Sensex is trading further higher today, while other Asian stocks are trading lower

Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, July 2, 2024: As per the ISM data, US manufacturing PMI declined for the 3rd straight month, down

to 48.5 from 48.7 and the price pressure on inputs eased to a 6-month low. Investors

will track the JOLTS report, ADP data, non-farm payroll and Fed minutes, as this will

offer more cues on rate outlook. Global investors also closely monitored the growing

developments around the political space, ahead of the key elections. In Germany,

inflation eased down in Jun’24 to 2.5% (lowest in 3-years) from 2.8% in May’24 led

by lower energy prices. Core inflation also cooled off to 2.9% (previously 3%), while

service inflation remained unchanged at 3.9%. This data print came in ahead of the

Eurozone inflation which is expected to moderate down to 2.5% (2.6% in May’24)

raising the likelihood of another rate cut possibly in Sep’24.

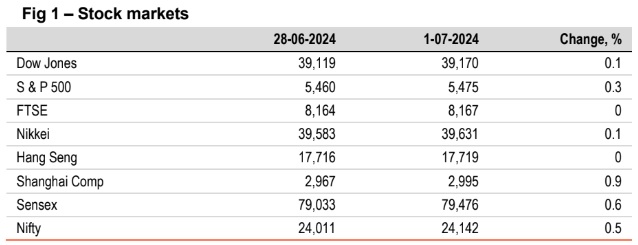

Barring FTSE (flat), other global indices ended higher. US stocks closed in

green led by gains in technology stocks. Shanghai Comp surged by 0.9% after

a surprising jump in manufacturing Caixin PMI which was in contrast with official

data. Sensex ended higher supported by strong gains in IT and consumer

durable stocks. It is trading further higher today, while other Asian stocks are

trading lower.

Global currencies ended mixed. DXY remained broadly stable despite a rally in

US bond yields. EUR rose by 0.3% as investors sought comfort from a weaker

than expected majority for the far-right parties in the French elections. JPY

languished near a 38-year low. INR depreciated by 0.1%. It is trading further

weaker today, in line with other Asian currencies.

Except Japan and China, other global yields closed higher as investors

assessed the political dynamics in US, UK and France. 10Y yield is US rose

amidst growing expectations of a win for Republican candidate Donald Trump.

In Germany and UK, 10Y yields rose by 11bps each. India’s 10Y yield ended flat

at 7.01% and is trading at the same level today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)