Reduced tax on the healthcare sector marks a transformative step toward greater affordability and inclusivity

FinTech BizNews Service

Mumbai, September 4, 2025: The 56th meeting of the GST Council was held in New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The GST Council inter-alia made the recommendations relating to changes in GST tax rates, provide relief to individuals, common man, aspirational middle class and measures for facilitation of trade in GST.

Following are insightful perspectives from the leading insurers:

Naveen Chandra Jha, MD & CEO, SBI General Insurance:

“The GST Council’s decision to reduce tax on the healthcare sector marks a transformative step toward greater affordability and inclusivity. At a time when India’s healthcare market is poised for significant growth, this reform acts as a timely catalyst to strengthen the ecosystem by addressing one of the biggest barriers to quality healthcare affordability.

Whether it is making life-saving drugs more accessible or lowering the cost of health insurance, the move directly tackles a long-standing challenge and will enable millions of families to take a crucial step toward financial and medical security.

For the health insurance sector, this change comes at a pivotal moment. As India’s healthcare needs expand and medical risks evolve, the importance of universal health coverage has never been more evident. Health insurance is not merely a financial product, it is a lifeline that protects families, supports well-being, and builds resilience against future uncertainties.

At SBI General Insurance, we view this reform as a strong driver in accelerating India’s journey toward ‘Insurance for All by 2047.’ Our focus will be on leveraging this opportunity to design affordable, accessible, and customer-centric health insurance solutions, while expanding our reach across rural and semi-urban India.”

Tarun Chugh, MD &CEO, Bajaj Allianz Life Insurance:

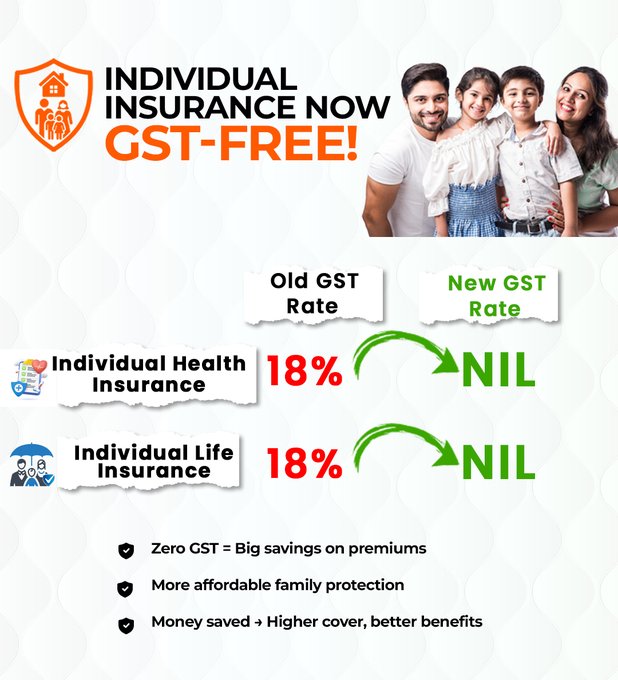

“The much-awaited decision to exempt individual life insurance policies from GST is a welcome move and a key milestone for the Indian life insurance industry. It will help bring down the cost of insurance for customers and play a vital role in increasing insurance penetration in the future. This reform comes at a pivotal moment where all of us - the industry, the regulator and the governments - are working towards enabling the vision of ‘Insurance for All by 2047, in India.”

Mr. Rakesh Jain, CEO of Reliance General Insurance

"The GST Council’s decision to exempt health insurance premiums while allowing insurers to utilise input tax credits is a landmark step that combines consumer benefit with industry growth. This reform will make health protection more affordable for millions of families, senior citizens, and small businesses who often find premiums to be a stretch. By lowering the cost of entry, it encourages more individuals to seek coverage earlier, thereby strengthening the risk pool and improving the long-term resilience of the insurance sector. Insurance is not just a financial product but a safeguard for households against rising healthcare costs and unforeseen emergencies, and this measure will help embed it more deeply into financial planning. We view this as a forward-looking reform that creates a win-win scenario for both consumers and insurers, and one that will contribute meaningfully to the journey of building a healthier and more financially secure India."

Ankit Agarwal, Founder and CEO, InsuranceDekho:

"The GST exemption on life and health insurance premiums marks a pivotal moment for the industry. By removing the 18% tax burden, insurance becomes meaningfully more affordable, particularly for first-time buyers and underserved segments. This move not only reduces financial stress for existing policyholders but also lowers the entry barrier for millions who’ve long remained uninsured. More than a tax reform, this is a behavioural nudge that will encourage families across Bharat to prioritise protection. It's a powerful and welcome step toward mainstreaming insurance adoption and advancing the national goal of 'Insurance for All'."

Anand Roy, Star Health and Allied Insurance:

"The Government's decision to exempt health and life insurance premiums from GST marks a pivotal shift for the industry. This reform will reshape the insurance landscape, accelerating penetration, driving higher renewal rates, building deeper customer loyalty and a critical catalyst for future growth. This sets the stage for an era of enhanced insurance penetration which has remained critically low, making coverage more affordable and accessible, and bringing us closer to the IRDAI's vision of ‘Insurance for All by 2047.’ This is a significant step that will build greater trust in the system and support the sector’s long-term growth. From a business perspective, it strengthens the foundation for continued expansion and ensures a more sustainable future for the industry."