INR recovered, but it is trading weaker today, while other Asian currencies are trading mixed

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, June 6, 2024: Private payroll data (ADP employment) in the US shows that employers added 152k jobs in May’24—slowest in 4 months and lower than est.: 175k and 188k in Apr’24.

Large firms (500 or more employees) added 98k jobs, while smaller firms (less than 50 workers) reported 10k job cuts (1st since Nov’23). Manufacturing sectors reported 20k job cuts (highest since Jul’22). Softer than expected labour market trends have fired up Fed rate cut bets. In contrast, US ISM service activity index showed improvement as the index rose to 53.8 in May’24 from 49.4 in Apr’24, led by rise in new export orders and business activity. In Europe, services sector activity seems to be holding ground with PMI for May’24 at 53.2 versus 53.3 in Apr’24. In Germany

while activity improved to 12-month high, in France it is at 4-month low.

ECB’s rate decision is awaited today. In India, services PMI moderated to 60.2 from 60.8.

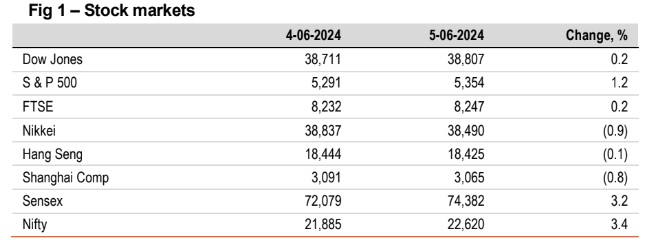

Global indices ended mixed. US indices ended in green with S&P 500 hitting a

record high led by gains in technology stocks. Investors monitored May’s private

payroll data and the growing plausibility of 2 rate cuts by Fed this year. Sensex

rebounded and settled 3% higher with auto, IT and FMCG amongst the top

gainers. It is trading higher today, in line with other Asian indices.

Global currencies ended mixed. DXY strengthened by 0.2% supported by

stronger than expected services PMI data (53.8 in May from 49.4). Investors will

turn their focus towards ECB policy decision, with 25bps rate cut possibility. INR

recovered, but it is trading weaker today, while other Asian currencies are

trading mixed.

Except China (flat) and UK (higher), other global yields continued to decline. US

10Y yield fell by another 5bps, tracking softer labour market data. In UK,

continued expansion in the services sector, albeit at a slower pace, kept

investors on edge regarding the timing of BoE’s 1st rate cut. India’s 10Y yield

fell by 1bps, and is trading even lower today at 7.02%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)