Mixed trends for listed insurers

FinTech BizNews Service

Mumbai, October 13, 2025: The Kotak Institutional Equities has come out with its latest report on Insurance sector.

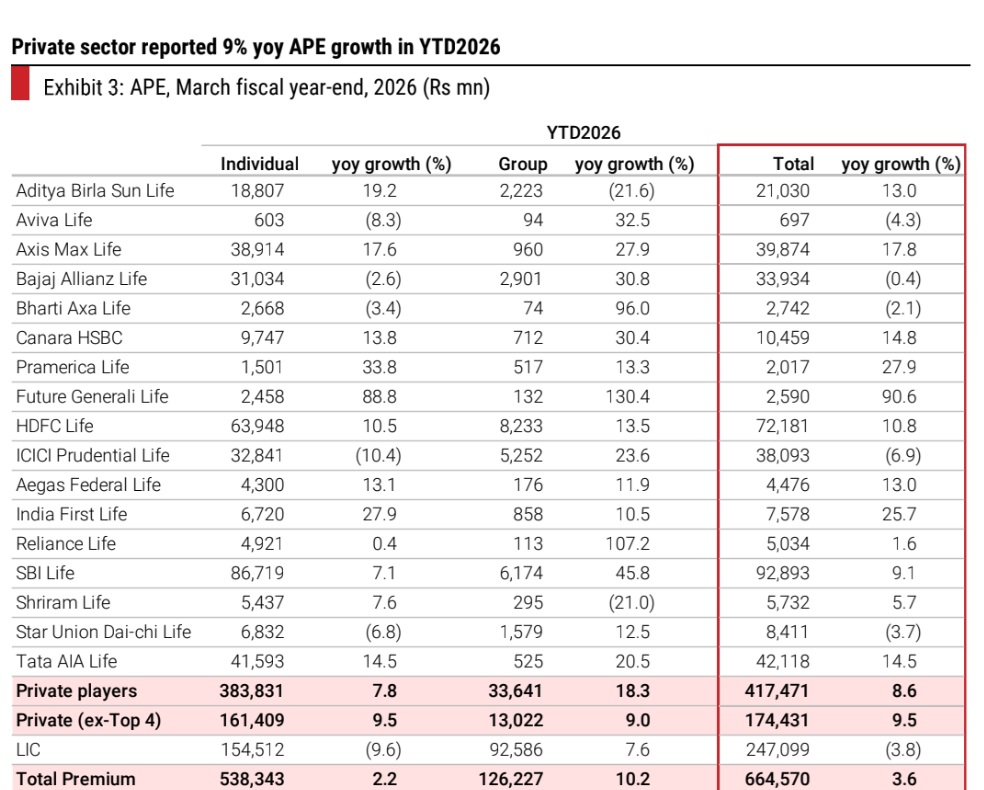

Moderate APE growth in September

Private life companies reported 9% annualised premium equivalent (APE) growth in September, translating to similar growth for 2QFY26. A weak August was likely followed by faster momentum after the GST exemption in September, but yoy growth for the month was distorted by a high base. SBI Life, after months of weakness, reported a pickup to 19% APE growth in September, driving 10% growth for 2Q. Axis Max Life held on tall with 13% growth (15% for the quarter). HDFC Life remained weak at 6%, but a strong July lifted quarterly growth to 10%. ICICI Prudential Life and LIC remained weak with 6% and 16% yoy decline in September, leading to 5-7% decline in 2QFY26.

September and 2QFY26 growth strong on 2-year CAGR

The APE growth appears moderate for private players at 9% yoy in September and 2QFY26 on an elevated base; the 2-year CAGR was strong at 15% for private players. Tier-II players fared better during the quarter, reporting 18% growth (2-year CAGR) compared to top-4 players (13% on 2-year CAGR). Surrender value guidelines kicked in during October 2024, leading to front-ending of demand in September 2024; this created a high base for September 2025 and 2QFY26.

Trends in individual APE were similar, with the top-4 players reporting 15% growth in September and 14% in 2Q (both on a 2-year CAGR basis); tier-II players fared better (up 21% in September and 18% for 2Q, both on a 2-year CAGR basis). Volumes (NoP) were flat yoy in 2QFY26 for the top-4 players. In contrast, the growth in tier-II players is largely driven by volumes; NoP growth was strong at 11% yoy in 2QFY26 for tier-II players.

Mixed trends for listed players

4 | Axis Max Life reports strong growth. Axis Max Life reported moderate 13% APE growth in September and 15% APE growth in 2QFY26, in line with expectations, driven by both volumes (NoP up 9% yoy) and value. Two-year CAGR of APE was higher at 23% yoy. Axis Max Life has consistently outperformed peers in the previous four quarters, delivering 11-23% APE growth (4-15% for top-4 players). |

4 | Moderate growth for HDFC Life. HDFC Life delivered 10% APE growth in 2QFY26, up 18% on a 2-year CAGR basis, even as September was weak at 6% yoy (14% on a 2-year CAGR basis). This growth was largely driven by value, with ticket sizes up 1-21% during the quarter. The number of policies was down 3% yoy in 2QFY26. While an elevated base had a moderating effect on growth, a muted pickup in growth after GST exemption was also a factor. |

4 | Moderate decline in premium for ICICI Prudential Life. APE declined 6% yoy in September and 5% yoy in 2QFY26; even on a 2-year CAGR basis, growth was moderate at 11% in September and 11% in 2Q. The weakness for the quarter is reflected in both volumes (down 3% yoy) and value (down 0-15% yoy). The company reported APE growth of 1% in September and decline of 3% in 2QFY26. |

4 | LIC reported sharp decline in premium. LIC reported sharp decline of 32% yoy in individual APE in September 2025 and 15% yoy in 2QFY26, on a high base. A pickup in the group business, up 35% yoy in September 2025 and 13% in 2QFY26, partially offset the drag. LIC fared better on 2-year CAGR APE basis at 5% in 2QFY26 and 14% in 1HFY26. |

4 | Sharp pickup in growth for SBI Life. The APE growth picked up to 19% in September 2025, leading to 10% growth in 2QFY26. An overhang of weakness in the parent channel weighed on growth over the previous 15 months. The APE growth will likely pick up/hold on in 2HFY26E, with this momentum sustaining, as we expect the parent bank to step up. |