INR Is Trading Stronger Today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, July 08, 2024:US jobs report indicated a softening momentum in the labour market, bolstering the case for a rate cut in Sep’24. While non-farm payrolls increased more than expected by 206,000 in Jun’24 (est. 190,000), data for both Apr’24 and May’24 was revised sharply lower. Unemployment rate edged up to its highest since Oct’21 to 4.1% in Jun’24 from 4%. Growth in average hourly earnings slowed to 0.3% from 0.4% in May’24. Elsewhere in Japan, real wages declined for the 26th straight month by 1.4% in May’24. In Europe, focus remained on political developments. In UK, the new Prime Minister faces multiple challenges amid faltering growth in the country. In France, results of the second-round elections solidified expectations of a hung parliament. This week, focus remains on inflation reports from China, Germany, US and India, along with central bank meetings in New Zealand and South Korea.

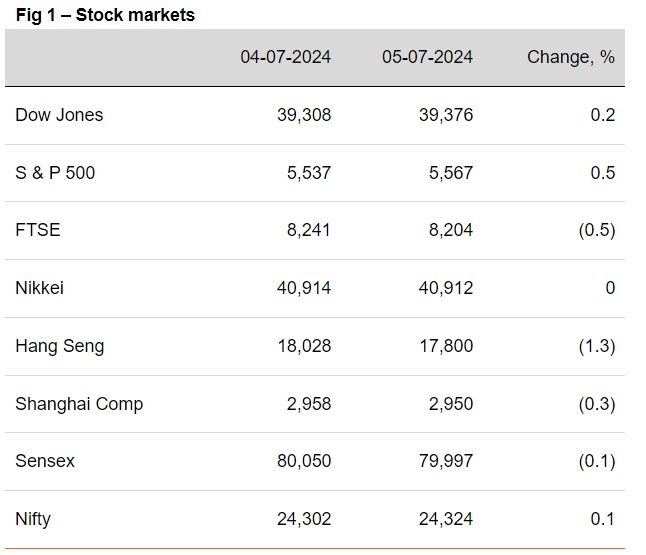

§ Global indices ended mixed. Stocks in US were supported by softening labour market conditions raising hopes of a rate cut in Sep’24 (CME Fed watch probability at 72% vs 57.9% last week). Stocks in UK were lower, as investors kept a close eye on election results where Labour Party won a resounding majority. Asian stocks traded cautiously with Hang Seng losing the most. Sensex was a tad down. It is trading lower today in line with its Asian peers.

§ Global currencies ended higher against the dollar. DXY declined as recent data has led to expectations of a Sep’24 rate cut. GBP appreciated the most after a landslide victory for the Labour party in UK elections. INR closed broadly unchanged. It is trading stronger today, in line with other Asian currencies.

§ Except China (higher), global yields closed lower. US 10Y yield fell the most supported by steep downward revisions in payroll numbers. Yields in Germany and UK also felt the impact of the same. Risk off sentiment surrounding evolving political landscape also led to increased demand for sovereign securities. India’s 10Y yield fell a tad, eyeing auction results. It is trading at the same level today.

Oil prices eased amidst reports of a ceasefire between Israel and Hamas.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)