Indian fixed income managed to deliver healthy returns across all sectors in 2023

Pankaj Pathak,

Fund Manager (Fixed Income),

Quantum AMC

Mumbai, January 29, 2024: Amidst high inflation, tightening monetary policy and broadening geopolitical conflicts, Indian fixed income managed to deliver healthy returns across all sectors in 2023.

In the Rear View

Crisil 10-year Gilt Index, which tracks the performance of 10-year Indian government bond, retuned 7.82% in the year. While the Crisil Liquid Debt Index which comprises of below 3 months maturity debt papers, delivered 7.13%.

Short term yields moved up during the year due of tight liquidity conditions towards the end of the year. While longer term bond yields declined, thanks to strong demand from long term domestic investors. Consequently, the yield curve flattened during the year.

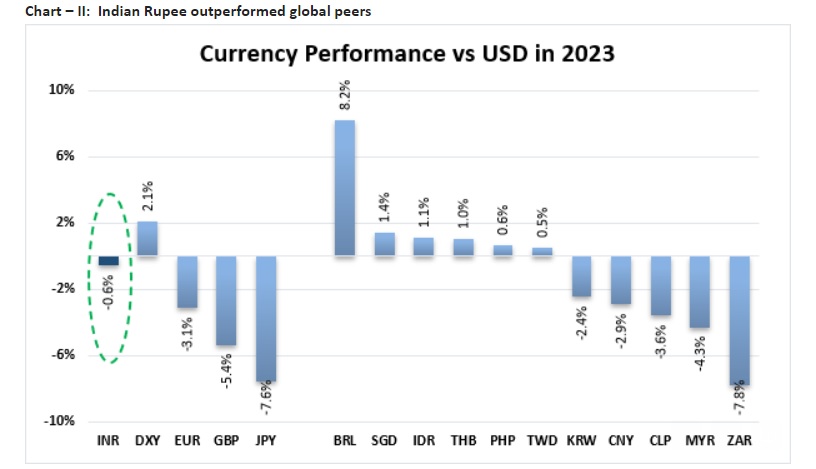

Indian currency showed remarkable resilience to global volatility. The Indian Rupee traded in a narrow range between 81 to 83.5 per USD through the year. It posted a marginal decline of 0.60% as against 2.1% rise in the Dollar index for the year 2023.

What lies Ahead?

Outlook for the Indian fixed income looks positive. Some of the factors that support our view are as follows:

Global policy reversal - The global synchronized rate hiking cycle has come to a halt. In 2024, most of the central banks are expected to cut rates. Monetary easing in advance economies should be favourable for emerging markets like India as capital flows into EMs tend to increase during rate cutting cycle.

Core disinflation:

Domestically, CPI inflation has been highly volatile due to volatile food prices in the last few months. However, the Core CPI, which excludes the volatile food and energy prices, has been coming down consistently over the last twelve months.

In December 2023, the Core-CPI dropped below the RBI’s 4% target (3.9% y-o-y for December 23). Based on the current trend, the Core-CPI is expected to slide down further to around 3.4% by Mid-2024. Although the RBI’s target is based on headline CPI, it would draw comfort from falling core inflation which tends to be more sticky.

RBI’s Rate cut debate

With declining inflation trend and rising real interest rates, some members of the monetary policy committee (MPC) have started to make a case for rate cuts. We expect the debate about rate cuts to intensify in coming MPC meetings.

The RBI is widely expected to change the stance from ‘withdrawal of accommodation’ to ‘neutral’ in the February MPC meeting and start cutting rates in the second half of CY 2024.

Demand outpacing supply:

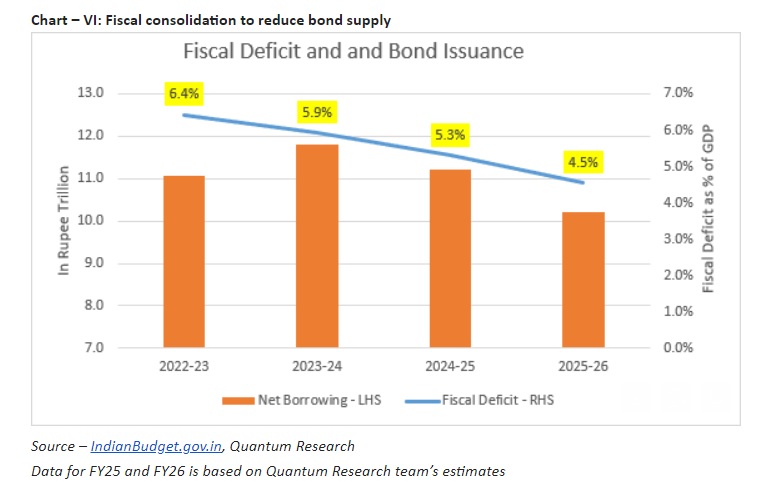

The demand-supply dynamics in the bond market in likely to change significantly over the next two years. While the fiscal deficit expanded to 9.2% of GDP during pandemic shock in FY2020-21. The government has been on a path of fiscal consolidation with an aim to bring down the fiscal deficit to 4.5% of GDP by FY 2025-26.

The government is on the path to achieve its fiscal deficit of 5.9% of GDP for the current financial year. Based on the glide path, the fiscal deficit target for FY2024-25 should be around 5.3% of GDP. With this target, the government’s gross market borrowing will be Rs. 800 billion lower than past year at around Rs. 14.6 trillion.

Given the healthy growth trend in bonds demand from long term investors like Insurance companies, pension funds, PFs etc, we expect the total government bond supply to fall short of demand over the next two years.

Bond Index Inclusion:

India will be included in the JP Morgan GBI-EM Index starting June 2024. Another global index provider, Bloomberg has also proposed to include India (subject to approval by index participants) in the Bloomberg EM Local Currency Debt Index starting September 2024.

Foreigners are under invested in Indian bond market with only 1.61% of total outstanding government bonds owned by foreign investors. (Data as of September 2023). India’s inclusion in the global bond indices is expected to attract USD 25-30 billion of foreign investments into Indian bonds over the next 12 months.

FPIs (foreign portfolio investors) have been consistently buying Indian government bonds eligible for FAR (Fully Accessible Route) in 2023. We expect the pace of FPI buying to increase substantially over the coming month.

What should Investors do?

Considering a strong case for yields to decline over the next 1-2 years backed by the reasons described above, we believe long term government bonds offer a rewarding opportunity.

Dynamic Bond Funds are probably best placed to capture this opportunity with a flexibility to change if things don’t pan out as expected. However, investors need to have a longer holding period of at-least 2-3 years to ride through the intermittent volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Disclaimer:

The views expressed here in this article do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). Readers of this article are advised to seek independent professional advice and arrive at an informed decision before making any investments.

Risk Factors: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.