Aditya Birla Sun Life AMC Ltd. Presents “Annual Market Outlook 2026”: Lack of valuation rerating and INR depreciation has contributed to India’s underperformance relative to global equities

FinTech BizNews Service

Mumbai, 7 January 2026: Aditya Birla Sun Life AMC Ltd. Has come out with interesting research report titled “Annual Market Outlook 2026.”

Why India Looks Ready To Reclaim After The Reset

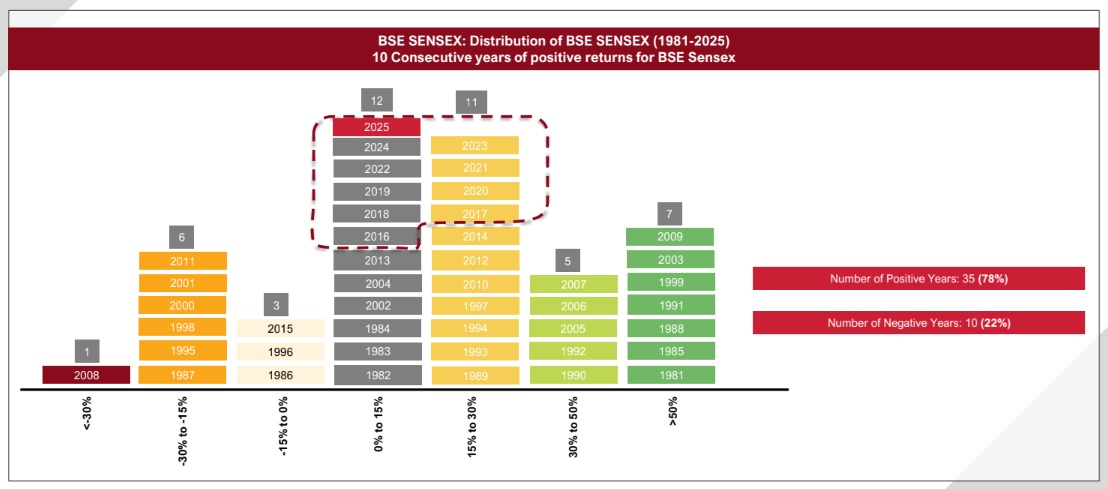

The year 2025 can be best characterized as an eventful and challenging year with the headline

indices returning double-digit returns and extending their winning streak to 10 years in a row. This

was on the back of many initiatives and events that continued to dominate headlines ranging from

interest rate cut, tax rate cut, sovereign rating upgrade for India, accelerated rupee depreciation,

all-time high SIP inflow among others. With such a steady flow of positive headlines, the

expectation was for India’s financial markets to comfortably tide over the hurdles in 2025. But

reality was starkly different. We grappled with weak earnings growth, compression in the

valuation picture along with an uncertain global backdrop. The investor experience turned out to

be uneven with small & midcap returns being lower than the frontline index. With this background

of how 2025 turned out to be, the key question to ask would be – How will markets react in 2026?

The answer to that can best be described by three words – Reboot, Refresh, Reclaim!

Reboot: due to geopolitical uncertainty

The global sentiment for 2025 was dominated by geopolitical uncertainty, trade friction and tariff

concerns among other things. Amidst all this, the rupee witnessed accelerated depreciation

which turned out to be in India’s favor as it maintained the export competitiveness and provided

macro stability. From a money flow point of view, foreign investors turned cautious with their

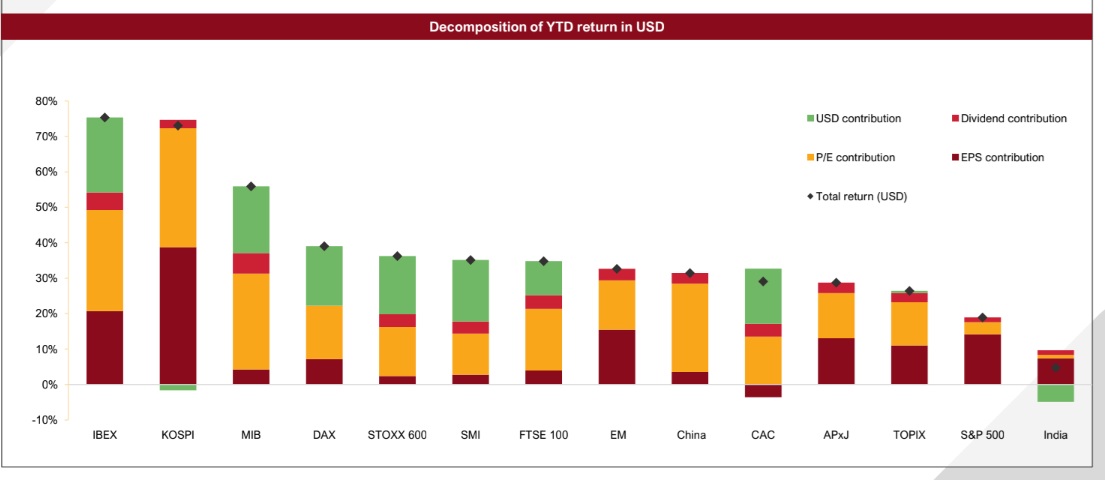

positioning also at record low levels. As a result, India underperformed not only developed

markets but also emerging peers despite being the fastest growing economy in the world. India’s

relative performance versus Emerging Markets is at a historical low. Lack of valuation rerating and INR depreciation has contributed to India’s underperformance relative to global equities.

This reboot has cleared excesses as the valuation froth has moderated, equity supply has eased,

foreign investor positioning is light, and currency competitiveness has improved.

Refresh: focus on domestic consumption, rupee depreciation & monetary stimulus

The government and central bank have ensured the fiscal and monetary policy actions of last year

have laid a solid foundation for future growth. This includes a 125-bps rate cut, liquidity infusion,

tax rate cut along with GST rationalization. Thanks to these, we can expect a pickup in urban

consumption in 2026 along with benign inflation. This refresh will pave the way for the much-

awaited pickup in domestic consumption. This will also aide in expected earnings revival of Indian

corporates in the new year. Nifty earnings are expected to grow in the range of low-to-mid teens

over the next couple of years. Not just equity, but debt too would benefit from this refresh with

transmission of rates and an expected 25-bps rate cut by the RBI in the coming months.

Reclaim: better times ahead with improved earnings outlook in new sectors/themes

This phase is expected to extend beyond 2026 with India reclaiming its earnings momentum,

global relevance and its long-term equity story. As earnings start catching up in 2026, the gap

between profit growth and market capitalization growth could propel markets higher. We believe

the indiscriminate small & midcap outperformance phase is behind us while large caps are better

positioned in this phase.

From an asset allocation point of view, domestic equities remain attractive relative to other asset

classes while fixed income would likely offer stability as the rate cycle turns positive. Overall,

2026 is not expected to be a straight line as geopolitics, trade concerns and currency movement

continue to persist as real risks. After the reboot and refresh, investors can look forward to

reclaiming earnings-led returns.