Sequential contraction in most indicators, however, seasonal post festive season

FinTech BizNews Service

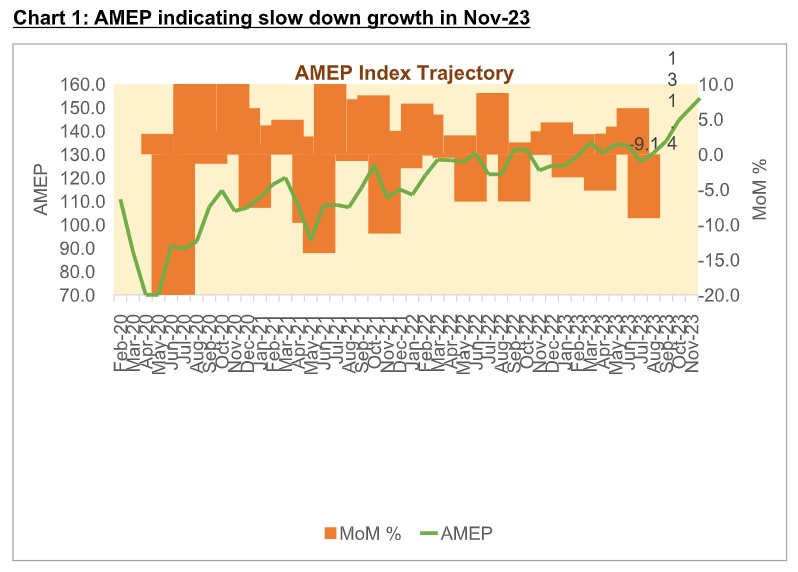

Mumbai, January 2, 2024: After reaching an all-time high in October 2023, Acuité Macroeconomic Performance index (AMEP index) witnessed a moderation in November 2023 by dropping 9.1%MoM. While this may be partly due to the typical seasonal moderation in economic activity post the peak festive season, this also reflects the likelihood of a slowdown in the robust pace of economic activity in the remaining fiscal period. Nevertheless, the index has still shown an annualized growth of 6.8% during the month with only three indicators out of sixteen indicators recording a contraction. While the trade metrics – exports and imports continue to see an adverse impact of lower commodity prices and the global slowdown, diesel consumption has also declined vs a higher base in last Nov-22.

A notable surge in steel production, driven by increase spending in the Indian infrastructure sector, continued to lead to a double digit i.e 11.8% YoY growth in Nov-23. During April-Nov’23, finished steel production rose by 13.1% YoY over April-November 2022.

One of the indicators reflecting the strength in consumption demand is the automotive sales (passenger vehicles, two and three wheelers) volumes which increased by 25.7% YoY. However, a sequential drop of 13.2% MoM has happened after the peak festive demand seen in Oct-23. Apart from the push from festive demand, launch of new vehicle models particularly in the SUV category, improved availability of semi-conductor chips and the ongoing state elections have also given an impetus to auto sales in the third quarter of the current fiscal. The industry expects to close the year 2023-24 with sales of around 4.1 million units.

Tractor sales volumes rose by 6.4%YoY while on a sequential basis, it dropped significantly by 38.9%. Cumulatively, the tractor volumes have shown a weak trend in the current fiscal contracting by 5.7% YoY in the Apr-Nov’23 period and reflect the risks of lower agricultural growth in the current year.

Rail traffic continued to exhibit a significant traction, reflecting sustained industrial activity and a spurt in travel during the festival period; both rail freight and rail passenger traffic saw a healthy annualised growth of 8.5% and 5.1% along with a sequential pickup of 3.1% MoM for rail freight (estimated, actual data not yet available for Nov-23). The total coal production in India rose by 11% to 84.5 million tonnes (MT) in November, compared to the 76.1 MT in the same month of the previous fiscal year, contributing to the higher freight traffic.

The level of power generation increased by 6.1%YoY but witnessed a sharp sequential decline of 13.8%MoM in Nov-23. Cumulatively, power generation increased by 7.7% from April-November 2023 compared to same period last year primarily due to erratic monsoon in the current year.

Retail fuel i.e., petrol and diesel consumption exhibited a mixed result, with petrol recording 9.4%YoY increase and diesel contracting by -3%YoY, respectively. Overall fuel demand fell year-on-year by 2 per cent in November 2023. This decrease was caused by a 3 per cent fall in diesel sales according to data released by the petroleum ministry. Diesel sales make up about 40 per cent of overall refined products’ consumption. However, there was an increase in consumption of aviation turbine fuel (ATF), petroleum and liquefied petroleum gas (LPG).

Credit growth (non-food) continues to stand at 20.6% YoY (including the impact of HDFC merger). While the credit growth is gradually getting broad-based, the demand remains high from the services sector, particularly non-banking finance companies (NBFCs) that borrow for on-lending purposes, and retail loans for non-housing purposes. The latest clampdown on retail unsecured loans may slow down the bank credit growth to some extent. Credit growth also continues to be higher than deposit growth in Nov’2023.

Expectedly, the sharp rise in festival induced consumer purchases has led to robust growth in GST collections at 15.1%YoY with E-way bills generation rising at 8.5%YoY, partly also due to increased compliance with GST rules.

The trade data continues to evoke concern with both export and import decreasing by 2.8% and 4.3% YoY respectively in Nov-23. However, the trade deficit this November is also lower than in Nov’22 when it was at USD 22.1 billion. The deficit shrunk primarily on account of a sharp decline in imports, specifically that of non-petroleum, oil, and lubricants (non-POL) imports.

All India Employment Rate increased marginally by 2.4%YoY but dropped by 0.3%MoM reflecting ongoing structural challenges in the labour market. As per CMIE, November ended with an unemployment rate of 9.2 per cent.

India Manufacturing PMI (Purchasing Managers’ Index) remained steady with only a modest uptick, rising to 56.0 in Nov-23 from 55.5 in Oct-23. On the other hand, PMI Services witnessed a significant decline from 58.4 in the previous month to 56.9 which is the lowest print in the current fiscal. While the indices’ levels continue to reflect a healthy undercurrent of economic activity in both manufacturing and services sectors, the moderation in the PMI trajectory over Oct-Nov’23 indicates a potential slowdown in GDP growth in H2FY24 after a robust first half when the Indian economy grew by 7.7%.

Disclaimer: Acuité has taken due care and caution for writing this release. Information has been obtained by Acuité from sources which it considers reliable. However, Acuité does not guarantee the accuracy, adequacy or completeness of information on which this release is based. Acuité is not responsible for any errors or omissions or for the results obtained from the use of this release. Acuité has no liability whatsoever to the users / distributors of this release.