While headline growth has come off, the fire segment has fired this year

FinTech BizNews Service

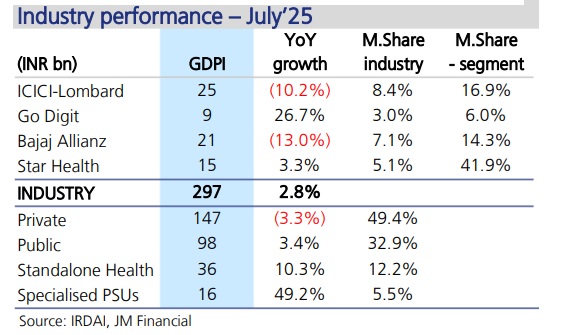

Mumbai, August 21, 2025: The general insurance industry posted weak growth of 3% YoY in Jul’25 in gross premiums (unadjusted for 1/n). The segmental composition looks good, with the fire segment growing 28% YoY and crop premiums down 36% YoY. Both ICICIGI and Bajaj had reported YoY contraction in the month – Bajaj’s contraction was on account of mass health while ICICIGI saw a decline in crop, both tender-driven businesses, states Raghvesh Sharan of JM Financial Institutional Securities, in in a sectoral update on General Insurance

In fire segment, key players reported strong growth – Digit +73% YoY, ICICI Lombard +28% (in line with the industry) and Bajaj Allianz +20%. On a YTD basis, growth stands at an impressive 19%, inching up every month since a strong start to the year in April, when the segment had grown 16%. In contrast to the fire segment, the motor segment is losing steam through the year, with growth down to 6%, from 11% highs in April.

While ICICI Lombard reported a YoY decline in motor premiums for the second straight month, both Bajaj and Digit posted strong growth. With the impact of 1/n accounting, health growth continues to look weak with the industry growing just 3% YoY to get YTD growth down to 7%. However, SAHIs continued their growth momentum, growing ~10% in both retail and non-retail premiums. Interestingly, Star Health caught up with Niva Bupa in retail health growth, at 9% YoY, while it saw non-retail premiums contract 45% YoY, in line with its strategy of curtailing the business.

While headline growth has come off, the fire segment has fired this year and retail health and motor have been broadly steady. In current norms, reported growth and profitability remain suppressed for the industry. Despite weak GDPI growth, ICICI Lombard’s earned premiums and profits should continue to grow 10%+. Star Health has reported in-line results in 1QFY26 after 3 quarters of disappointment - with growth catching up, another couple of quarters of controlled claims should see the stock rerate.