INR Is Trading Flat Today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, July 10, 2024: While acknowledging the progress made in bringing inflation closer to the Fed’s target, the Fed Chair refrained from providing a timeline for future rate cuts. He also noted the recent softening in labour market conditions, opens up space for looser monetary policy going ahead. In China, CPI inflation rose less than expected by 0.2% in Jun’24 (est. 0.4 %) YoY, as domestic demand remained weak. Deflation in PPI eased further to 0.8% from 1.4% in May’24, matching estimates. On the other hand, PPI inflation in Japan edged up to 2.9% in Jun’24 from 2.6% as a weak yen

pushed up input prices. This along with increasing wages is likely to nudge the BoJ towards a possible interest rate hike expected by the markets. Separately, Reserve Bank of New Zealand kept interest rates steady and noted that inflation is likely to fall within its target in H2 2024. In India, RBI’s financial inclusion index edged up in Mar’24, led by improvement in all three sub-indices (access, usage and quality).

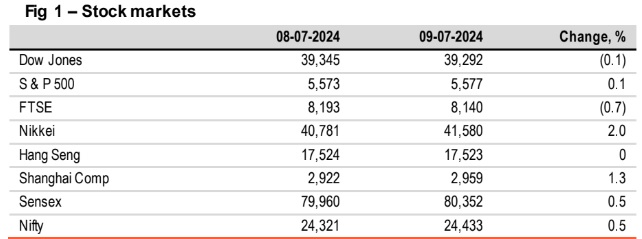

Global indices ended mixed. Investors monitored comments from Fed Chair

who acknowledged that recent macro data has bolstered case for policy easing.

Apart from this, political uncertainty in Europe, also weighed on investor

sentiments. Nikkei rose the most, while FTSE edged down. Sensex inched up. It

is trading lower today, while Asian stocks are trading higher.

Global currencies closed broadly lower against the dollar. DXY rose by 0.1%

despite dovish comments from Fed Chair. JPY depreciated the most by 0.3%.

INR closed broadly unchanged as a stronger dollar offset the drop in oil prices.

It is trading flat today, while other Asian currencies are trading mixed.

Global yields closed mixed. In UK, 10Y yield firmed up by 5bps awaiting

comments from BoE member. US 10Y yield rose by 2bps as investors remained

cautious over future trajectory of Fed fund rates. China’s 10Y yield fell a tad

ahead of inflation data. India’s 10Y yield closed stable and is trading flat today.

Oil prices fell as supply disruptions from cyclone Beryl were less severe than

expected.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)