Core exports continue to face risks stemming from global growth slowdown and halt of key agri exports

Radhika Piplani

Chief Economist

DAM Capital Advisors

Mumbai, November 16, 2023: India’s October 2023 goods trade deficit widened to USD31.5 bn, the lowest in the series, led by 20.8% MoM (+12.3% YoY) jump in imports and 2.5% decline in exports (+6.2% YoY).

Exports moderated…

Exports declined for the second consecutive month to USD33.6 bn in October 2023, but the pace moderated to (- )2.5% MoM as against (-)10.4% MoM in September 2023. Core exports declined for the second consecutive month at a reduced pace of 1.3%. Oil exports contracted as well amid the decline in oil prices (-3.8% MoM). Within non-oil exports, key agri-related commodities such as rice, other cereals, tea, coffee experienced a decline. Some textile related sectors such as readymade garments, jute, and cotton also weakened. Additionally, engineering goods, iron ore, gems and jewellery exports also witnessed a decline. With oil prices lower in November so far (-5.5% MoM), it is likely that the oil exports will moderate further (assuming constant volume). Core exports continue to face risks stemming from global growth slowdown and halt of key agri exports such as rice, sugar, etc. Higher export price of onion starting end-October is further expected to weigh on agri-exports.

Imports surged to an all-time high…

Imports jumped by 20.8% MoM to USD65 bn, led by a broad-based increase across oil, gold and non-oil-non-gold or core imports.

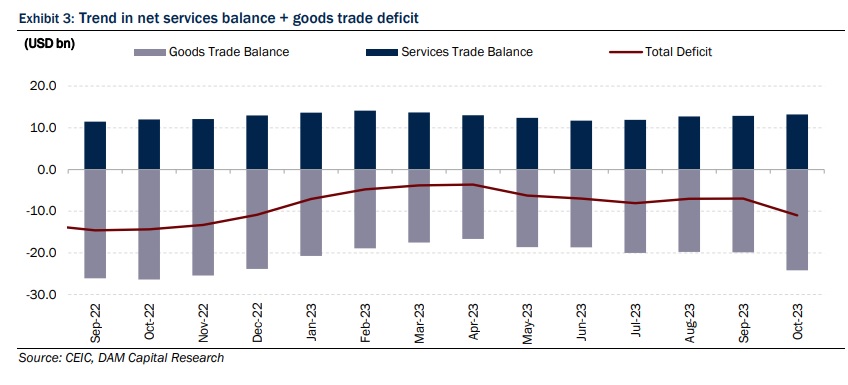

Services export excels once again

The October 2023 net service surplus widened to USD14.4 bn, highest in ten months to October. This was due to the pick-up in services exports by 1% MoM (+13.4% YoY) and decline in services imports by 1.8% MoM (+6% YoY). On FYTD24 basis, net service surplus has grown by 15.7%, despite global headwinds. This is likely due to higher IT and BPO services exports to the US, the UK, and Europe.

CAD/GDP to remain contained within 2%

An increase in trade deficit to an all-time high might unnerve the currency traders due to the concerns about its impact on current account deficit. However, we see this print as a one-off. The surge in gold, silver, electronics, and oil imports suggest inventory build-up in anticipation of festive and marriage-related spend in November and December. Goods exports, on the other hand, continue with their weakening momentum, however, at a reduced pace. Despite good exports looking weak, services exports are likely to offset its negative impact on current account balance.

Overall, we expect current account deficit at USD64 bn or 1.8% of GDP (oil avg: USD85 pb). With RBI’s FX reserve at USD590.8 bn as on 3 November 2023, sudden capital outflows are likely to encounter FX intervention to prevent a sharp rupee depreciation. Although we see rupee in the range of 83.00-83.50 in the near term, we do not reject the possibility of it touching 84.50 by March 2024.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)