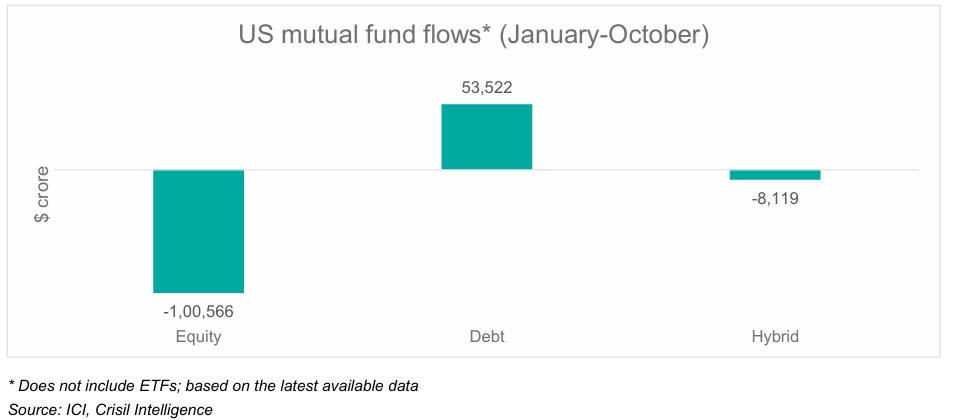

The US witnessed its highest outflows from equity funds since January 2025, with investors turning cautious and shifting to debt funds

FinTech BizNews Service

Mumbai, 14 December 2025: Investor sentiment differs across US and Indian markets Trends in mutual funds in the US and Indian markets until October 2025 reveal a divergence in investor sentiment, states AMFI monthly note of November 2025, released last Thursday.

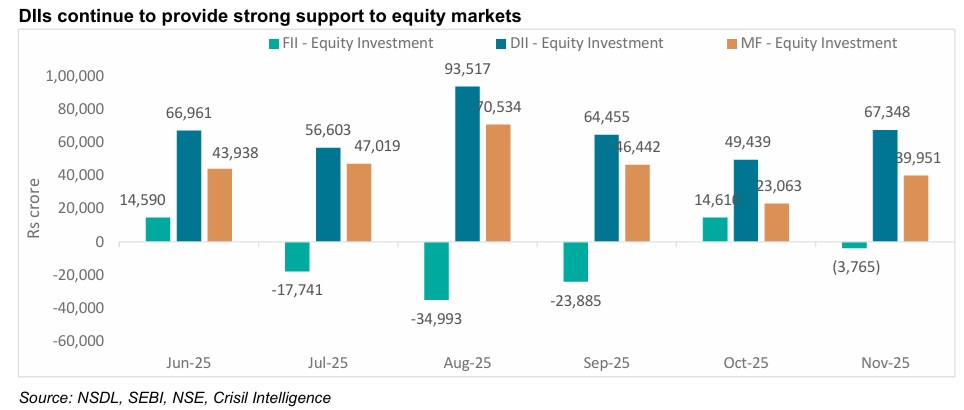

While the US witnessed its highest outflows from equity funds since January 2025, with investors turning cautious and shifting to debt funds, the Indian market continued to attract investors with sustained confidence in equity and hybrid funds.

Supported by factors such as better-than-anticipated corporate earnings, improved growth forecasts and optimism over a trade deal with the US, domestic mutual funds recorded net inflows across equity and hybrid funds.

MF Ind Folios Continue To Grow At Steady Pace

The mutual fund industry added net folios of 26.11 lakh in November, taking the total folio count to 25.86 crore from 25.60 crore in October. The equity category and the others category (which largely comprises passive funds) added 15.02 lakh and 6.91 lakh folios, respectively. These two categories accounted for 84% of the month’s new folio additions.