Except INR, other global currencies ended broadly weaker against the dollar

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, April 23, 2024: As the concerns around Middle East conflict eased, global indices rebounded with demand for safe haven assets waning. Prices for gold and oil moderated. In the upcoming policy meet, investors anticipate BoJ will not change rates after Governor commented to ‘proceed cautiously’ and first assess the impact of recent policy change. Separately, Australia’s composite PMI scaled up to a 2-year high (53.6 in Apr’24 from 53.3 in Mar’24) and in Japan, business activity climbed up at its fastest pace in over 8-months (52.6 from 51.7 in Mar). Investors will closely await India’s flash PMI reading and release of US PCE data scheduled this week.

§ Barring Shanghai Comp, other global indices ended higher. US indices rebounded after ending lower as investors continued to monitor quarterly earnings reports. FTSE closed at a record high amidst growing expectations of a rate cut. Sensex continued to climb up supported by a strong rally in consumer durables and capital good stocks. It is trading higher today, in line with other Asian stocks.

Except INR, other global currencies ended broadly weaker against the dollar. EUR and GBP depreciated as both ECB and BoE are expected to cut rates before the Fed. JPY depreciated to its weakest since Jun’90, ahead of BoJ’s policy meeting. INR appreciated by 0.1% as oil prices eased. It is trading further stronger today, in line with other Asian currencies.

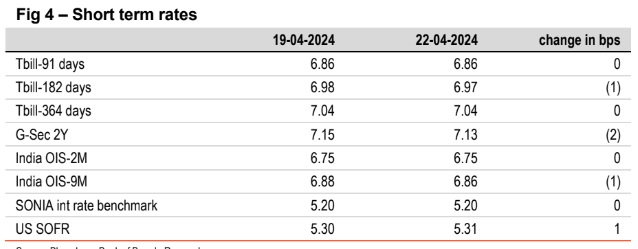

Except Japan, other global yields edged down. 10Y yield in UK fell the most by 3bps amidst expectations that the BoE is likely to cut rates in Jun’24. On the other hand, Japan’s 10Y yield rose by 4bps as investors turned their focus on upcoming BoJ policy amidst a sustained weakness in JPY. India’s 10Y yield fell by 4bps amidst easing tensions in Middle East. It is trading further lower at

7.17% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)