Sequential momentum has picked up across headline, food, fuel, and core inflation

Radhika Piplani

Chief Economist

DAM Capital Advisors

FinTech BizNews Service

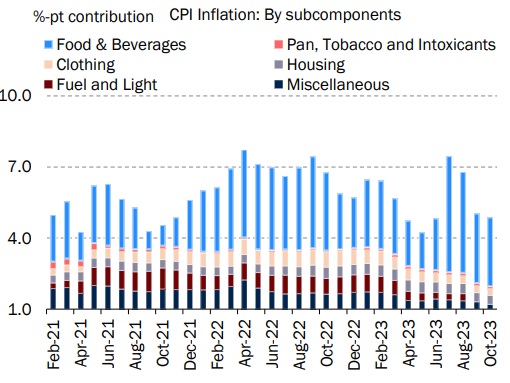

Mumbai, November 14, 2023: Retail inflation eased to four month-low print of 4.9% in October 2023. More importantly, core inflation dropped to 4.3%, lowest since April 2020. Both the prints are supported by favourable base of last year.

· In annual terms, the broad-based moderation across all the major components is comforting; however, the sequential momentum has picked up across headline, food, fuel, and core inflation.

· As such, the MPC would continue to maintain their hawkish tone to see a sustained downtrend in inflation towards the 4% target while ensuring tightness in banking liquidity.

· We continue to foresee ‘higher for longer’ interest rate scenario for India through H1 FY25, in tandem with global monetary policy, and expect FY24 inflation to average 5.4%, in line with RBI’s estimate. q Food inflation: limited comfort On a YoY basis, food inflation reached 6.2% in October 2023, almost similar to previous month. However, on a sequential basis, it increased 1.0% after two consecutive months of decline led by the rise in prices of vegetables, fruits, eggs, and milk.

· Vegetable prices picked up due to a double-digit growth in onion prices (15.5% MoM), for the fourth consecutive month.

· Cereal prices grew by 0.8% MoM in October 2023 (Sep: 1.2%), due to a fall in prices of rice rather than those of wheat.

· Price momentum of pulses eased to 2.5% in October 2023 (Sep: 4.1%), led by government intervention through imports.

q Core inflation: limited comfort

Core inflation (e.g., food, fuel, PTI) eased on an annual basis but increased on a MoM basis (Oct-2023: 4.3% YoY; 0.3% MoM, Sep-2023: 4.6% YoY, 0.2% MoM). Housing, clothing, household goods and services, and health prices increased on a sequential basis. Price momentum of transport, communication, and recreation was retained, whereas prices of education and personal care products dropped on a MoM basis. We remain comfortable with the trajectory of core inflation going forward and expect it to continue below 5% for remaining months of the fiscal year.

q Fuel inflation: limited comfort

Although petrol and diesel prices remained unchanged for retail consumers, the seasonality around ‘firewood and chips (+0.2% MoM)’ and ‘dung cake (0.8%MoM)’ has kicked in (traditional source of heat). Both these components contribute more than one-third to the fuel inflation. This comes at a time when kerosene prices at the PDS also increased in September (+6.3% MoM) and October (+2.3% MoM). At a consolidated level, fuel inflation picked up by 0.2% MoM (-0.2% YoY) in October 2023 vs. (-) 3.1% MoM (0% YoY) in September 2023.

q MPC to remain on hawkish pause

The CPI inflation has corrected sharply from 7.4% in July 2023 to 4.9% in October 2023, led by overall moderation in food prices and core inflation since that time. However, the MPC’s objective is to see inflation levels closer to the 4% target on a sustained basis. This, in our view, still seems a distant reality. The October inflation was supported by the favourable base of last year, and we see inflation picking up once again next print onwards (Nov-2023 prelim est.: 5.3%). Furthermore, inflation has not yet eased across components on a sequential basis, as seen from the above commentary. As such, it is too early for the MPC to draw comfort from this print alone. Although we now expect FY24 inflation to average at 5.4% (earlier:5.7% with downside risks), we maintain our view that the MPC would tread with caution going forward. We expect status quo on repo rate through H1 FY25, with liquidity being closely managed.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)