Strong Premium Performance Across All Segments in May 2024

FinTech BizNews Service

Mumbai, June 11, 2024: In May 2024, LIC, the insurance behemoth demonstrated impressive growth across all its premium categories, showcasing the company's robust performance and resilience. The Individual Premium, Group Premium, and Group Yearly Premium recorded remarkable increases, highlighting LIC's strong market presence and effective strategies.

For May 2024, the Individual Premium was Rs 4,058.13 crore, up from Rs 3,607.55 crore in May 2023. Group Premium rose to Rs 12,569.25 crore from Rs 10,431.53 crore in the same month the previous year. Group Yearly Premium reached Rs 63.01 crore, compared to Rs 17.21 crore in May 2023.

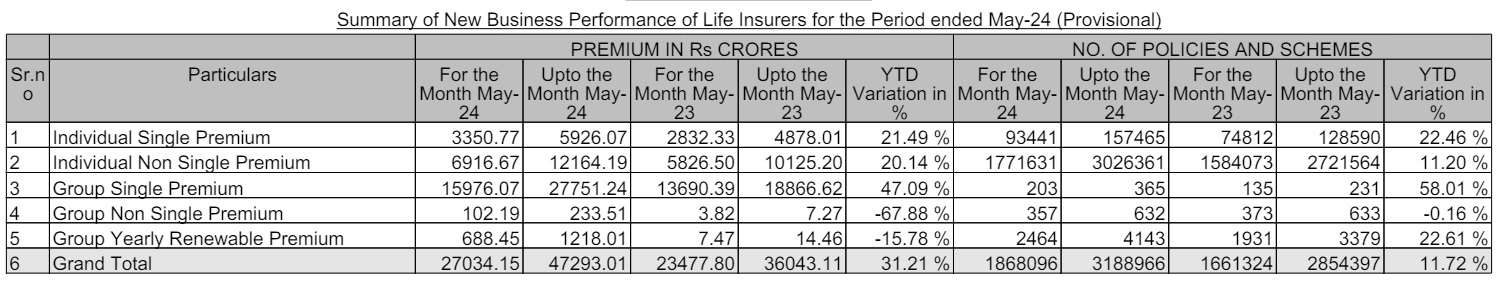

According to data released by the Life Insurance Council, in a boost to the Indian insurance industry, new business premium collections of life insurers witnessed a remarkable surge 61.23% in April 2024. This surge was characterized by exponential growth in group single premium and encouraging trends in individual policies. According to data collated by the council, the NBP of Indian life insurers soared to Rs20,258.86 crores in April 2024, marking a substantial increase from Rs12,565.31 crores in April 2023. The premium earned from new contracts in a given period is referred to as the new business premium. The standout factor driving this surge is the remarkable increase of 126.33% in Group Single Premium, signaling a growing emphasis on comprehensive insurance coverage among corporate entities. This trend reflects a strategic shift towards prioritizing risk management strategies amidst prevailing uncertainties in the economic landscape.

Furthermore, the data reveals positive growth trends in individual policy segments, with Individual Single Premium Policies witnessing a 19.05% growth, and non-single premium policies experiencing a commendable 10.31% increase. Another contributing factor to the industry's growth trajectory is the significant expansion of the insurance workforce, evidenced by the addition of 49,205 life insurance agents within the first month of the financial year. This surge in agent recruitment underscores the growing allure of the insurance sector as a lucrative career option, supported by promising growth prospects and evolving consumer needs. "This increase is being complemented by the rapid pace of digitalisation being undertaken by life insurers which should further aid in the growth of the sector as well as in deepening penetration across the nation," the council said.