The peaking of the rate cycle will affect APAC developed market (DM) banking sectors more than those in EMs

FinTech BizNews Service

Mumbai, January 3, 2024: Robust Economic Growth to Support Sector Outlooks: Economic growth in APAC will generally remain strong in 2024, especially in emerging markets (EMs), supporting sector outlooks across the region. We expect real GDP to expand by, or above, 5% in India, Indonesia, the Philippines and Vietnam, and China’s performance will still be strong by most other countries’ standards. Headwinds from slower Chinese growth, weak global demand and higher interest burdens following the rise in interest rates over 2022-2023 will weigh on performance for many sectors, but the bulk of our APAC sector outlooks for 2024 remain neutral.

Diverging Prospects for EM and DM Banks:

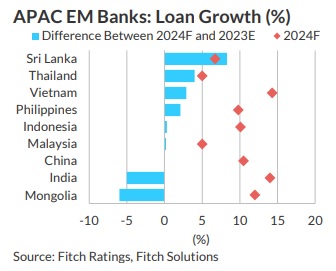

Growth in APAC EMs should buoy loan demand and limit the potential adverse effects on asset quality from interest rates, which we believe have largely peaked across the region. The peaking of the rate cycle will affect APAC developed market (DM) banking sectors more than those in EMs. We expect net interest margins (NIMs) and nonperforming loan ratios to come under pressure in DMs in 2024, but the degree of weakening will generally be modest. Deteriorating Outlooks Concentrated in China, Australia and New Zealand: Slower economic growth, lower rates and the government’s adapting policy response will add to headwinds faced by several sectors in China, reflected in a number of deteriorating outlooks, notably for property developers and banks. For details, see our Greater China Cross- Sector Outlook 2024 report. Our outlooks for the Australian and New Zealand banking sectors and structured finance sectors remain deteriorating for 2024. Our expectation is that the worsening in asset quality following higher interest rates will be most marked in these markets, being felt more in 1H24 than 2H24. Geopolitical Risk Remains a Factor: Sino-US tensions have eased recently, but we expect relations to remain challenging, which will lead companies to pursue further supply-chain diversification to limit exposure to geopolitical risks. These trends could be a significant factor for outlooks in several sectors, particularly industrial and technology, and may also influence investment and growth prospects for some sovereigns such as Singapore, Korea, Thailand and Vietnam.

What to Watch

• The economic backdrop in much of APAC will remain relatively supportive for revenue growth

and credit profiles in 2024, in contrast to some other regions.

• A sharper slowdown in China’s growth than we assume would pose significant risks for Chinabased issuers in multiple sectors, and would also have adverse credit ramifications regionally.

• A sharper easing of monetary policy in the US than we expect could also allow governments in

APAC to cut rates faster, reducing interest burdens and easing pressure on credit profiles.

APAC EM Growth Supports Sector Outlooks:

The outlooks for the banking sectors in India and Indonesia, as well as APAC EM as a whole, move to improving in 2024, partly reflecting the robust economic backdrop. The outlook for Indonesian homebuilders moves to neutral in 2024, from deteriorating in 2023, supported by rising contracted sales. We also expect a recovery in the semiconductor sector, after a severe downturn in 2023, reflected in our neutral outlook for the APAC technology sector in 2024, compared with the deteriorating outlook last year.

Many Sovereigns More Vulnerable to Shocks:

We expect debt ratios to rise in 2024 for about half of the Fitch-rated APAC sovereigns, due to high borrowing costs and mostly modest fiscal deficit reduction plans, despite solid economic growth rates. Many sovereigns in the region have lost fiscal headroom in recent years, making them more vulnerable to new external shocks. External financing pressures should continue for some vulnerable frontier markets, while the nature and timeline for Sri Lanka's foreign-currency debt restructuring remains uncertain.

Corporates' EBITDA Margins to Improve:

Fitch expects the aggregate EBITDA margin for APAC corporates to recover in 2024, to around 14%, following three years of declines. The natural resources and oil & gas sectors will be the exceptions, recording narrowing margins, as several commodity prices fall from recent high levels. We forecast net leverage to be broadly stable in 2024, at around 2.5x across APAC sectors, but decreasing the most in the chemicals and gaming, lodging and leisure sectors as a result of significantly stronger free cash flow generation used to pay down debt, combined with better EBITDA. However, we anticipate leverage to increase slightly in the technology, natural resources and homebuilding sectors. The sector outlook on Asian palm oil remains deteriorating in 2024, unchanged from mid-2023. We expect weaker average crude palm oil prices amid higher output, with lower EBITDA and higher leverage. The impact should be smoothed by higher yields and lower unit production costs, and producers have flexibility to reduce capex and dividends to support credit profiles.

Energy Transition to Continue:

Energy transition efforts will continue to drive investment in many sectors in APAC, including utilities, natural resources, automotives and metals. Recent reports that the US has raised concerns with Mexico about Chinese investments in that country, including in electric vehicle projects, highlight the potential for geopolitical factors to play a growing role.

Post-Covid 19 Recovery Lift Fades in Transport Sectors: Our outlook for the APAC airports subsector moves to neutral in 2024, from improving in mid-2023. Airports will continue to benefit from the unwinding of pent-up demand, but we expect growth to fade in 2H24. Meanwhile, we expect APAC ports to see lower throughput and toll-road traffic growth to stabilise in 2024. Risks to the sector from fuel price surges and high interest-rate pressure remain, but resilient demand will cushion the negative impact on traffic.

Duncan Innes-Ker, Senior Director, Fitch Wire, explains: “Robust regional economic growth – particularly in Asia’s large emerging markets - should offset headwinds from slowing growth in China, weak global demand and high interest rates, helping to support performance across sectors in APAC in 2024.”

DISCLAIMER & DISCLOSURES All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings.