The Assets under Management (AUM) of children’s mutual funds surged to touch Rs20,081.35 crore in May 2024, up from Rs8,285.59 crore in May 2019

FinTech BizNews Service

Mumbai, June 19, 2024: The Assets under Management (AUM) of children’s mutual fund witnessed nearly 142 per cent surge in the last five years to touch Rs. 20,081.35 crore in May 2024, up from Rs. 8,285.59 crore in May 2019. On a year-on-year basis, the AUM increased by nearly 31 per cent from Rs 15,375.40 crore in May 2023.

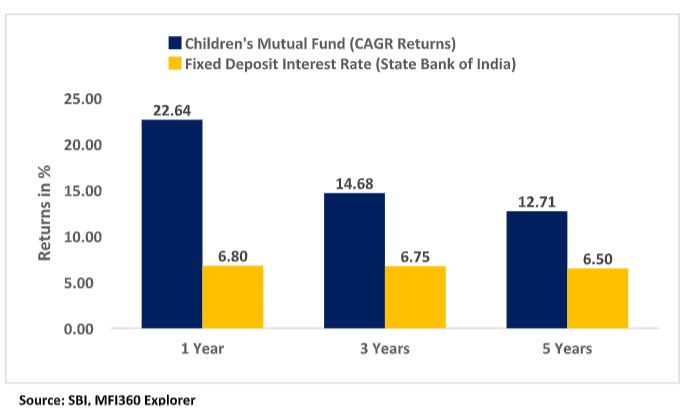

Interestingly, the children’s mutual fund as on May 31, 2024 has witnessed a category average CAGR returns of 22.64 per cent, 14.68 per cent and 12.71 per cent over a 1-year, 3-years and 5-years period respectively ICRA Analytics said in its latest report. The returns are significantly higher as compared to fixed deposits (as per State Bank of India), which on an average gave 6.80 per cent, 6.75 per cent and 6.50 per cent returns over a 1-year, 3-years and 5-years period.

According to Ashwini Kumar, Senior Vice President and Head Market Data, ICRA Analytics, the surge in education inflation, which is estimated at close to 11-12 per cent (almost twice the country’s inflation rate), is encouraging an increasingly large number of parents to look for suitable investment avenues to fund their children’s education. The attractive rate of returns coupled with the growing awareness among parents regarding mutual fund investments is contributing to a surge in AUM of these funds.

“Children’s mutual funds come with a lock-in period of 5-years or more and this inculcates a disciplined investing and savings habit for investors and discourages withdrawals. The exposure to both equity and debt results in diversification which helps to mitigate risk that arises out of individual stock pricing and helps maximise returns. Moreover, the ownership of the investment can be easily transferred once the child becomes a major and reaches adulthood. All these factors are contributing to a good growth in AUM of children’s mutual funds over the last four-to-five years,” Kumar said.

The net flows into children’s mutual funds witnessed a growth of 28 per cent, 102 per cent and 23 per cent over a 1-year, 3-years and 5-years period. The number of folios has increased by around 4 per cent at 29.93 lakh folios as of May 2024, as against 28.83 lakh in May 2019.

There are around eight children’s mutual funds available in the market at present and of them, the AUM of HDFC Children’s Gift Fund is among the highest accounting for nearly 52 per cent of the total AUM of children’s mutual funds at Rs. 9,018.60 crore as on May 2024. UTI Children’s Hybrid Fund accounts for around 25 per cent at Rs. 4,433.81 crore; SBI Magnum Children’s Benefit Fund Investment Plan – Reg – Growth accounts for 12 per cent at Rs. 2,023.42 crore and UTI Children’s Equity Fund – Growth for around 6 per cent at Rs. 1,010.49 crore. The AUM of Axis Children’s Gift Fund – Lock in – Reg – Growth was at Rs 822.90 crore; SBI Magnum Children’s Benefit Fund – Savings Plan at Rs. 110.77 crore; Union Children’s Fund – Reg – Growth at Rs. 46.70 crore and the AUM of LIC MF Children’s Fund stood at Rs. 15.70 crore as on May 2024.

“We expect the growth momentum in children’s mutual funds to sustain moving forward backed by improved risk appetite among investors due to upbeat growth prospects of the domestic economy and the increased awareness and acceptance for mutual fund investments due to higher returns generated as compared to certain other traditional sources of investment. The advent of improved technology and digital payments are likely to further facilitate the process,” Kumar added.