Gold Posts 25% YTD Gains, Outlook Remains Firm

Silver has also followed suit with a 15% YTD gain on COMEX; A surge in safe-haven demand from both institutional and retail investors

FinTech BizNews Service

Mumbai, April 17th, 2025: Gold has delivered a stellar performance in the first four months of 2025, gaining nearly 25% year-to-date (YTD) and marking all-time highs on both MCX and COMEX. Silver has also followed suit with a 15% YTD gain on COMEX. This sharp rally is attributed to a combination of heightened geopolitical risks, trade tensions—particularly between the U.S. and China—and a surge in safe-haven demand from both institutional and retail investors, according to a repport from Motilal Oswal Financial Services.

Commodities: Sequential decline in volumes after recording the highest ever ADTO in Feb’25

As per the 'Sector Update report on FINANCIALS - CAPITAL MARKET' by Motilal Oswal Financial Services;

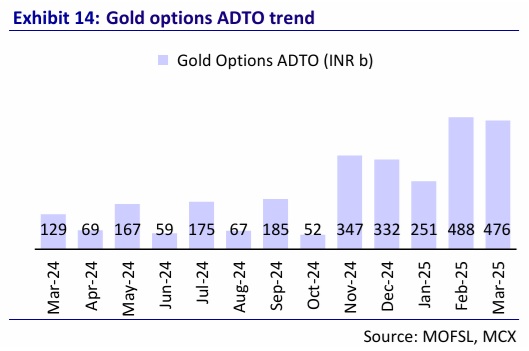

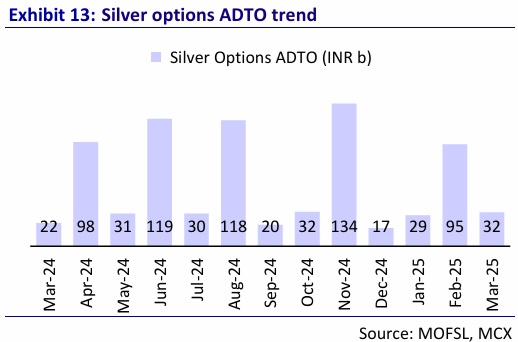

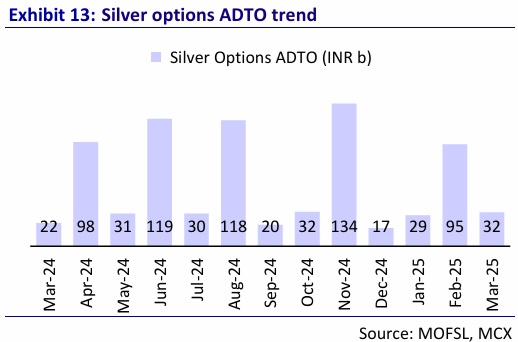

- Total volumes on MCX declined 9% MoM to INR49.1t in Mar’25 (up 83% YoY), with ADTO declining to ~INR2.5t after achieving a peak in Feb’25 (INR2.6t). Option volumes declined 10% MoM to INR43.4t, while futures volumes declined 1% MoM to INR5.8t.

- The decline in options volumes was largely due to a 9%/6%/68% MoM dip in crude oil/ gold/silver volumes. This was offset by a 29% MoM growth in natural gas volumes.

- In commodity futures, a 1%/18% MoM decline in crude oil/silver volumes was offset by 9%/20% MoM growth in gold/index volumes.

Market activity recovers sequentially

- In Mar’25, total ADTO recovered strongly, growing 22% MoM to a four-month high of INR353t. While cash activity witnessed a slight recovery with ADTO above INR1t (+8% MoM), F&O ADTO delivered a strong 23% MoM growth driven by market volatility.

- Retail participation improved across segments as valuations became attractive post-market corrections. Retail cash ADTO grew 11% MoM to INR380b, while retail futures and options premium ADTO grew 4% MoM to INR580b.

- Commodity notional ADTO was mainly affected by volatility in crude oil and precious metals as it declined from its Feb’25 peak to INR2.5t (-4% MoM) in Mar’25.

- Demat additions continue to decline and were the lowest since Apr’23 at 2.0m in Mar’25 (2.3m in Feb’25). Historically, demat addition has been weak during the phase of weak market performance and high uncertainty in macroeconomic conditions.

- Mutual fund AUM declined ~1% MoM in Mar’25 to INR66.7t (up 21% YoY), with equity AUM remaining broadly stable MoM at INR28.6t (INR28.8t in Feb’25). SIP flows were largely stable at INR259b vs. INR260b in Feb’25.

- The capital market ecosystem witnessed a mixed performance in FY25, with strong growth in 1HFY25 and then declining activity in 2HFY25 due to regulatory impact, weak market sentiments, and uncertain macroeconomic conditions. We expect the revival in volumes witnessed in Mar’25 to sustain the driving stable growth trajectory of brokers and exchanges as participation rises gradually. Mutual fund activity is anticipated to remain stable, backed by industry efforts to spread awareness, enhance financial literacy, and promote a long-term investment perspective. Our top picks in the sector are: ANGELONE, BSE, HDFCAMC, and Nuvama.

Equity: Sequential recovery in ADTO; BSE’s F&O market share on the rise

- Total ADTO grew 22% MoM in Mar’25 to INR353t, led by 22%/8% growth in F&O/ cash ADTO to INR352t/INR1t. The option premium ADTO grew 7% MoM to INR635b.

- In the cash segment, NSE maintains a dominant position with a 95% market share in Mar’25. Conversely, BSE’s F&O market share continues to expand MoM. It had a notional turnover market share of 36.7% in Mar’25 (36% in Feb’25) and an option premium turnover of 19.6% (19.3% in Feb’25).