For FY24 and FY25, CAD expected at 1.4% and 1.5% of GDP

Radhika Piplani

Chief Economist

DAM Capital Advisors

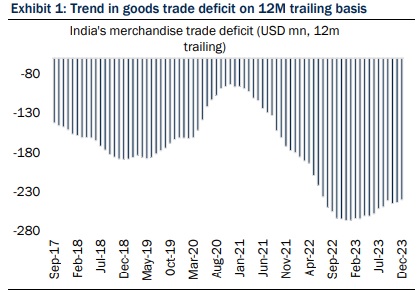

Mumbai, January 16, 2024: December goods trade deficit narrowed to USD19.8 bn, with exports rising more than imports on a sequential basis (Nov 2023: USD20.6 bn).

Exports registered strong growth

Exports rose by 13.5% MoM to USD38.5 bn in December 2023. On an annual basis, the increase was by 1% YoY in December 2023 [November 2023: (-)2.9%YoY]. Value of oil exports moderated due to a decline in oil prices by 7.3% MoM in December. Non-oil exports picked up sharply by 19.6% MoM on account of calendar year-end seasonality.

· On an annual basis, exports of tobacco, spices, oil seeds, meat, dairy products, gems and jewellery, pharma, engineering goods, electronics, cotton, handicrafts, and plastic increased. · Exports of tea, coffee, cereals, leather, chemicals declined but at a reduced pace. q Imports increased as well… Imports rose by 6.9% MoM to USD58.3 bn in December 2023, led by increase in non-oil-non-gold (core) imports. Oil imports registered flat growth possibly on account of higher import volumes negating the effect of lower oil prices. Gold imports fell for the second consecutive month in December following the festive stocking in October. · Core imports increased by 11.6% MoM to USD40.3 bn, led by higher imports of fertilisers, artificial resins, plastic materials, pearls, precious and semi-precious stones, machine tools, machinery (electronic and non-electronic), electronics and pharma products. Year-end sales and wedding season are likely to be the reason for higher imports of pearls, precious stones, electronics, etc., whereas the ongoing rabi season is likely to be the key driver for higher fertiliser imports. q Services export: Modest decline The December 2023 net service surplus widened marginally to USD14.6 bn, as against the downwardly revised print of USD14.4 bn in November. On a YoY basis, services exports declined by 10.6%, whereas imports declined by 16.2%. A modest decline was also witnessed on a sequential basis (exports:(-)0.7%; imports:(-)3.1%). We consider the decline as a one-off and remain positive on the overall export dynamics of the services sector. q CAD/GDP to remain contained well within comfort zone in FY24 and FY25 In FYTD24, goods trade deficit averages to USD20.9 bn as against USD23.6 bn in the corresponding period of last fiscal. Similarly, the services trade balances averages to USD13.2 bn in FYTD24, as against USD11.6 bn in the corresponding period of last fiscal year. With goods trade deficit trailing lower and net services surplus trailing higher so far, the pressure on CAD is expected to be way lower this year as compared to the last year. This is adequately reflected in the movement of USDINR, with the pair now trading below 83 level. We believe that even if there are any headwinds to merchandise trade, going ahead, due to unexpected global growth slowdown or commodity market volatility, services exports can to an extent act as a strong buffer. As such, we expect CAD/GDP at 1.4% and 1.5% in FY24 and FY25, respectively (assuming average oil prices at USD83pb and USD80pb, respectively). In our view, in the run-up to 2024 General Elections, USDINR is expected to trade in the range of 82.75-83.25 keeping in view the strong macroeconomic fundamentals, robust capital inflows on likely policy continuity, favourable oil prices, and relative dollar weakness. After the election results, rupee is expected to weaken to 83.50- 84 level. As a base-case scenario, we expect USDINR to average at 83.50 in FY25, pricing in lower depreciation than the historical average.

(Disclaimer/Disclosures: DAM Capital the Research Entity (RE) is also engaged in the business of Investment Banking and Stock Broking and is registered with SEBI for the same. DAM Capital and associates may from time to time solicit from or perform investment banking or other services for companies covered in its research report. Hence, the recipient of this report shall be aware that DAM Capital may have a conflict of interest that may affect the objectivity of this report. Investors should not consider this report as the only factor in making their investment decision. The RE and/or its associate and/or the Research Analyst(s) may have financial interest or any other material conflict of interest in the company(ies)/ entities covered in this report.)