52% YoY Growth in Equity AUM; At INR53.4 Tn MF industry’s AUM declines 2.1% MoM: Motilal Oswal Fund Folio Report

FinTech BizNews Service

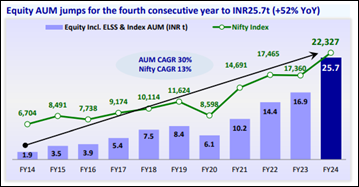

Mumbai, April 15, 2024: According to Motilal Oswal Fund Folio Report, the MF industry’s total AUM jumped 35% YoY (INR14Tn- Trillion) to INR53.4 Tn in FY24, propelled by growth in equity funds (INR8,759b), other ETFs (INR1,797b), balanced funds (INR1,582b), arbitrage funds (INR856b), and liquid funds (INR714b). Investors continued to park their money in mutual funds, with inflows and contributions in systematic investment plans (SIPs) reaching a new high of INR192.7b in Mar’24 (up 0.4% MoM and 35% YoY).

AUM: Down 2.1% MoM to INR53.4t; equity inflows moderate

Total AUM of the MF industry declined 2.1% MoM to INR53.4t in Mar’24, primarily due to a MoM decrease in AUM for liquid (INR1,615b), and income (INR278b) funds. Conversely, the AUM for equities (INR404b), other ETFs (INR192b), and balanced (INR101b) funds increased MoM. Equity AUM for domestic MFs (including ELSS and index funds) increased 1.6% MoM to INR25.7t in Mar’24, led by a rise in market indices (Nifty up 1.6% MoM). Notably, the month saw an decline in sales of equity schemes (down 8.4% MoM to INR591b). The pace of redemptions declined marginally to INR347b (down 1.7% MoM). Consequently, net inflows moderated to INR244b in Mar’24 from INR292b in Feb’24.

Top 20 funds: Value of equity MFs rises 2.3% MoM and 52.1% YoY

Total equity value for the top 20 AMCs increased 2.3% MoM (+52.1% YoY) in Mar’24 vs. a 1.6% MoM rise (+28.6% YoY) for the Nifty-50.

Among the Top 10 funds, the maximum MoM increase was seen in ICICI Prudential Mutual Fund (+4.9%) followed by Kotak Mahindra Mutual Fund (+3.2%), SBI Mutual Fund (+2.7%), Nippon India Mutual Fund (+2.7%), and UTI Mutual Fund (+2.5%).

Sector wise weightage: MoM increase seen in Capital Goods, Consumer, and Pvt Banks:

In Mar’24, MFs showed an interest in Capital Goods, Consumer, Private Banks, Automobiles, Healthcare, NBFCs, Retail, Metals, and Telecom, leading to a MoM rise in their weights. Conversely, Technology, PSU Banks, Cement, Consumer Durables, Real Estate, Infrastructure, and Media saw a MoM moderation in weights.

Private Banks (16.9%) was the top sector holding for MFs in Mar’24, followed by Technology (8.7%), Autos (8.3%), Capital Goods (7.9%), and Healthcare (7.4%). Telecom, Metals, Retail, Capital Goods, and Consumer were the sectors that witnessed the maximum increase in value MoM

Sectoral allocation of funds: Healthcare, Capital Goods, and Autos over-owned

The top sectors where MF ownership vis-à-vis the BSE 200 is at least 1% higher: Healthcare (17 funds over-owned), Capital Goods (15 funds overowned), Consumer Durables (10 funds over-owned), Autos (9 funds over-owned), and NBFCs (9 funds over-owned).

The top sectors where MF ownership vis-à-vis the BSE 200 is at least 1% lower: Consumer (20 funds under-owned), Oil & Gas (18 funds underowned), Technology (14 funds under-owned), Private Banks (14 funds under-owned), and Utilities (13 funds under-owned).

Nifty-50 snapshot: MFs net buyers in 54% of the stocks

The highest MoM net buying in Mar’24 was observed in HDFC Life (+17%), ITC (+16.3%), TCS (+10.7%), Eicher Motors (+9.5%), and JSW Steel (+7.6%)

Nifty Midcap-100 snapshot: MFs net buyers in 57% of the stocks

The highest MoM net buying in Mar’24 was seen in Mazagon Dock, SAIL, Dr Lal Pathlabs, Bandhan Bank, and JSW Energy.

Top schemes and NAV change: 19 of the top 25 schemes close higher MoM

Among the top 25 schemes by AUM, the following reported the highest MoM increase: Axis ELSS Tax Saver Fund (+5.2% MoM change in NAV), SBI Focused Equity Fund (+5.2% MoM), Axis Bluechip Fund (+4.1% MoM), SBI Bluechip Fund (+3.2% MoM), and Nippon India Large Cap Fund (+2.5% MoM).

Value surprise: Maximum MoM decline seen in the Technology stocks

In Mar’24, the top 10 stocks that saw the maximum MoM increase in value were ITC, HDFC Bank, L&T, ICICI Bank, Maruti Suzuki, Reliance Industries, Bharti Airtel, Kotak Mahindra Bank, Interglobe Aviation, and Avenue Supermarts. In Mar’24, five of the Top 10 stocks that saw a maximum drop in value were from the Technology domain. Infosys, HCL Tech, Coforge, SBI, Persistent Systems, Sundaram Finance, LTIMindtree, LIC of India, ICICI Lombard General Insurance, and Apollo Tyres declined the most in value MoM.