In the light of MPC's comfortable outlook on growth and undeterred focus on the 4% inflation target, a prolonged pause is expected to continue

FinTech BizNews Service

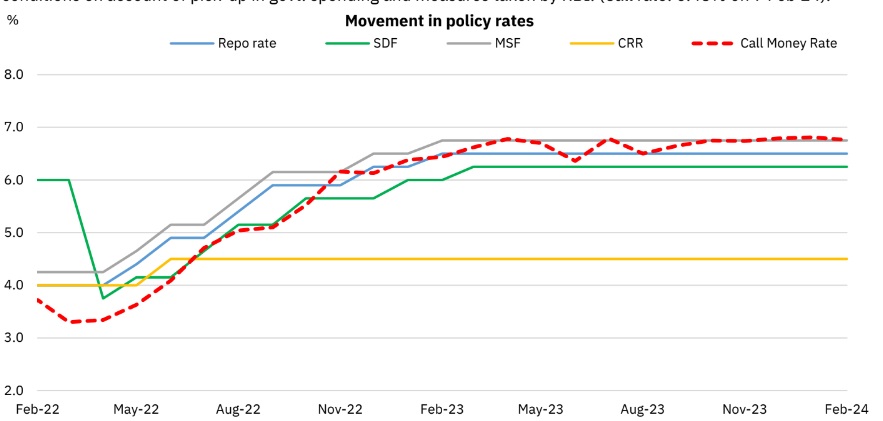

Mumbai, February 9, 2024: The RBI’s Monetary Policy Committee (MPC) decided to keep the policy repo rate unchanged at 6.5% and retain the ‘withdrawal of accommodation’ stance on a 5:1 majority, as the past rate hikes continue to work their way through the economy. Tirthankar Patnaik, PhD, Chief Economist, National Stock Exchange of India, explains: “With headline inflation expected to moderate in the near-term, weather (rabi sowing) and geo-political risks may impart upward pressure. With core at sub-4% level, Governor’s statement pointed the need to remain vigilant during the on-going process of disinflation. Forecast for headline CPI for FY24 is maintained at 5.4% while this is expected to decline to 4.5% in FY25. FAE[1] projects the FY24 at 7.3%--marking the third successive year of 7%+ real GDP growth rate. With robust manufacturing activity, healthy balance sheets of banks and corporates, and continued focus on capital expenditure keeps the growth outlook intact with RBI projecting the real GDP growth at 7% for FY25. RBI has been keeping a close eye on the liquidity tap with its recent VRRR and VRR auctions as liquidity conditions remain tight. While exogenous factors like government spending in the coming months will have implications on the systemic liquidity, RBI will use the appropriate instrument to maintain the money market rates (that saw some volatility over the last one week) closer to the policy repo rate of 6.5%.

While the MPC’s decision on maintaining status quo on rates and stance is in line with expectations, accompanied commentary remains hawkish. MPC reiterated its commitment to aligning inflation to the target and repeatedly highlighted the need to remain vigilant on the process of last mile of disinflation. Moreover, RBI maintained the “nimble and flexible” approach to manage liquidity such that the money market rate is maintained around the policy repo rate of 6%. In the light of MPC’s comfortable outlook on growth and undeterred focus on the 4% inflation target, we continue to expect a prolonged pause. Until then, RBI is likely to continue to focus on liquidity management to ensure liquidity conditions remain aligned with the monetary policy stance.”