Certainty in an Uncertain World

FinTech BizNews Service

Mumbai, February 15, 2024: Were you worried about your investments when….

Lehman declared Bankruptcy, Sept 15th, 2008 and markets plummeted by 50%?

when the COVID Pandemic hit, March 2020, and cities turned into ghost towns and markets collapsed in a span of days?

When the world faced these crises even global leaders did not have clarity on the way forward. Financial experts struggled to make sense of the chaos unfolding around them and were unsure of how to tackle the panic and uncertainty that gripped investors worldwide.

However, Industry Veteran Mr. Ajit Dayal Founder of Quantum Advisors, has

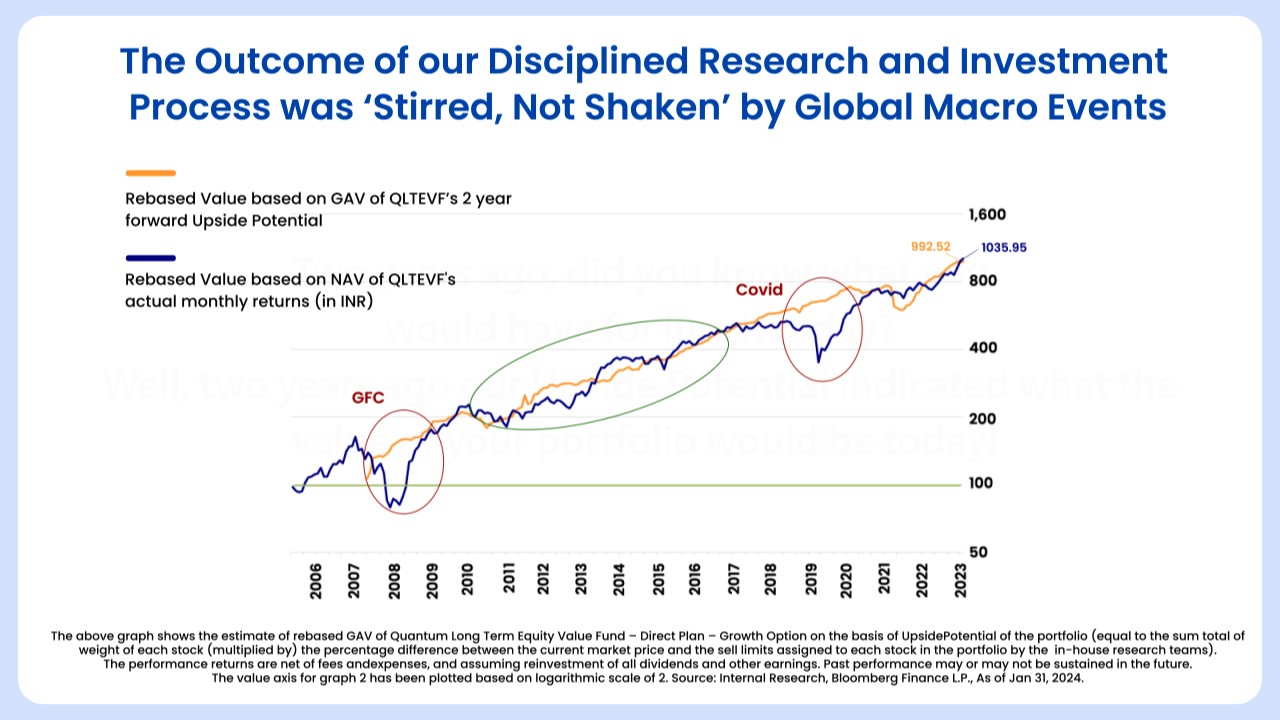

always believed that a steadfast investment approach backed by disciplined research & investment process can help investors navigate such crises and safeguard their portfolio in turbulent times. Ajit Dayal explains with the backdrop: “While the world seemed to shake & markets collapsed, Quantum had strong conviction in its portfolio and believed in its potential. A visual testament of this belief is our Unique Upside Potential chart calculated every month since April 2008, that estimates the Gross NAV of our Portfolio looking out 2 years into the future.”

The estimates indicate that the portfolio should have increased by 9.9 times in 17 years, 13.8% CAGR. In actual fact, the Portfolio NAV - after all expenses - increased by 10.4 times in 17 years, 14.1% CAGR. Ajit points out: “Our predictive power ensured that we were stirred, not shaken by two massive Global Macro Events: GFC and Covid.”

Uncertainties Still Prevail

In the current times, uncertainties such as market swings, inflation, geopolitical uncertainty & global slowdown dominate the investing landscape. Ajit states: “As the political landscape heats up, it is natural to be concerned about its potential impact on equity markets. The election results are unexpected & it’s difficult to predict market reaction. The key to weathering any uncertainty lies in adopting an investment strategy that offers predictability of outcomes with an ability to manage downside risk better.

We believe that our time-tested investment process to estimate Upside Potential can help navigate market volatility & achieve predictable outcomes even in the most uncertain of times. The certainty of outcome is the result of a disciplined research and bottom-up stock selection process that identifies opportunities that are undervalued relative to historical performance.”

QLTEVF

The Quantum Long Term Equity Value Fund (QLTEVF) is mindful of valuations by setting pre-defined buy-sell limits. Ajit elaborates: “We select companies trading at a 25-40% discount to its 2-year forward intrinsic value, coupled with catalysts for realizing their estimated upside potential. Quantum Long Term Equity Value Fund has carved a niche for itself, by being able to predict certainty in equity outcomes to provide stability to your portfolio. With a remarkable 17-year track record of weathering market cycles, QLTEVF has acted as an anchor in a sea of uncertainty.”

Spreading The Goodness Of Investing

Quantum Mutual Fund was established in 2006 with the launch of its first fund. Quantum Mutual Fund nurtures a partnership culture with investors, business partners, and employees to spread the goodness of investing. Quantum Mutual Fund is committed to providing simple Investment Solutions with transparency, and integrity.

Quantum now offers 12 simple and easy-to-understand products for achieving different financial goals. Ajit claims: “Our tried and tested research-oriented process gives a channel to get risk-adjusted returns that outperform the market in the long term. Quantum’s continued relevance is a product of its reputation as a trailblazer in the realm of mutual fund investing with a solid track record and a commitment of providing progressive investment strategies.”

(Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.)