Mutual Funds Allocate Rs5,294Cr into IPOs, Backing Small Cap Growth Stories: Ventura .

FinTech BizNews Service

Mumbai, 5 August 2025: According to a study by Ventura, a full-service stock broking platform, in the quarter ended on June 2025, the mutual fund industry has shown robust participation in newly listed companies, with total investments amounting to over Rs5,294 crore across recent IPOs.

A majority of these new entrants fall under the small cap category, with only one categorised as a mid cap. The data highlights the mutual fund industry's strategic allocation towards smaller, scalable businesses that have the potential to deliver superior returns over time.

New Entrants –IPO | Market Value (Rs. in crores) | Categorisation |

Ather Energy | 1351 | Small Cap |

HDB Financial Services* | 1331 | Mid Cap |

Schloss Bangalore | 679 | Small Cap |

Aegis Vopak Terminals | 495 | Small Cap |

Belrise Industries | 398 | Small Cap |

Oswal Pumps | 387 | Small Cap |

Ellenbarrie Industrial Gases* | 357 | Small Cap |

Kalpataru | 241 | Small Cap |

Sambhv Steel Tubes* | 55 | Small Cap |

Note: Companies with a market value above Rs. 20 Crore have been considered.

*Listing was in 1st Week of July-25 Month.

Equity Fund Performance: Majority Beat Nifty 50, Fewer Beat Benchmarks

Study also shows an analysis of 335 equity schemes across the top 20 AMCs (by AUM) for the Jan–Mar 2025 quarter reveals that 90% of schemes outperformed the Nifty 50 TRI, highlighting the index's relative underperformance during the period. However, only 41% of schemes outperformed their respective category benchmarks, indicating tighter competition and more selective alpha generation.

Invesco MF led on benchmark outperformance, with 13 out of 16 schemes (81%) outperforming — the highest success rate among peers. Meanwhile, Mirae, Kotak, Nippon, Edelweiss, Canara Robeco, and Aditya Birla SL MF saw all their equity schemes beat the Nifty, showcasing consistent delivery across portfolios.

Larger fund houses like ICICI Prudential MF and Aditya Birla SL MF had the highest absolute number of outperforming schemes vis-à-vis the Nifty, but benchmark outperformance remained more dispersed across mid-sized players.

AMC Name | No. of schemes | Benchmark | NIFTY |

SBI MF | 24 | 5 | 18 |

ICICI Pru MF | 31 | 13 | 25 |

HDFC MF | 21 | 6 | 19 |

Nippon India MF | 16 | 6 | 16 |

Kotak MF | 22 | 11 | 22 |

Aditya Birla SL MF | 24 | 10 | 24 |

UTI MF | 17 | 5 | 15 |

Axis MF | 16 | 3 | 14 |

Mirae MF | 11 | 7 | 11 |

Tata MF | 20 | 8 | 18 |

DSP MF | 15 | 5 | 11 |

Bandhan MF | 14 | 4 | 12 |

Edelweiss MF | 12 | 3 | 12 |

HSBC MF | 14 | 10 | 14 |

PPFAS MF | 2 | 0 | 0 |

Motilal Oswal MF | 14 | 10 | 13 |

Invesco MF | 16 | 13 | 16 |

Franklin Templeton MF | 13 | 4 | 12 |

Canara Robeco MF | 12 | 6 | 12 |

Quant MF | 21 | 10 | 18 |

Note: AUM-wise, the top 20 fund houses are considered. Quarterly absolute returns were considered for the period Jan-Mar 2025. Nifty 50 TRI returns are considered.

Small Cap Funds Lead Equity AUM Growth in the Quarter

The study says that, small cap funds witnessed a 20% surge in assets under management (AUM), the highest among all categories. This sharp growth marks a significant reversal, as small cap funds climbed from the bottom of the rankings in the previous quarter to take the top spot, highlighting renewed investor confidence in high-growth, high-risk segments.

Mid cap (17%) and multi cap (16.5%) funds also registered robust growth, underscoring a broader market rally and increased interest in diversified exposure beyond large cap names. The rise in AUM across these categories suggests that investors are willing to move down the market-cap curve in search of better returns, driven by favorable valuations, improved earnings visibility, and strong flows from domestic retail investors.

The large & mid cap category followed closely with a 14.8% rise, benefiting from balanced exposure to stability and growth. Interestingly, sectoral/thematic funds also saw an uptick (11.9%), reflecting investor interest in focused plays such as manufacturing, defense, and EVs.

In contrast, flexi cap, focused, and value/contra funds saw relatively muted growth (10–13.5%), while traditionally stable categories like large cap, ELSS, and dividend yield funds lagged behind, indicating a shift in sentiment toward more aggressive and alpha-seeking strategies.

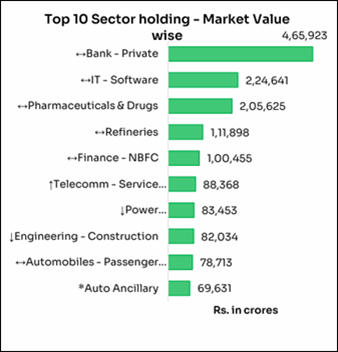

Core Sectors Dominate MF Holdings; Telecom and Auto Ancillary Gain Share

Mutual fund holdings remain concentrated in a few key sectors, with Private Banks accounting for the largest share at 30% of the top 10 sectoral AUM (Rs4.66 lakh crore). IT – Software and Pharmaceuticals follow with 15% and 13.5% shares respectively. The top five sectors remained unchanged, but the bottom half saw notable reshuffling. Telecom – Services rose to sixth position (Rs88,368 crore; 5.8%), reflecting increased investor interest in a sector poised for digital growth. Auto Ancillary, now at 4.5% (Rs69,631 crore), entered the top 10 for the first time, displacing Hospitals & Healthcare.

Meanwhile, Power and Engineering, Construction saw slight declines in position, despite sizeable allocations. The changes highlight selective portfolio realignment by fund managers, balancing sector rotation with long-term structural themes.