Gateway to India’s Next Generation of Blue Chips; The New Fund Offer (NFO) opens on December 18, 2025, and closes on January 1, 2026.

FinTech BizNews Service

Mumbai, December 17, 2025: Kotak Mahindra Asset Management Company Ltd (“KMAMC”/ “Kotak Mutual Fund”) announced the launch of the Kotak Nifty Next 50 ETF, an open-ended exchange-traded fund that enables investors to participate in India’s growth story by investing in the potential icons of tomorrow. The New Fund Offer (NFO) opens on December 18, 2025, and closes on January 1, 2026.

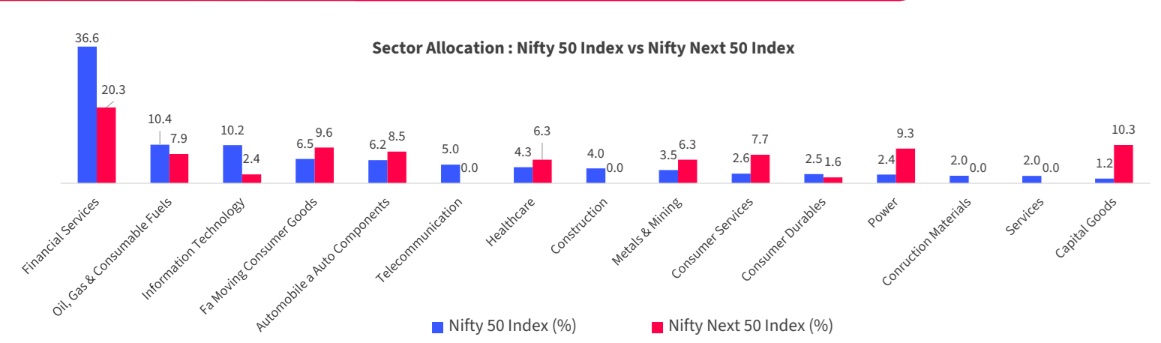

The Nifty Next 50 Index represents 50 companies from Nifty 100 after excluding the Nifty 50 companies. This selection aims to give investors exposure to potentially growing names with the reliability of large caps. The ETF currently is well-diversified across sectors, reducing concentration risk while providing unbiased exposure.

The Kotak Nifty Next 50 ETF is a passively managed fund that aims to track/replicate the Nifty Next 50 Index, providing transparent and cost-effective access to a diversified basket of high-potential companies. The PE multiple of Nifty Next 50 index is currently trading at a discount i.e. 21.8, which is lower compared to its 10-year average historical of 29.9, making it a reasonable entry point^. (PE stands for Price-Earnings).

With a minimum investment of just Rs. 5,000 during the NFO, investors can conveniently participate

With a minimum investment of just Rs. 5,000 during the NFO, investors can conveniently participate

in India’s next wave of market leaders through a single, diversified investment.

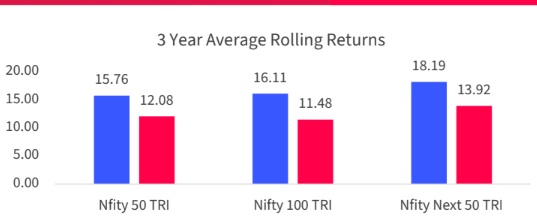

Nilesh Shah, Managing Director, Kotak Mahindra AMC, said, "The Kotak Nifty Next 50 ETF is designed

for investors who want to tap into India’s potential set of market leaders. The index has a track record

of delivering superior returns in 3,5,10 & 20 years to Nifty 50 TRI, and currently having better

diversification makes it a compelling choice for long-term wealth creation. We believe this ETF will

empower investors to participate in India’s growth journey. With the launch of this market-cap based

ETF, we further strengthen our overall passive fund offerings "

Devender Singhal, Fund Manager & Executive Vice President, Kotak Mahindra AMC added, "By

tracking this index, our ETF offers investors access to a wide range of sectors and companies that may

be future members of the Nifty 50 club. Our focus will be on minimizing tracking error and ensuring

that investors benefit from the full potential of this index."

The Kotak Nifty Next 50 ETF is a gateway to India’s future market leaders. With valuations at a discount

to historical averages and India’s economy poised for sustained growth, this launch comes at an

opportune moment for investors seeking long-term wealth creation