Global gold ETFs added US$38bn in H1, boosted by a strong June (+US$7.6bn). Their total AUM rocketed 41% to US$383bn in H1, and collective holdings rose 397t to 3,616t.

FinTech BizNews Service

Mumbai, July 8, 2025: Global gold ETFs added US$38bn in H1, boosted by a strong June (+US$7.6bn). Their total AUM rocketed 41% to US$383bn in H1, and collective holdings rose 397t to 3,616t, as per the latest data released by World Gold Council.

North America (+ US$21bn) accounted for the bulk of inflows in H1. Followed by Asia (+US$11bn) and Europe (+US$6bn).

Gold trading volumes averaged US$329bn/day in H1, the highest semi-annual value on our record.

Highlights

H1 in review

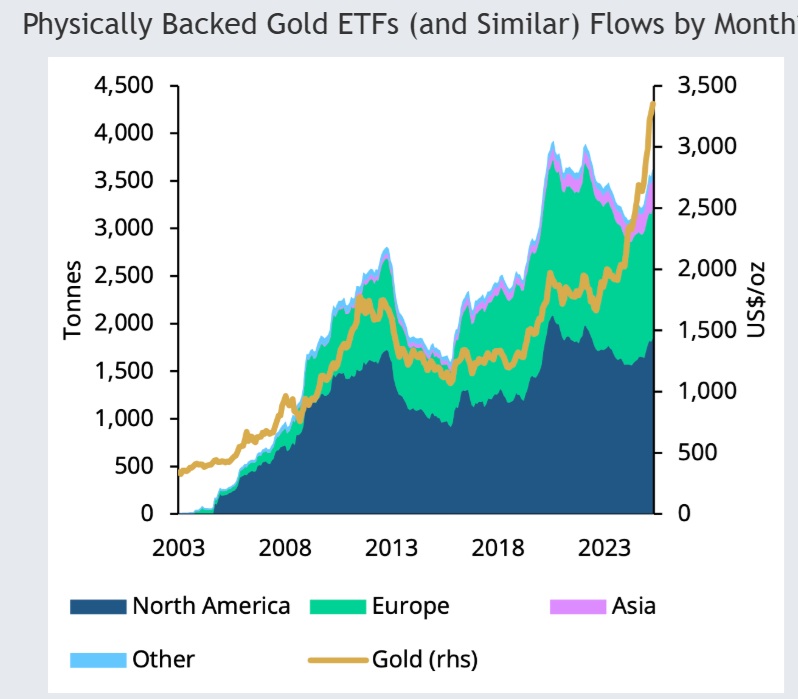

Global physically backed gold ETFs1 saw inflows of US$38bn during H1, boosted by strong positive flows in June (Chart 1), marking the strongest semi-annual performance since H1 2020.2 All regions saw inflows last month, with North American and European investors leading the charge.

During the first half, North America accounted for the bulk of inflows, recording the strongest H1 in five years. And despite slowing momentum in May and June, Asian investors bought a record amount of gold ETFs during H1, contributing an impressive 28% to net global flows with only 9% of the world’s total assets under management (AUM). European flows finally turned positive in H1 2025 following non-stop semi-annual losses since H2 2022.

By the end of H1 the surging gold price and notable inflows pushed global gold ETFs’ total AUM 41% higher to US$383bn, a month-end record. Collective holdings in H1 grew 397t to 3,616t, the highest month-end value since August 2022 (Chart 2).

Regional overview

North America attracted US$4.8bn in June – the strongest monthly inflow since March – bringing total H1 inflows to US$21bn. Spiking geopolitical risks amid the Israel-Iran conflict boosted investor demand for safe-haven assets and supported inflows into North American gold ETFs. Although it held rates steady in June, the US Fed continued to express concerns about slowing growth and rising inflation.3 Markets are now pricing in three rate cuts by the end of 2025 and an additional two in 2026.

The investor response has been swift: US Treasury yields declined, and the dollar continued to weaken. Persistent policy uncertainty and ongoing fiscal concerns are likely to remain an overhang on the market, which in turn could help support gold ETF demand in the near to medium term.

European inflows continued for a second month, adding US$2bn in June – the strongest since January – and lifting the region’s H1 total to US$6bn. The UK led inflows in the month; although the Bank of England kept rates unchanged at its June meeting, the stance was generally dovish. 4 Combined with weaker growth, easing inflation and the cooling labour market, investors raised their bets on future rate cuts. This resulted in local yields declining and pushed up gold’s allure. Meanwhile, the eighth cut from the European Central Bank, uncertainties surrounding growth, and rising geopolitical risks generally, contributed to gold ETF demand in several major markets.

Asian flows flipped positive in June, albeit only mildly at US$610mn, ending at US$11bn – a record amount for any H1 period. India led inflows in June, likely supported by rising geopolitical risks in the Middle East. Japan recorded inflows for the ninth consecutive month (US$198mn, US$1bn H1), possibly driven by elevated inflationary concerns – particularly when the rice price surged.6 China only saw mild inflows in the month (US$137mn) as trade tensions eased and the local gold price moderated.7 Nonetheless, China’s H1 inflows of US$8.8bn (85t) were unprecedented amid spiking trade risks with the US, growth concerns and the surging gold price.

Funds listed in other regions attracted US$148mn in June, pushing H1 inflows to US$661mn. Australia and South Africa were the main contributors, both during the month and in H1. It is worth noting that Australian gold ETF AUM and holdings reached respective month-end peaks in June.