Marsh reports significant growth in global transactional risk insurance market in 2024; The total number of policies placed for Indian transactions increased by 30% compared to 2023

FinTech BizNews Service

Mumbai, April 10, 2025: Marsh, the world’s leading insurance broker and risk advisor and a business of Marsh

McLennan (NYSE:MMC), has recently released its 2024 Transactional Risk Insurance Year in Review report, highlighting

significant trends and developments in the transactional risk insurance market over the past year.

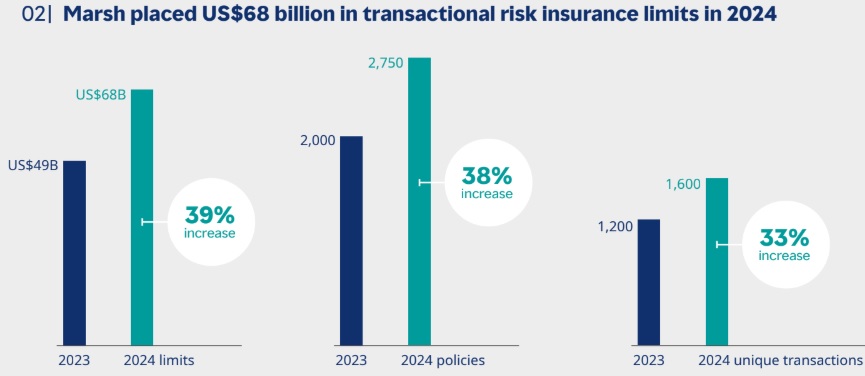

With global deal volume growing 8% to US$3.4 trillion in 2024, the demand for transactional risk insurance solutions

surged, driven by a growing recognition of its value in mitigating risks associated with complex transactions. Marsh

placed transactional risk insurance limits of US$67.8 billion across over 2,750 policies, marking a 38% increase from

the prior year.

India continued to solidify its position as a key transactional risk insurance market in Asia, driven by strong M&A momentum and a smarter approach to risk management. The country witnessed a notable increase in the use of innovative insurance structures as more buyers opted for full deal value coverage through fundamental warranty top-up policies. At the same time, there was a rise in claims activity, showing that the market is becoming more mature and competitive. This further reinforces the role of transactional risk insurance as a core component of deal execution.

Key findings from the India market include:

Market confidence remained strong, with M&A activity sustaining momentum from 2023 into 2024. A key indicator of this confidence was the 26% decline in average premium rates (from 1.8% to 1.3%), making insurance more attractive for dealmakers. Sellers increasingly adopted sell-buy flips and pre-exclusivity underwriting, enhancing competition among bidders and further integrating transactional risk insurance into deal structures.

Commenting on the report, Sanjay Kedia, Chief Executive Officer, Marsh McLennan India President & CEO, Marsh India, states that, "India’s transactional risk insurance market has reached an inflection point, shaped by larger deal sizes, increased cross-border activity, and more nuanced underwriting. The transactional risk insurance market in India is currently valued at USD 146 billion and is experiencing a steady growth rate with a CAGR of 10-12%. The placement of a USD 840 million insurance cover—the largest of its kind in Asia—signals a deepening market maturity and the strategic role of insurance in navigating complex transactions. As deals move faster and become more tailored, insurance is no longer a safeguard but a catalyst enabling precision, speed, and confidence in dealmaking."

Aditya Samag, Head of Private Equity and M&A, Marsh India, said, “India’s M&A market continues to demonstrate strong momentum, with sustained deal activity across sectors like healthcare, technology, and financial services. The 30% increase in transactional risk policies placed in 2024, coupled with a significant reduction in premium rates, showcases the confidence of dealmakers in using insurance as a strategic enabler. With record-breaking deals and competitive auctions becoming more common, we see a growing reliance on risk transfer solutions to enhance deal certainty and unlock greater value for investors.”

Notable activity was observed in sectors such as technology, healthcare, and renewable energy, where dealmakers used transactional risk insurance at near-record levels. The renewable energy sector, in particular, saw a significant rise in the use of tax insurance, reflecting ongoing trends in sustainability initiatives. Growth was further buoyed by increased usage of transactional risk insurance in emerging markets, particularly in Latin America and Africa, highlighting the expanding capacity of local insurers to facilitate cross-border transactions, according to the report.

Overall, the global transactional risk insurance market was generally favorable to buyers in 2024, with double-digit decreases in pricing for primary layers of coverage across all regions. Underwriting capacity remained ample globally, with approximately US$1 billion of limits typically available for single transactions in North America and Europe, though insurers began to manage limit deployment more conservatively toward the end of the year, owing to increased claims activity on larger insurance programs.

According to the report, transactional risk insurance claims increased by 20% and 30% in North America and EMEA, respectively in 2024. Asia’s claims activity remained stable compared to 2023, while the Pacific region experienced a slight decrease in claims notifications.

"Last year marked a pivotal year for transactional risk insurance, with a notable recovery in global M&A activity and an increased recognition of the value of insurance solutions in managing transaction-related risks; said Craig Schioppo, Global Head of Transactional Risk, Marsh. “While geopolitical uncertainty has adversely impacted global M&A activity through Q1 2025, we remain optimistic about the continued growth of this market and its role in facilitating successful transactions across various sectors.”