentiments have received a boost after President Xi Jinping stepped up support for China’s economy. The new round of government’s support plans that include issuing additional sovereign debt and raising the budget deficit ratio. China has rarely adjusted its budget mid-year, having previously done so in periods including 2008, in the aftermath of the Sichuan earthquake. The stimulus will propel growth in sectors the government favors, such as advanced manufacturing and renewable energy, an crucial demand driver for Silver.

Metals

According to Kaynat Chainwala, Base Metals, Kotak Securities, LME base metals gained momentum yesterday buoyed by hopes of major stimulus announcement from China. LME Copper surged to $8100/tonne on Tuesday, after hitting 11-month low of $7856/tonne on Monday, as Reuters reported citing sources that China is set to launch fresh stimulus to shore up economic recovery, with parliament expected to approve just over 1 trillion yuan ($137 billion) in additional sovereign debt issuance, in order to help provide a much needed fiscal push to reach the growth target. Global miner Anglo American now expects to produce between 830,000 and 870,000 metric tons of copper this year, lowering a previous forecast of 840,000 to 930,000. Divergent PMI figures from major developed nations could not affect the prices much. S&P Global said US manufacturing PMI pulled out of a five-month contraction and edged to 50 in October on a pickup in new orders, and services activity rose modestly to 50.9 amid signs of easing inflationary pressures. On the other hand, Eurozone Composite PMI slipped to three year low at 46.5 in October as private sector output declined at its steepest rate in 35 months and UK Composite too remained in contraction at 48.6, both stirring fears of a recession. LME Aluminum rose 0.7% while Zinc hit a high of $2458.5/tonne amid stimulus optimism and as stocks fell to fresh eight month and three month lows respectively. LME base metals extend gains today as China’s legislature approved a plan that includes issuing additional sovereign debt worth 1 trillion yuan ($137 billion) in the fourth quarter to support disaster relief and construction. Also, risk sentiments improved on signs that the Israel-Hamas war will remain contained for the time being as the US and Saudi Arabia agreed to pursue diplomatic efforts to maintain stability across the Middle East.

Crude Oil

As per KS Commodity Insight’s today’s report, WTI Crude oil futures extended losses for the third straight day on Tuesday, plunging more than 7% in last three trading days, as the Israeli ground invasion of Gaza was held-off amid hostage release talks and defense forces ramping up preparations for a multi front war. The US and Saudi Arabia agreed to pursue diplomatic efforts to maintain stability across the Middle East, the White House said Tuesday, easing fears of major disruptions to the oil market. Meanwhile, Russia’s oil flows are climbing steadily and rose to a four month high during the previous week, as Moscow’s adherence to a pact with Saudi Arabia to keep barrels off the global market shows signs of waning. API inventory data released earlier today showed that stocks of crude oil in the US fell by 2.668 million barrels during the previous week, and investors keenly await EIA data later today.

Natural Gas

NYMEX Henry Hub gas prices slightly rose on Tuesday, even as warmer-thannormal weather in the East for this time of year continues to delay seasonal demand for the heating and power-plant fuel. According to Atmospheric G2, “early warmth should skew period anomalies to the warmer side of average in the South and East Coast” through 29th Oct – 2nd Nov. Below-normal temperatures are seen throughout the Midwest. Meanwhile, European natural gas prices fell as tepid demand and healthy stockpiles counter concerns about a wider conflict in the Middle East. . Any sign that the Israel-Hamas war could expand into the broader Middle East has traders on edge. Even though Israel’s military said there are “long weeks of fighting ahead,” we expect gas prices to remain subdued for now, amid weak demand and ample storages

RATING SCALE FOR DAILY REPORT

BUY- We expect the commodity to deliver 1% or more returns.

SELL - We expect the commodity to deliver (-1%) or more returns.

SIDEWAYS - We expect the commodity to trade in the range of (+/-)1%

NOTE - The recommendations are valid for one day from the date of issue of the report, subject to mentioned stop loss, if any.

(Disclaimer: Our research should not be considered as an advertisement or advice, professional or otherwise. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and the like and take professional advice before investing. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.)