The Tata Technologies got 7.36 million applications, which by itself is the highest in the history of Indian primary market

FinTech BizNews Service

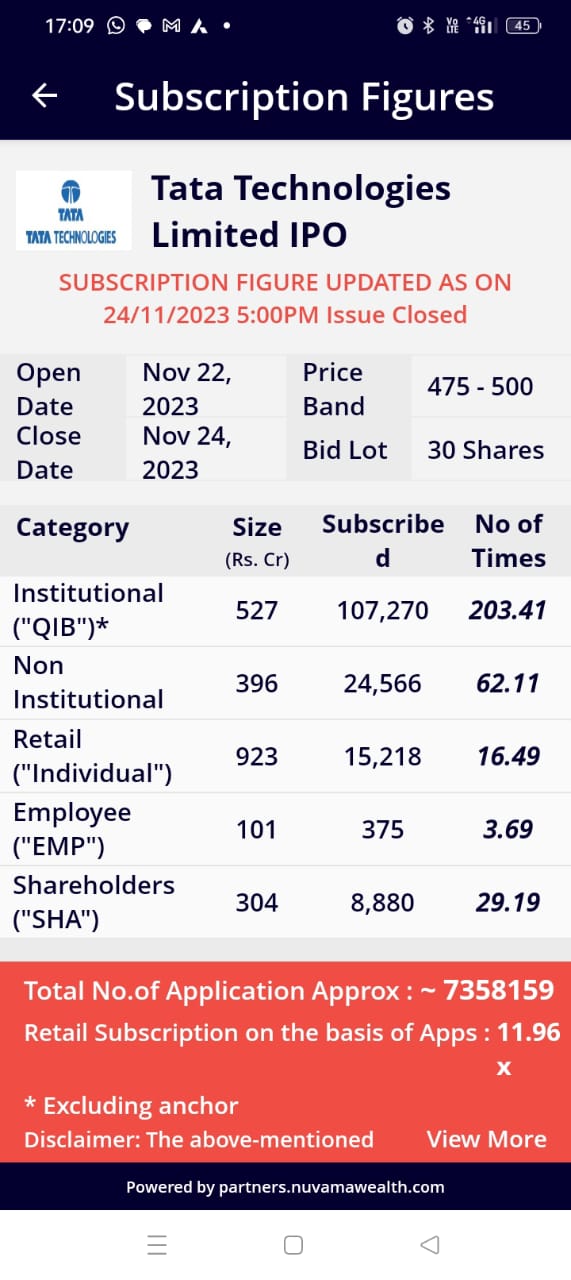

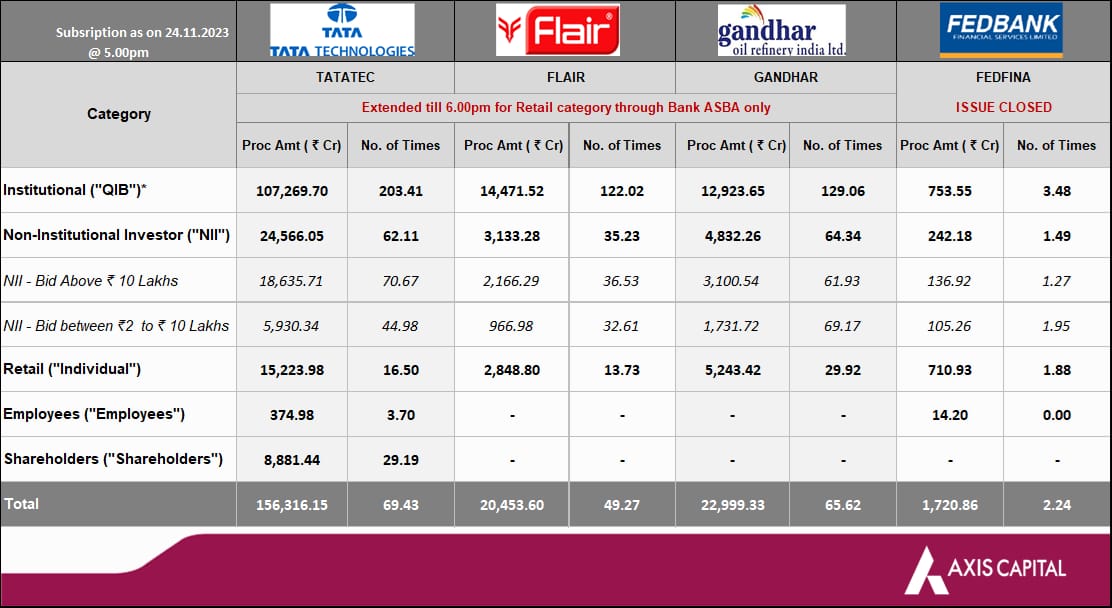

Mumbai, November 25, 2023: Week ending 24th Nov, 2023 witnessed unprecedented euphoria as the investors poured in about Rs2.6 trillion into 5 IPOs. The week gone by was one of the busiest weeks for primary market in recent years, as 5 mainboard IPO of Tata Technologies, Flair Writing, Fedbank Financial Services, Gandhar Oil Refinery India, and IREDA opened to raise around INR 7,377 crore. The Tata Technologies got 7.36 million applications, which by itself is the highest in the history of Indian primary market. The previous record was in the name of LIC, which had got 7.34 mn applications last year.

IREDA IPO subscribed 39 times

The Initial Public Offering of Indian Renewable Energy Development Agency Limited was subscribed 38.80 times on the final day of bidding with QIB leading from the front. The issue received bids of 18,27,25,26,640 shares against the offered 47,09,21,451 equity shares, at a price band of Rs.30-32, according to the data available on the stock exchanges. Qualified Institutional Buyer Portion was subscribed 104.57 times, Non-Institutional Investors Portion subscribed 24.16 times, whereas Employee Portion was subscribed 9.80 times and Retail Portion was subscribed 7.73 times. IDBI Capital Markets & Securities Limited, BOB Capital Markets Limited, and SBI Capital Markets Limited are the book-running lead managers. Company Information Indian Renewable Energy Development Agency Limited, a Government of India (“GoI”) enterprise notified as a “Public Financial Institution” (“PFI”) registered as a Systemically Important Non-Deposittaking Non-Banking Finance Company (a “NBFCND-SI”), with Infrastructure Finance Company (“IFC”) status. It is a financial institution with over 36 years of experience in promoting, developing and extending financial assistance for new and renewable energy projects, and energy efficiency and conservation projects. It provides a comprehensive range of financial products and related services, from project conceptualisation to post-commissioning, for renewable energy projects and other value chain activities, such as equipment manufacturing and transmission. It is also India's largest pure-play green financing NBFC in India. IREDA is the issuer of first debt security (green masala bond) in India listed on IFSC exchange. IREDA is the first financial institution in India to raise green masala bonds IREDA is among the first financial institution to raise global funds for climate financing from DFIs / multilaterals in India.