Mahavir Lunawat, Co-Founder, Pantomath Group: At Pantomath, we progress with values and currently, we stand strong with 109 IPOs managed within a decade. Today, as one team, we have done 150 fundraising transactions and have expanded our investor network to over 1000 investors. We are proud to state that we have served over 600 clients across India from over 30 different industries

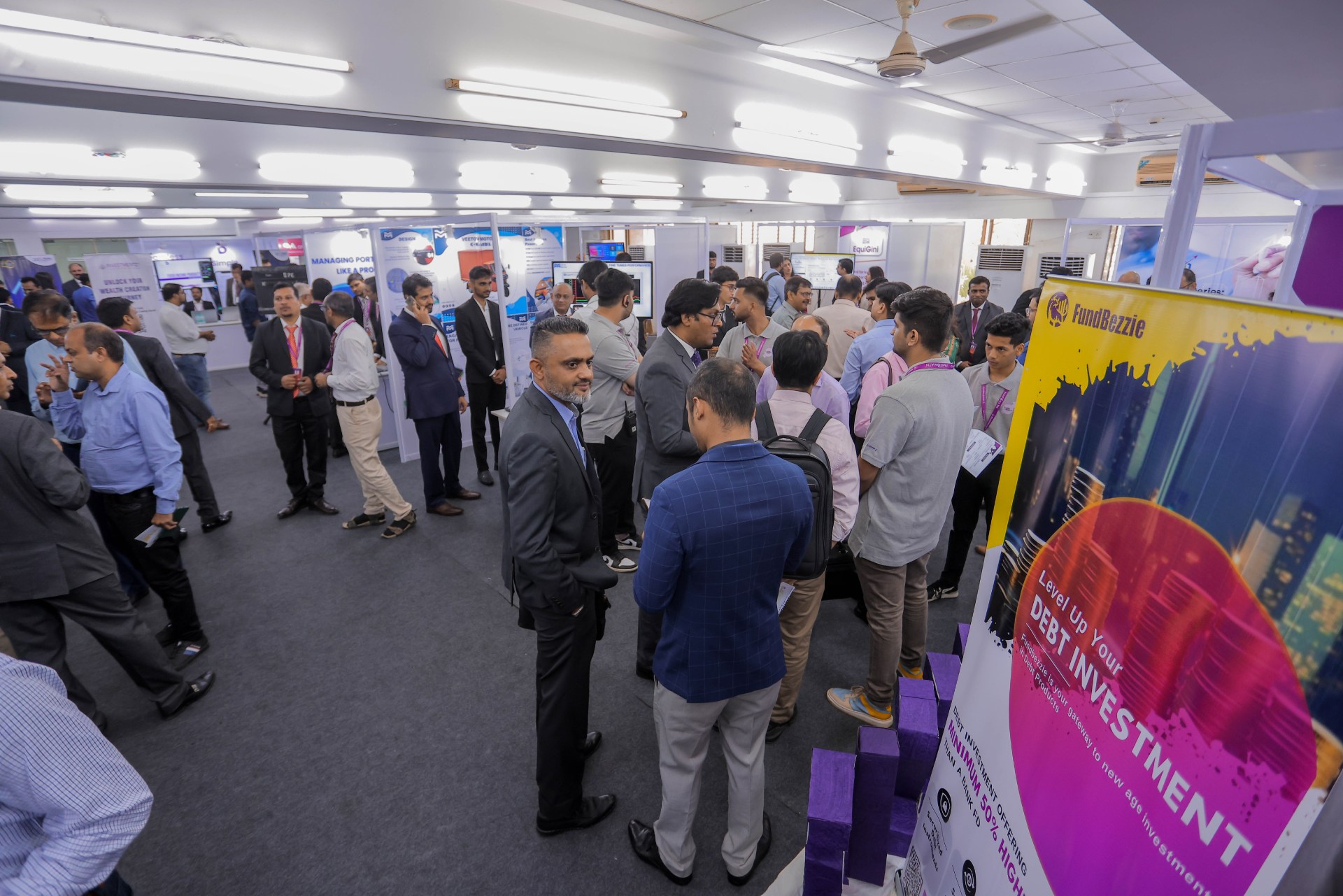

Investor Expo at Pantomath Headquarter

FinTech BizNews Service

Mumbai, December 6, 2023: Pantomath Group - one of the fastest-growing financial services groups - completed 10 years on Tuesday, 5th December 2023. To commemorate the decade of contribution to capital markets, Pantomath Group organized day-long series of events consisting of a Board Room Think Tank, Investor Roadshow, Investor Expo, Pranic Healing Session, Movie Show, Food Fiesta, and an in-person live interaction with the Legendary Bollywood singer Mr Sukhwinder Singh.

During the event, Pantomath exhibited 10 new initiatives consisting of a digital investment banking platform, an AI-powered real-time lead, and sales generation engine, actionable decision-ready insights and reports derived from hundreds of sources, a one-stop trading platform, a wealth management platform, a portfolio of stocks or ETFs based on ideas and strategy, Pre-IPO fund new series, scientific investing platform, and unlisted securities trading platform. Pantomath will be introducing these initiatives in a succession over the next 10 weeks

Mr. Mahavir Lunawat, Co-Founder, Pantomath Group, said, “Pantomath Group has been at the forefront of contributing to India’s growth. The 10th anniversary is an important occasion for us as we have not only managed to help investors discover high-potential companies that were untracked but also acted as growth enablers by helping them list on the capital market. At Pantomath, we progress with values and currently, we stand strong with 109 IPOs managed within a decade. The goal has always been to strategically reshape the capital market and become a growth enabler to the companies that have the potential to contribute to the Make in India mandate.”

Mr. Lunawat added, “Over the years, with the support of our team, business partners, regulators, investors, clientele among our other stakeholders, we have completed 10 years of our contribution to markets. Today, as one team, we have done 150 fundraising transactions and have expanded our investor network to over 1000 investors. We are proud to state that we have served over 600 clients across India from over 30 different industries. This significant journey of growth is all because of our stakeholders.”

Ms. Madhu Lunawat, Co-Founder, Pantomath Group, said, “The financial ecosystem is governed by trust and that is what Pantomath has achieved over the last 10 years. With a clear vision of investing in the right asset classes, Pantomath has jumped to scale from 3 to a 300-member team today. We believe in becoming a vibrant platform for companies who are the hidden changemakers of the industry and the upcoming decade will be of these changemakers.”

At Boardroom Think Tank, the dignitaries like Mr. Harish Mehta Founding Chairman, NASSCOM and Founder, Onward Technologies Ltd.; Mr. Prem Godha, CMD, IPCA Laboratories; Mr. Mihir Vora, CIO, Trust Mutual Fund; Swami Shri Parmatanandji Maharaj; and legendary Singer Sukhwinder Singh discussed a range of themes consisting The Mavericks Effect of India’s progressive IT Mandate; The Secret Source of Successful Entrepreneur; Art of Investing; Navigating Entrepreneurship to Leadership Lesson in Bhagwat Gita and Orchestrating Success.

Similarly, at the Investor’s Roadshow, the participant companies like Creative Newtech Ltd; Manorama Industries Ltd; Hi-Tech Pipes Ltd; Arihant Superstructures Ltd; Prince Pipes and Fitting Ltd; Man Infra Constructions Ltd; Aeroflex Industries Ltd; Fino Payment Bank and Vishnu Prakash R Punglia Ltd articulated their growth strategies and overall value proposition. Some of these companies had the highest IPO subscription ever recorded in the primary market.

For the last 10 years, Pantomath Group has been reaching out to businesses at the remotest locations across the length and breadth of India, becoming one of the fastest-growing financial services groups. With this, the group has managed to secure India’s largest private network of more than 7000 businesses.

About Pantomath Financial Services Ltd: -

In a decade, Pantomath has become one of the fastest-growing financial services groups backed by Investment banking, Fund management, and distribution verticals. The Group has recently expanded into wealth management, fin-tech, stock broking, and distribution by acquiring a significant stake in Asit C Mehta Financial Services Limited, a 40-year legacy created by Deena Mehta and Asit C Mehta.

Pantomath Group was founded by Ms. Madhu Lunawat and Mr. Mahavir Lunawat on 5th December 2013. Mahavir Lunawat is an industry veteran with extensive expertise in capital markets & investment banking and Madhu Lunawat has over two decades of experience in investment management, corporate finance, asset reconstruction, and many other related financial services.

For over a decade, Pantomath Group has been reaching out to businesses at the remotest locations across the length and breadth of India. The team at Pantomath travels to small towns and villages, scans through the industrial clusters, and identifies high-growth businesses. Over the period, the Pantomath Group has emerged as India’s largest private network having direct corporate connect with more than 7,000 business houses.

Pantomath Group’s lines of business consist of –