Strong earnings growth to act as the accelerator to the market

FinTech BizNews Service

Mumbai, 17 February 2026: The Indian market may see a gradual upward movement in the next few months after months of stagnation, driven by improving earnings outlook but also impeded by high and possibly lower multiples in the consumption sectors. 3QFY26 results were decent, with strong growth in the revenues and earnings of consumption sectors, auguring well for FY2027E earnings, as per the latest Kotak Institutional Equities - Strategy Note, authored by Sanjeev Prasad, MD & Co-Head. .

Strong earnings growth to act as the accelerator to the market

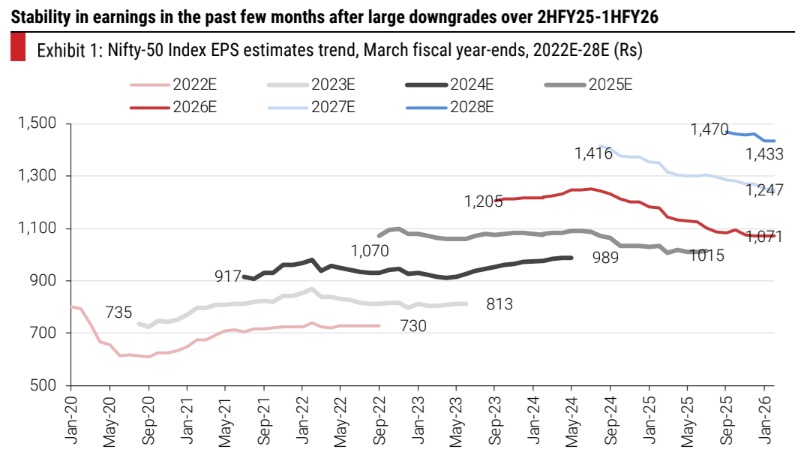

We expect FY2027E and FY2028E net profits of the Nifty-50 Index to grow 16% and 15% after a muted 8% growth in FY2026. We base our constructive view on earnings on (1) higher nominal GDP growth in FY2027 (around 10%) versus in FY2026 (around 8%); (2) recovery in consumption demand from 2HFY26, aided by lower GST, income tax and interest rates; and (3) stronger export revenues on the ‘conclusion’ of the long-pending India-US trade deal. Nonetheless, we note downside risks to earnings from (1) weaker-than-expected global growth and (2) lower-than-expected margins in the case of automobiles and consumer staples on raw material and/or competitive pressures.

Rich valuations to act as brakes on the market

We find the valuation of the Indian market and several sectors and stocks to be quite high despite the lengthy period of time correction in the market. The multiples of the consumption and investment sectors have been sustained at high levels, despite large earnings downgrades over FY2025-1HFY26 due to (1) continued price-agnostic buying of domestic retail investors and (2) enduring faith of the Street about an imminent and strong recovery in earnings. Multiples in most sectors (other than financials) are above or in line with pre-Covid multiples despite (1) lower earnings growth and (2) weaker fundamentals in most cases due to increased competition and/or other disruption threats. The market continues to misprice disruption threats, as recent events have shown.

Moderate outlook for both consumption and investment

We expect steady consumption and investment in the next few quarters, with limited scope for any meaningful acceleration in either, given the low scope for further fiscal and monetary stimulus. Low-income household consumption may see a modest recovery on better affordability and government capex should see a moderate pickup; however, household capex will likely see a slowdown. We note that (1) robust government capex (railways, roads), (2) strong residential real estate demand (household capex) and (3) strong high-income household consumption had driven overall GDP growth over FY2021-25.

Decent 3QFY26 augurs well for the next few quarters

3QFY26 net income of the Nifty-50 Index grew 9.8% versus our expectation of 2.5% growth, and net income of the KIE coverage universe grew 15.1% versus our expectation of an 8% increase. 3QFY26 EBITDA of the Nifty-50 Index increased 5% versus our expectation of 4.4% growth and EBITDA of the KIE coverage universe grew 11.7% versus our expectation of a 10.6% increase.