The top 4 listed private players did particularly well at 59-71%, while smaller players’ performance was relatively modest, likely due to unfavorable pricing

FinTech BizNews Service

Mumbai, 10 January 2026: Kotak Institutional Equities has come out with an insightful research report on Insurance.

GST cut drives health and term growth

The GST cut has likely spurred growth in individual sum assured (up 38-54% yoy for the private sector) and retail health (36-47% for the private sector, including SAHIs) in the first two months of the quarter. The strong momentum in ULIPs continues to drive savings APE. An interplay of changing product mix and ITC loss has likely driven 0-22% VNB growth for the listed private players. SAHIs also benefit from a strong topline in health and an improvement in the peaking of the claims ratio last year. PB Fintech benefits from the above, even as it may need to share input tax credit (ITC) losses with insurance companies.

Strong growth in sum assured

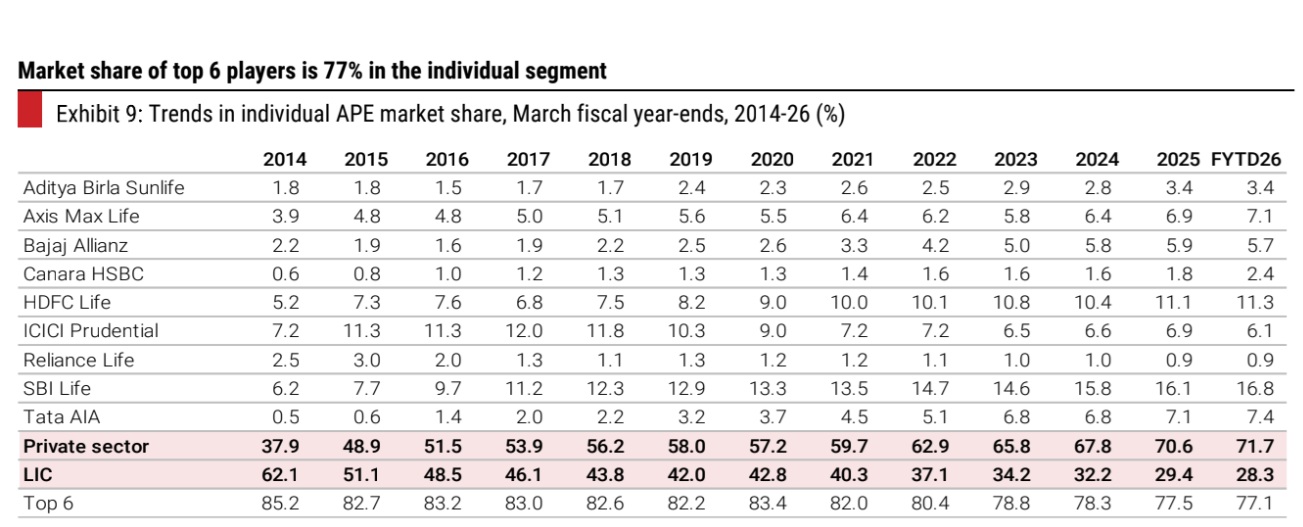

Exhibit 8 shows that sum assured growth was strong at 35-53% for the private sector and 60% for LIC for the first two months of the quarter. The top 4 listed private players did particularly well at 59-71%, while smaller players’ performance was relatively modest, likely due to unfavorable pricing. The GST cut led to a 15% decline in term prices (Exhibit 10) and likely spurred demand. While we expect the momentum to moderate, we continue to expect growth in sum assured/term business to remain higher than the savings business in the near- to medium-term, which in turn will boost margins.

Margins compress; APE supports VNB growth

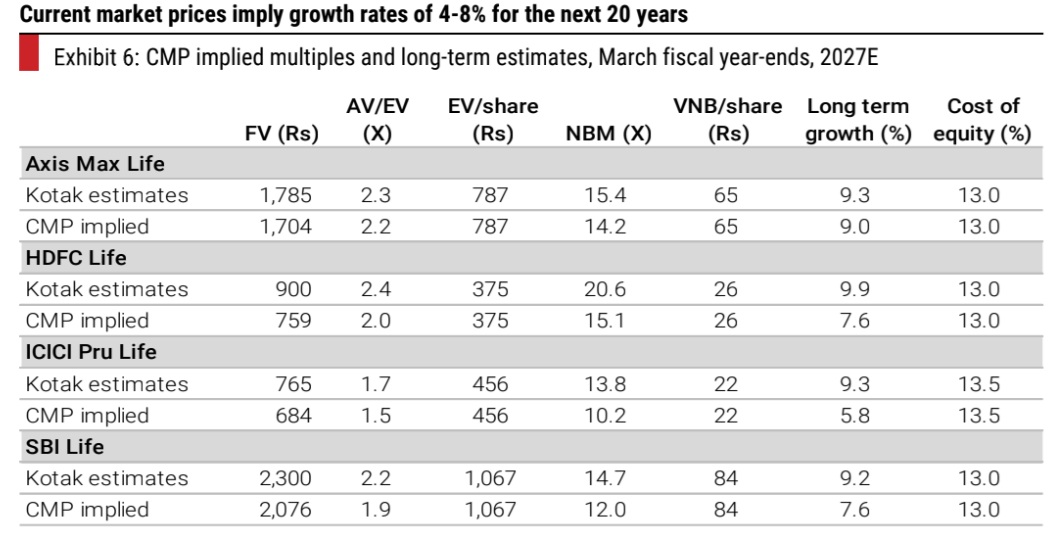

We model 0-22% VNB growth for listed players under coverage. APE growth has likely picked up to 3-23% from -3% to +16% in 2QFY26 and -5% to +15% in 1QFY26. This likely reflects the lower base and some pickup in momentum during the quarter. Market sources suggest strong growth in ULIPs, which drives volumes, though it weighs down on margins. VNB margins will be an interplay of product mix changes (higher protection offset by higher ULIPs yoy), the drag of ITC losses and the labor code. The base effect plays a key role in yoy margin expansion/contraction (-300 bps to +100 bps) for the quarter. Most companies called out a 175-350 bps impact on VNB on account of ITC losses due to the GST exemption (Exhibit 11). SBI Life and LIC chose to retain most of the ITC losses, while Axis Max Life and HDFC Life will share the same with distributors and other stakeholders.

Non-life companies: SAHIs shine

We expect SAHIs under coverage to deliver 17-50% growth in gross premium, extrapolating trends in the first two months of the quarter. Retail health insurance has seen strong growth after the GST cut driving the business for Niva Bupa and Star Health. Recent trends in claims ratios have been encouraging. Health insurance companies seem to be improving engagement with hospitals on tariffs as well. ITC losses will, however temper profitability, part of which may be shared with distributors. We have assumed in our forecasts that 70-80% of the ITC losses will be shared with other stakeholders.

Strong growth at PB Fintech

The rally in retail health and term will benefit PB Fintech which concentrates on these two segments. We expect digital new business growth to accelerate to 35% from 23% in 1QFY26 and 18% in 2QFY26 on account of the same. We build in a marginal impact on take rates (due to the sharing of ITC losses); EBITDA margins (7.4% in 3QFY26 versus 6.2% in 2QFY26) should see a drag from the high growth in new business.