The proportion of NBFC exposure in relation to aggregate credit has reduced from 9.7% in March 2023 to 9.4% in March 2024: CareEdge Ratings

FinTech BizNews Service

Mumbai, May 10, 2024: The credit exposure of banks to NBFCs stood at Rs15.5 lakh crore (Trillion) in March 2024, indicating a 15.3% y-o-y growth that is approximately half of the growth rate reported in March 2023, as per a special report by CareEdge Ratings. This growth is after HDFC’s exposures being reclassified after its merger with HDFC Bank. On a month-on-month (m-o-m) basis, the amount rose by 2.2%. However, the proportion of NBFC exposure in relation to aggregate credit has reduced from 9.7% in March 2023 to 9.4% in March 2024. This can be attributed to the RBI's increasing risk weights and rising capital market borrowings.

• Meanwhile, the Mutual Fund (MF) debt exposure to NBFCs, including Commercial Papers (CPs) and Corporate Debt, reached Rs. 1.90 lakh crore in March 2024 witnessing an increase of 29.9% y-o-y and 2.2% sequentially, with CPs remaining above the one lakh crore mark for four consecutive months. Meanwhile, given the general credit risk aversion of MFs, the exposure to NBFCs, particularly those rated below the highest levels, is not expected to witness significant traction. Consequently, the aggregate dependence of mid-sized NBFCs on the banking sector for funding is likely to remain high.

• Highlighting the relative size of their exposure to NBFCs, MFs' debt exposure to NBFCs rose to 14.76% as a percentage of “Banks’ advances to NBFCs” in March 2024 from 12.07% in March 2023, and sequentially from 12.58% in February 2024.

The data in Figure 1 does not include liquidity made available to NBFCs by banks via the securitisation route (direct assignment & pass-through certificates) and Treasury investments made by banks in the NBFCs’ capital market issuances. Liquidity availed by NBFCs including HFCs through the securitisation route was approximately Rs 1.94 lakh crore for the twelve months ending March 2024.

Compared to February 2018 numbers, absolute bank lending to NBFCs has jumped to around 4x. Meanwhile, MF exposure has reduced by 17.9% over six years due to risk aversion by mutual fund managers. Interestingly, MF exposure to NBFCs as a share of Debt Assets Under Management (AuM) has reduced from nearly 20% in the latter part of 2018 to around 12% by March 2024. On the other hand, the share of banks’ advances to NBFCs as a share of aggregate advances doubled from around 4.5% in February 2018 to 9.4% in March 2024.

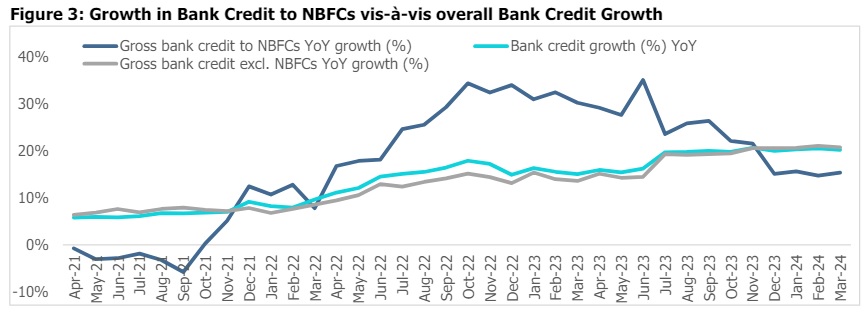

The credit extended by banks to NBFCs has exhibited a consistent upward trend for close to six years and continued its acceleration along with the phased reopening of economies after the Covid-19 pandemic. This trend can be primarily ascribed to the expansion in the AuM of NBFCs. The credit exposure of banks to NBFCs stood at Rs 15.5 lakh crore in March 2024, indicating a 15.3% y-o-y growth which is approximately half of the growth rate reported in March 2023. This growth is after HDFC’s exposures being reclassified after its merger with HDFC Bank. On a month-on-month (m-o-m) basis, the amount rose by 2.2%. However, the proportion of NBFC exposure in relation to aggregate credit has reduced from 9.7% in March 2023 to 9.4% in March 2024. In March 2024, the six-month average y-o-y expansion in bank advances to NBFCs has reduced to around 19% levels compared to the approximately 23-25% average growth in the 12 months prior to the same. Additionally, the growth rate of advances to NBFCs has been below the overall bank credit growth since December 2023. This can be attributed to the RBI's increasing risk weights and elevated capital market borrowings.

As the above figure shows, the spread between domestic and US and EU g-sec yield has been broadly trending down. ECB issuances increased 90% y-o-y during Apr-Feb FY24. Meanwhile, the domestic capital market has witnessed some traction. Corporate bond issuances increased 18% y-o-y in FY24. Issuances in H1 were up 48.9% y-o-y while issuances in H2 were up by only 0.2% y-o-y. Larger and better-rated NBFCs have been accessing the capital market given that most of the issuers are from the BFSI sector and over 90% of the aggregate issuers have been either AA or AAA-rated entities. Investment in corporate debt of NBFCs increased by 27.9% y-o-y and 4.7% m-o-m to Rs.0.86 lakh crore in March 2024. Meanwhile, the share of total corporate debt to NBFCs increased to 4.7% in March 2024 from 4.4% in March 2023. The outstanding investments in CPs of NBFCs have stayed above the Rs one lakh crore mark for four months, growing at 0.3% growth sequentially but increasing by 31.6% y-o-y to Rs.1.03 lakh crore in March 2024. CPs (less than 90 days) rose by 32.0% y-o-y to Rs.0.71 lakh crore in March 2024, CPs (90 days to 182 days) fell by 72.0% to Rs.0.02 lakh crore, and CPs (more than 6 months) increased by 33.7% to Rs.0.29 lakh crore in the reporting period. This increase comes on the backdrop of RBI increasing the risk weights on higher-rated NBFCs.

The percentage share of funds deployed by MFs in CPs as a percentage of banks’ exposure to the NBFCs stood at 6.7% in March 2024, increasing by over 80 bps y-o-y. The proportion of CPs (less than 90 days) deployed in NBFCs as a percentage of aggregate funds deployed for less than 90 days reached 10.3% in March 2024 as compared to 8.3% over a year ago period, the percentage of CPs (90 days to 182 days) fell to 5.1% from 9.1% over a year ago, and CPs (greater than six months) percentage increased to 11.8% in March 2024 as compared to 7.9% over a year-ago period.

Disclaimer: This report is prepared by CARE Ratings Limited (CareEdge Ratings). CareEdge Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CareEdge Ratings is not responsible for any errors or omissions in analysis / inferences / views or for results obtained from the use of information contained in this report and especially states that CareEdge Ratings has no financial liability whatsoever to the user of this report.