RBI invites solutions aimed at enhancing the safety and security of digital transactions and promoting inclusivity for persons with physical disabilities

Prerna Singhvi, CFA

Vice President – Economic Policy and Research

National Stock Exchange of India Limited (NSE)

Mumbai, June 8, 2024: The RBI’s Monetary Policy Committee (MPC), with a 4:2 majority, decided to keep the policy repo rate unchanged at 6.5% for the eighth consecutive time.

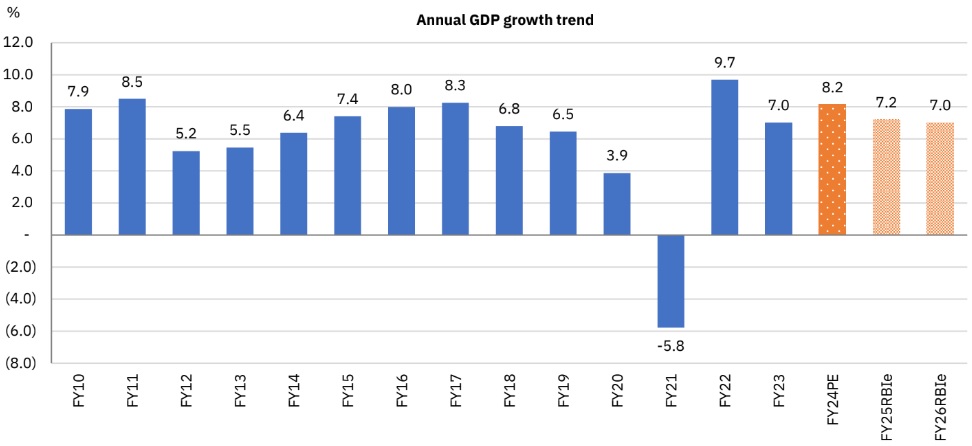

FY25E GDP growth upgraded to 7.2%

The ‘withdrawal of accommodation’ stance was also retained, citing the need to remain vigilant on inflation amid a strong growth landscape. Interestingly, this was the first time in the last eight policies that 2/6 members (vs. 1/6 in the April and February policy) dissented by voting for a 25bps cut and a change in the stance to ‘neutral’. The GDP growth forecast for FY25 was revised up by 20bps to 7.2%, reflective of sustained growth momentum, and underpinned by a revival in rural demand in the light of an expected normal monsoon, resilient urban consumption, and sustained investment activity. Meanwhile, the inflation forecast for FY25 was kept unchanged at 4.5%, with rising input cost pressures, uncertain food inflation trajectory and financial market volatility posing key risks to the outlook. The RBI’s nimble and flexible approach towards liquidity management via variable rate repo (VRR) and reverse repo (VRRR) operations has ensured liquidity conditions remain aligned with the monetary policy stance.

The MPC’s decision to pause was in line with expectations, with strengthening divergence in views between members adding a new dimension for the future course of policy actions. Further, a robust growth trajectory continues to provide space for the policy to remain decisively focused on inflation, and particularly so in the light of an uncertain food inflation trajectory that has been frequently marred by adverse weather events. This, along with the MPC’s commitment to durably align inflation with the 4% target, suggests continuation of a status quo for now. Until then, the RBI is likely to continue to resort to nimble and flexible liquidity management to ensure orderly movement in money market rates and thereby preserve financial stability.

Status quo for the eighth consecutive time

The RBI’s MPC expectedly decided to retain the policy repo rate at 6.5% and the ‘withdrawal of accomodation’ stance with a 4:2 majority, holding the rates steady for the eighth consecutive time. This is the first time in the last eight policies when two members (Prof Jayant Varma and Dr Ashima Goyal) have dissented from the Committee’s view, voting instead for a 25-bps rate cut and a change in stance to ‘neutral’. The MPC reiterated its commitment to ensuring price stability on a durable basis, which in turn would provide a conducive environment for sustainable growth. With this, the Standing Deposit Facility (SDF) and the Marginal Standing Facility (MSF) rates—the upper and lower bounds of the Liquidity Adjustment Facility (LAF) corridor—remained unchanged at 6.25%, and 6.75% respectively.

Inflation forecast for FY25 retained at 4.5%

The headline inflation has been on a steady downward trend since Feb’24, with core infaltion (headline ex food/fuel) falling to the lowest level in the current CPI series. That said, food inflation has remained a concern, weighed down by persistence of inflation pressures in pulses, vegetables, cereals and spices, with frequent climate-related wagaries adding to the uncertainty. On the positive side, a normal monsoon may provide upside support to food prices. Further, rising input cost pressures emanating from supply chain bottlenecks, volatile crude oil prices and rising non-energy commodity prices pose upside risks to the core inflation outlook. Against this backdrop, the RBI maintained its inflation projection at 4.5% for FY25, with all quarterly projections remaining unchanged (Q1: 4.9%, Q2: 3.8%, Q3: 4.6% and Q4: 4.5%). The inflation projection for FY26 is pegged at 4.1% as per the April’s Monetary Policy Report.

GDP growth hiked by 20 bps to 7.2%

The RBI hiked the GDP growth forecast for FY25 by 20bps to 7.2%, reflective of sustained growth momentum. This is underpinned by a) a revival in rural demand in the light of an expected normal monsoon, b) resilient urban consumption supported by strong manufacturing and services activity, c) sustained investment activity, aided by higher capacity utilisation, healthy balance sheets of corporates and banks and strong capex push by the Government, and d) improvement in global trade prospects. The upward revisions were across quarters, with Q1/Q4 GDP growth forecasts getting upgraded by 20bps to 7.3%/7.2% and Q2/Q3 by 30bps to 7.2%/7.3%. Key downside risks to the outlook include headwinds from geopolitical tensions, volatility in the international commodity prices and geoeconomic fragmentation.

Liquidity conditions easing

Liquidity conditions exhibited significant fluctuations during the April-June 2024 period. The system liquidity remained in the surplus during the first three weeks of April, averaging at Rs 1.1 lakh crore, only to slip into deficit in the later part of the month and May, thanks to advance tax/GST-related outflows, commencement of the Government’s borrowing programme, and higher currency outgo. In early June, surplus liquidity conditions resurfaced, averaging Rs.0.35 lakh crore. The RBI’s nimble and flexible approach towards liquidity management has helped keep the Weighted Average Call Money Rate (WACR) well-anchored within the LAF corridor of 6.25%-6.75%. The WACR averaged 6.57% during April-June (up to June 5th, 2024) period, marginally lower than the 6.61% observed during February-March period. Going ahead, the RBI is expected to continue to remain agile and inject/withdraw liquidity as needed to ensure financial market stability.

Regulatory measures

Among key regulatory measures, the RBI revised the definition of bulk deposits, with the limit for Scheduled Commercial Banks (exclusing Regional Rural Banks) and Small Finance Banks (SFB) set at ‘Single Rupee term deposits of Rs 3 crore and above,’ while for Local Area Banks, it was defined as ‘Single Rupee term deposits of Rs 1 crore and above.’ Further, to promote ease of doing business, the RBI decided to rationalise existing guidelines on export and import of goods and services under FEMA 1999, simplifying operational procedures for cross-border trade transactions.

Harnessing advanced technologies

In the realm of digital payments, the RBI proposed setting up a Digital Payments Intelligence Platform to mitigate payment fraud risks by harnessing advanced technologies and real-time data sharing across payment systems. Aditionally, the e-mandate framework was expanded to include recurring payments for Fastag, National Common Mobility Card (NCMC), and UPI Lite wallet auto-replenishment facility. Furthermore, the RBI launched its third global hackathon, “HaRBInger 2024 – Innovation for Transformation,” inviting solutions aimed at enhancing the safety and security of digital transactions and promoting inclusivity for persons with physical disabilities.

Rates to remain on hold for now

The MPC’s decision to retain status quo on rates as well as stance was in line with expectations, with strengthening divergence in views between members adding a new dimension for the future course of policy actions. Further, a robust growth trajectory continues to provide space for the monetary policy to remain decisively focused on inflation, and particularly so in the light of an uncertain food inflation trajectory that has been frequency marred by adverse weather events. This, along with the MPC’s commitment to durably align inflation with the 4% target, suggests continuation of a status quo for now. Until then, the RBI is likely to continue to resort to nimble and flexible liquidity management to ensure orderly movement in money market rates and thereby preserve financial stability.