Rs510 bn for FY24 looks to be a stretch, given only Rs80 bn has been garnered till date

Radhika Piplani

Chief Economist

DAM Capital Advisors

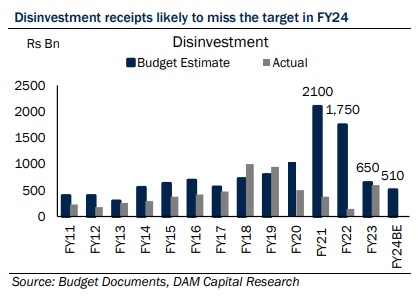

Mumbai, November 20, 2023: Total disinvestment proceeds since 2014 are about Rs4.75 tn until fiscal last year. However, the government’s performance on disinvestments has been mixed. Except for FY18 and FY19, disinvestment fell short of Budget Estimates (BE). During FY20, the government earned only half of the BE. In the pandemic years, receipts were much lower. In FY23, strategic sale in LIC garnered Rs205 bn out of the total disinvestment receipts of Rs353 bn, but there was still a Rs150 bn shortfall. Further, a delay in the IDBI Bank stake sale may cause the centre to miss its target for the fourth consecutive year.

· In FY24BE, disinvestment receipts are projected to be at Rs510 bn, in line with Rs500 bn for FY23RE. However, in our view, Rs510 bn for FY24 looks to be a stretch, given only Rs80 bn has been garnered till date. Key disinvestments that have been made in FY24 so far include Coal India, HAL, HUDCO, Rail Vikas Nigam, SJVN. Further projects in the pipeline include IDBI Bank, CONCOR, BEML, Shipping Corporation of India, NMDC Steel, HLL Lifecare and PDIL. q Elections and valuation expectations to reduce the pace of disinvestments going forward

· The financial bids for NMDC Ltd steel plant (NSL), located in Chhattisgarh (state elections in November), are expected to be postponed until the Lok Sabha elections. According to government officials, the sale of the plant will not be hurried unless it meets valuation expectations. The government had initially anticipated a minimum of Rs110 bn from the sale. Earlier this year, the government had announced multiple expressions of interest for NMDC Steel, with potential bidders including Tata Steel, Jindal Steel and Power, JSW Steel, Adani Group, and Vedanta Group for the government's majority stake.

· On 18 October, GoI also put an offer for sale (OFS) to reduce up to 7% stake in the state-run housing finance company - Housing and Urban Development Corporation (HUDCO). The plan included selling 3.5% of the company, with an option to sell an additional 3.5% if the offer was oversubscribed. The sale helped it to raise about Rs10.5 bn vs. Rs11 bn expectations.

· The proposed sale of IDBI Bank, which is expected to work as the template for future bank disinvestments, had received initial bids seven months ago and is yet to get the RBI’s “fit and proper” clearance on the shortlisted bidders.

· The Air India and LIC disinvestments marked a significant milestone, representing major privatisation in 19 years. Reportedly, the government might consider further dilution of LIC after the Lok Sabha election.

· The Railway Ministry raised concerns about the impact on logistics prices regarding CONCOR.

· The BPCL stake sale was cancelled due to a lacklustre response from potential investors.

· Winning bidders for Pawan Hans and Central Electronics were disqualified due to ongoing legal disputes.

With the corporate and income tax collections pacing up in Q2 FY24 (refer Fiscal: Direct tax collections catching up; Expenditure maintains pace, dated 31 October 2023), the centre appears closer to its target of achieving budget deficit target of 5.9% of GDP. Risks to this view remain from lower nominal GDP growth (8-9% vs. 10.5% BE). With nominal GDP expected to be lower, revenue receipts on account of direct and indirect tax collections might see a miss. If the pace of expenditure remains steady, then the possibility of fiscal slippage remains on the cards. To add, disinvestment receipts are likely to disappoint. Assuming disinvestments to achieve an optimistic target of Rs200-250 bn (FYTD24: Rs80 bn), we see risks of fiscal slippage by 10 bps.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)