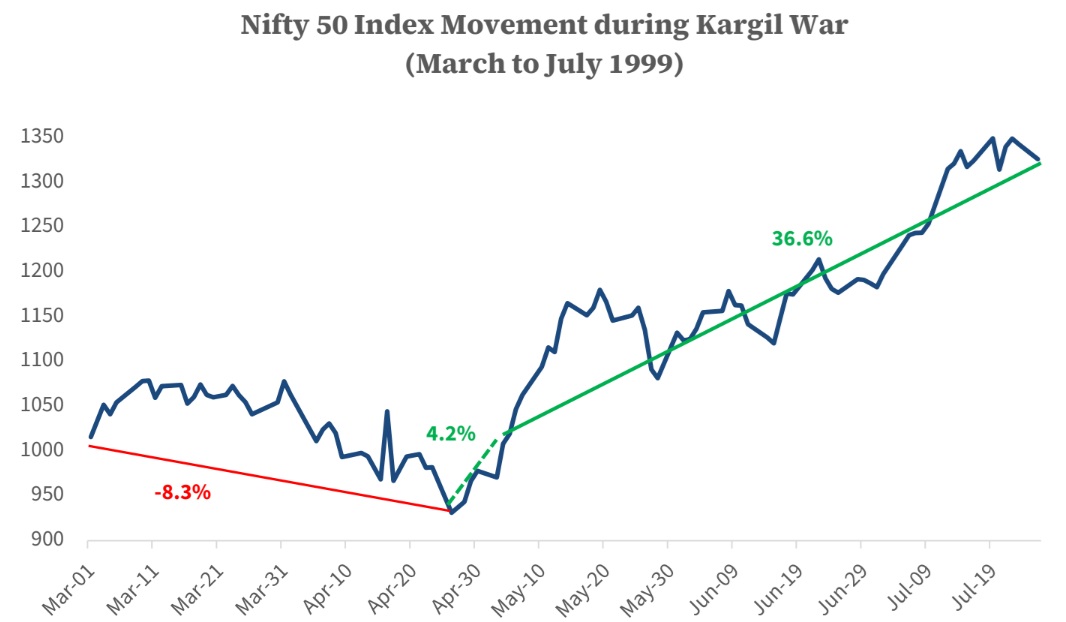

In the last major conflict (Kargil-1999), the equity markets have remained robust after an initial panic.

FinTech BizNews Service

Mumbai, May 7, 2025: Kotak Mutual Fund has come out with a report titled ‘OPERATION SINDOOR: Time To Panic Or Stay Put?’. The report analyses the impact of the last two surgical strikes by India, as well as past wars, on the markets and economy.

India has conducted OPERATION SINDOOR last night to avenge the Pahalgam attack. The

overnight attack was on 9 terrorist base camps of Pakistan and POK*

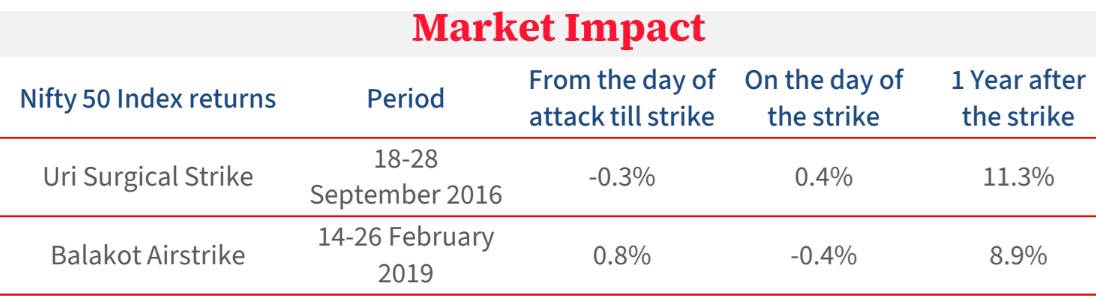

We have seen two such surgical strikes since 2016 (Uri and Balakot) and the impact on

markets have been limited.

Government action suggests there is low possibility of a war. However, in case of a full-blown

war, we must note that since 1950, India has seen 4 major wars. In the last major conflict

(Kargil-1999), the equity markets have remained robust after an initial panic.

Short term market swings during geopolitical events are unsettling, but history shows

that they rarely derail India’s long term growth story. In the long term, the macro-

economic factors and corporate earnings drive the stock market performance.

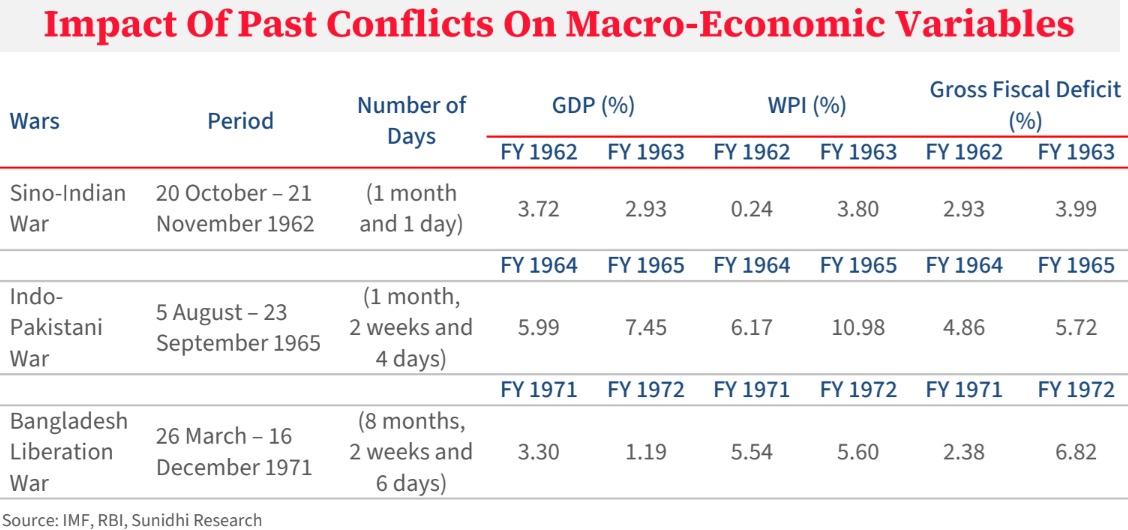

In the past conflicts, while there has been limited impact on growth, we have seen

increase in inflation and fiscal deficit.

It is difficult to predict the market direction however the last major conflict have

triggered temporary drawdowns before markets rebounded. Staying invested and

avoiding knee-jerk decisions may be prudent for long-term wealth creation.