Electricity, coal, cement and steel output trajectory driven by infrastructure sector

Suman Chowdhury,

Chief Economist & Head - Research,

Acuité Ratings & Research

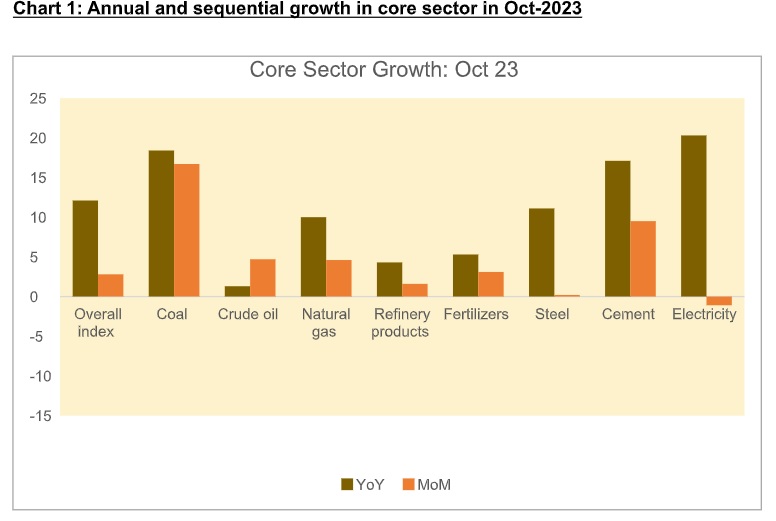

Mumbai, December 2, 2023: The output growth of eight core industries (ECI) stood at 12.1% YoY in Oct-23, sharply higher than the modest 0.7% YoY recorded in Oct-22. This was also significantly higher than the 9.2% YoY (revised) growth in Sep-23. Sequentially, the core sector index has risen by 2.8% in Oct-23 whereas it had dropped by 3.9% in Sep-23. For April-Oct’23, the core output grew 8.6% (provisional) as compared to 8.4% in same period last year. The Eight Core Industries comprise 40.27 percent of the weight of items included in the Index of Industrial Production (IIP).

The core sector has been broad based and all the eight core industries - Coal, Crude oil, Steel, Electricity, Natural Gas, Refinery Products, Cement, and Fertilizers recorded a healthy annualised growth in Oct-23 over the corresponding month of last year. Five of the eight core industries - electricity, coal, cement, steel, and natural gas have witnessed double-digit growth in October 2023. Electricity generation showed a robust growth rising of 20.3% YoY for the month which is highest among all the segments and largely reflects the additional power demand from the residential and agricultural markets due to warm weather conditions. Driven by higher demand from the power sector, coal output also notched up a growth of 18.4% YoY in Oct-23, higher than the 3.8% in Oct-22.

Here are our brief comments on each of the core segments:

Disclaimer: Acuité has taken due care and caution for writing this release. Information has been obtained by Acuité from sources which it considers reliable. However, Acuité does not guarantee the accuracy, adequacy or completeness of information on which this release is based. Acuité is not responsible for any errors or omissions or for the results obtained from the use of this release. Acuité has no liability whatsoever to the users / distributors of this release.