Ensuing Dollar Strength Can Be A Headwind For Gold Prices

YES Bank’s technical analysis sees gold prices extending to USD 4500-4550 / oz while silver prices can push up to USD 69 /oz.

FinTech BizNews Service

Mumbai, 20 December 2025: YES BANK has come out with its latest research report on the Precious metals:

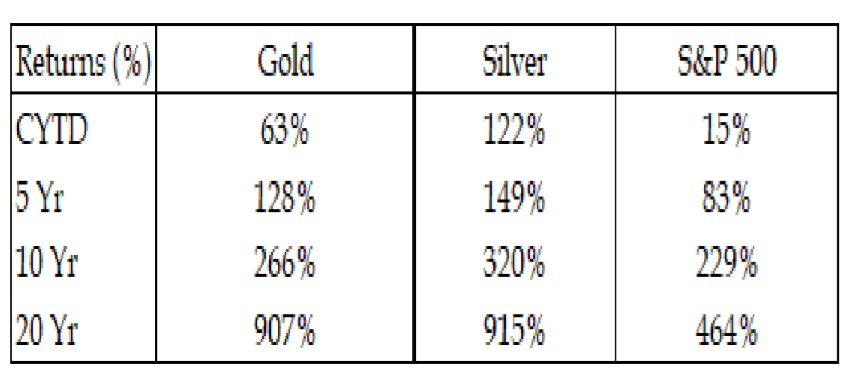

- In our gold outlook in July 2025, we had expected gold prices to be in a range of USD 3600-3800/oz by end 2025 (gold price in July 2025 was at USD 3300/oz), while silver prices were expected to be in the range of USD 41.50-42/oz (was quoting at around USD 37-38 that time).

- Further, the view then was based on the back of strong US labour markets and sticky inflation, that had raised doubts on the pace of interest rate cuts form the Fed in 2025. Dot plots then were indicating 7 members being in favour of only one cut in 2025.

- With the further rate cuts expected, one can expect the depreciation pressure to continue for the DXY. This should be a support for gold prices.

- On the other hand, we do not totally ignore the probability of a dollar appreciation in the second half of 2026, based on growth differential between the US and the rest of the world, especially Europe.

- German fiscal package has still not taken off, and hard data indicates a softer growth in the European region compared to the US.

- The potential driver for the future rate expectations of the ECB could be the implementation of the fiscal spend and other growth plans for 2026 and 2027.

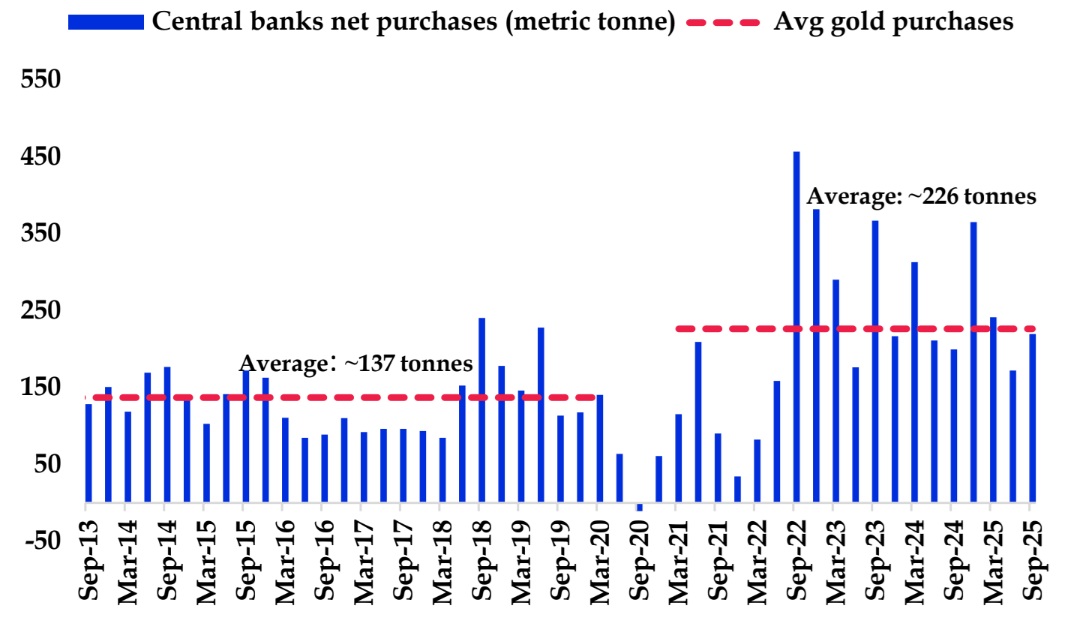

- Thus, ensuing dollar strength can be a headwind for gold prices. While market volatility continues, resolution in geo-political situations need to come down for the risk premium to cool – a high-risk premium situation has led to Central Banks extending their purchase of gold and can remain a long-term tailwind for gold prices.

- Continued global uncertainty and bets against the USD as a reserve currency has led to global Central Bank gold demand surge While this may continue, the pace could however slow in 2026

- Continued ETF flows have also boosted demand for gold Asia attracted highest ETF flows in November. Global gold ETFs have seen strong demand throughout the year except in May. Asia remains the top region attracting flows at 23.6 tonnes in November out of a total of 38.5 tonnes

- Our technical analysis, sees gold prices extending to USD 4500-4550 / oz while silver prices can push up to USD 69 /oz.