Robust manufacturing activity amidst easing input cost pressures, revival in construction and a gradual recovery in the rural sector bodes well for overall consumption demand

Fintech Biznews Service

Prerna Singhvi, CFA

Vice President – Economic Policy and Research

National Stock Exchange of India Limited (NSE)

Mumbai, December 8, 2023: The RBI’s Monetary Policy Committee (MPC)

unanimously decided to keep the policy repo rate unchanged at 6.5% and retain the

‘withdrawal of accommodation’ stance on a 5:1 majority, as the past rate hikes

continue to work their way through the economy. Even as the headline inflation has

fallen sharply since the last meeting, there are upside risks emanating from recurring

food price shocks and their implications on inflation expectations. Further, volatility in

crude oil prices and global financial markets pose additional risks. That said, the

headline inflation estimate for FY24 has been retained at 5.4% for the second

consecutive policy, falling to RBI’s mid-point target of 4% by the second quarter of

FY25. The RBI remained sanguine on the growth outlook and has revised its FY24

GDP growth estimate upwards by 50bps to 7.0%, moderating slightly to an average

of 6.5% in the first three quarters of FY25. While strong manufacturing and

construction activity, and gradual recovery in the rural sector is expected to improve

consumption demand, investment growth is expected to remain robust, aided by

healthy balance sheets of banks and corporates, and robust capex push by the

Government. Liquidity conditions remained tight in November, thanks to high festive-

led currency demand, and Government cash balances, nullifying the need of OMO

sales. That said, liquidity pressure is likely to ease going forward with a pick-up in

Government spending. The MPC’s decision on maintaining status quo on rates and

stance is in line with expectations, accompanied with a balanced commentary. While

the MPC reiterated its commitment to aligning inflation to the target, it also

highlighted the need for remaining ‘mindful of the risk of overtightening’ for the first

time in the current cycle. In the light of MPC’s comfortable outlook on growth and

undeterred focus on the 4% inflation target, we continue to expect a prolonged

pause. Until then, RBI is likely to continue to focus on liquidity management to

ensure liquidity conditions remain aligned with the monetary policy stance. • Status

quo on rates and stance: In line with expectations, the RBI’s MPC unanimously

decided to retain the policy repo rate at 6.5%, citing the need to maintain vigilance

given the upside risks stemming from food prices in the nearterm. Moreover, it

continues to monitor the impact of past rate hikes on the economy. With this, the

Standing Deposit Facility (SDF) and the Marginal Standing Facility (MSF) rates—the

upper and lower bounds of the Liquidity Adjustment Facility (LAF) corridor—remain

unchanged at 6.25%, and 6.75% respectively. The members also voted, with a 5:1

majority, in favor of keeping the “withdrawal of accomodation” stance intact, with

Prof. J. R. Varma expressing reservations for the ninth time in a row.

• Inflation forecast for FY24 retained at 5.4%: Moderating inflation conditions are

expected to sustain in the near-term with vegetable prices coming off and a sharp

cut in LPG prices. This, coupled, with softening of gobal commodity prices and

import dependent food products serves as a positive. That said, uncertainty around

food prices and Rabi sowing getting pushed-off due to delayed Kharif harvest poses

upside risks to the outlook. Further, recurrence of food price shocks and volatility in

crude-oil prices could result in second-order effects in the form of generalisation and

persistence of inflation. Taking these risks into consideration, the RBI has maintained

its inflation forecast for FY24 at 5.4%, retaining its Q3 and Q4 forecast at 5.6% and

5.2% respectively. Assuming a normal monsoon next year, CPI inflation is projected

at 5.2% in Q1FY25, falling to 4% in Q2FY25, only to rise marginally to 4.7% in

Q3FY25.

• GDP growth revised up by 50bps to 7%: Even as global economy remains fragile,

domestic growth outlook has exhibited resilience, thanks to durable urban

consumption demand and strong Government spending. Following a significant

positive surprise in Q2, the RBI revised its FY24 GDP growth forecast upwards by

50bps to 7%, with Q3 and Q4 figures revised up to 6.5% (+50bps) and 6% (+30bps)

respectively. The momentum is expected to sustain in FY25, with growth forecast

pegged at 6.7% in Q1FY25, 6.5% in Q2FY25 and 6.4% in Q3FY25. Robust

manufacturing activity amidst easing input cost pressures, revival in construction and

a gradual recovery in the rural sector bodes well for overall consumption demand.

Investment growth is also expected to remain robust, aided by improving business

confidence and robust capex spending by the Government. Further, healthy balance

sheets of banks and corporates provide a conducive environment for a steady

recovery in private capex. Key downside risks to the growth outlook may emanate

from a weaker-than-expected external demand, heightened geopolitical tensions and

strengthened financial market volatility.

• Focus remains on liquidity management: After falling into deficit in September for

the first time in 4.5 years, systemic liquidity remained in deficit for a large part of

October and November, thanks to strong festival-led currency demand, higher

Government cash balances and liquidity operations by the RBI. After OMO (open

market operations) sales amounting to Rs 85.9bn in October 2023 following the last

policy announcement, tighter-than-expected liquidity conditions in November

precluded RBI from undertaking further OMO sales. While average borrowing

through MSF increased from Rs 946bn in Sep’23 to Rs 1.2trn in Oct-Nov’23, money

parked in overnight SDF declined from Rs 760bn in Sep’23 to Rs580bn in Nov’23,

indicating a decline in the skewness of liquidity even as conditions continue to

remain tight. That said, liquidity pressure is likely to ease going forward with a pickup

in Government spending.

• Prolonged pause for now: While the pause on rates and stance was widely

expected, the commentary became much more balanced vis-à-vis a hawkish rhetoric

in the previous three policies. Even as the Governor reiterated MPC’s commitment to

aligning inflation to the 4% target, he also cautioned against the “risk of

overtightening” which looks like a first step towards moving to a neutral stance. In the

light of MPC’s comfortable outlook on growth and undeterred focus on the 4%

inflation target, we continue to expect a prolonged pause. Until then, RBI is likely to

continue to focus on liquidity management to ensure liquidity conditions remain

aligned with the monetary policy stance.

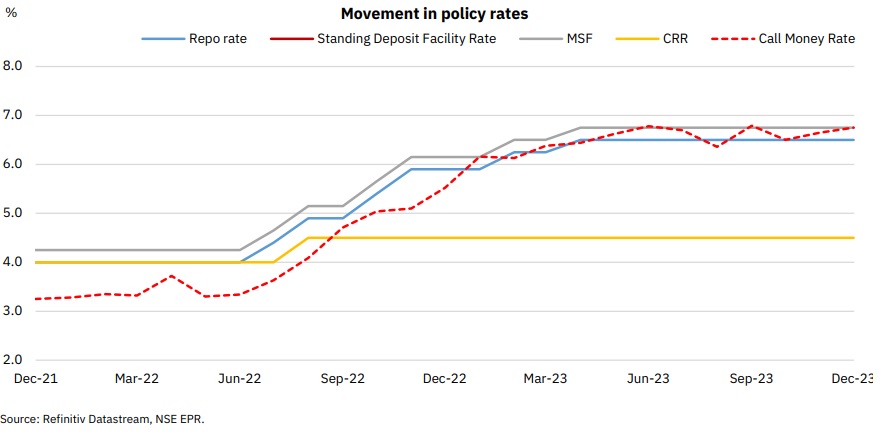

Movement in key policy rates

The policy repo rate was retained at 6.5% in the December policy, accompanied with

continuation of “withdrawal of accommodation” stance. Call money rate exceeded

the repo rate after the previous policy announcement that followed OMO sale by the

RBI. It further increased in November to 6.8% (30bps above MSF) after the

announcement of the increase in risk weights on NBFCs.

Net lending under RBI’s Liquidity Adjustment Facility

Net systemic liquidity remained mostly in deficit throughout October and November,

with liquidity injections through the LAF peaking at Rs 1.8trn on November 22nd, the

highest since Dec’18.

Change in yield curve on the policy day and in FY24 thus far (As on December

8th, 2023)

Yields have hardened across the curve since the last policy following the OMO sales

in October and increase in risk weights for NBFCs in November.

India vs. US policy rates and yield differential

Softening in global yields has resulted in widening of spreads between India and US

bonds.

India’s consumer inflation trajectory and RBI’s forecasts

The RBI maintained the headline CPI inflation forecast for FY24 at 5.4%. Further,

RBI expects inflation to decline to 4% in Q2FY25 while increasing to 4.7% in the third

quarter.

GDP growth trend and RBI’s estimates

The RBI has turned sanguine on the growth outlook and has revised its FY24 GDP

growth estimate upwards by 50bps to 7.0%. The forecast for Q3FY24 and Q4FY24

have also been revised upwards by 50bps and 30bps respectively from the last

policy. The momentum is expected to sustain in FY25, with growth forecast pegged

at 6.7% in Q1FY25, 6.5% in Q2FY25 and 6.4% in Q3FY25.

(Disclaimer This report is intended solely for information purposes. This report is

under no circumstances intended to be used or considered as financial or investment

advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any

securities or other form of financial asset. The Report has been prepared on best

effort basis, relying upon information obtained from various sources, but we do not

guarantee the completeness, accuracy, timeliness or projections of future conditions

provided herein from the use of the said information. In no event, NSE, or any of its

officers, directors, employees, affiliates or other agents are responsible for any loss

or damage arising out of this report. All investments are subject to risk, which should

be considered prior to making any investment decisions. Consult your personal

investment advisers before making an investment decision.)