The B30 universe with a collective equity AuM share in excess of 26% is a singular dimension that can sum up the potential of the market.

FinTech BizNews Service

Mumbai, April 19, 2025: The liberal step taken by SEBI to give impetus to growing the Mutual fund industry beyond the Top 30 locations has progressed in the right direction. The fast-disappearing digital divide, ease of access to information and expanding intermediation and advisory services have all come together to accelerate the retail investor participation from these locations.

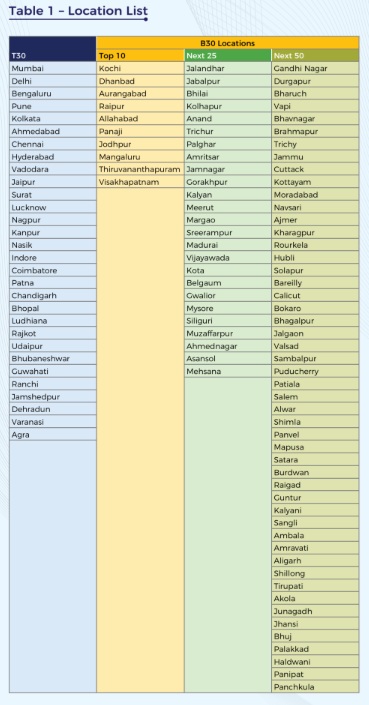

The CII-CAMS report titled “B30 locations - Performance & Potential” was recently released during the 18th edition of Mutual Fund summit. Pursuant to SEBI’s effort to support the growth of Mutual Funds in Tier-II and III cities and make mutual funds accessible and popular beyond the typical top tier cities, regulation provided AMCs with an option of charging additional TER (total expense ratio). Originally started as T15 (Top 15) and Beyond Top 15 (B15), this was expanded as T30 and B30 in 2018. T30 comprises of about 30 cities while B30 includes 404 cities and towns.

This report focuses on B30 locations to bring insights into growth trends, SIPs, Investor base and their preferences for the post-covid period viz. FY’23 to FY’25 (up to January’25). Data source is CAMS MFDEx (the largest data bureau serving the industry) which aggregates about 98% of the MF industry data for AuM.

Anuj Kumar, Managing Director, CAMS: "As we gave shape to the data, the insights brought out many pleasant surprises about the performance of B30 locations. The B30 universe with a collective equity AuM share in excess of 26% is a singular dimension that can sum up the potential of the market. While B30 locations continue to grow on the back of MFDs, digital adoption has to RIAs (registered investment advisors) making noticeable inroads into these markets. Another noteworthy dimension pointing to the vast opportunities of B30 locations is the 58% share of investor base (of the 3.6 Crore First holders base across CAMS serviced funds). The sachet investment SIP has played out exceedingly well in B30 locations, recording unprecedented new SIPs volumes and surpassing T30 locations. We believe investors and intermediaries from these locations can take the industry to its next tipping point."

Report Highlights:

T30 – B30 Asset Base

On an overall AuM basis, B30 locations have 18% share of the assets of the

industry. The share percentage improves vastly when we remove the concentrated

Institution led cash funds that emanates from T30 locations. Equity assets share

stands at 26% for B30 locations.

B30 AuM Growth by Locations

Higher growth witnessed beyond the Top10 B30 locations points to increasing

confidence in Mutual Funds as a wealth building route.

B30 locations have recorded over 2x Gross inflows into equity schemes in FY’25 compared to FY’23, keeping pace with the growth seen in T30 locations.

B30 Gross Sales by Distributor Type – Equity Schemes

MFDs’ unabated focus in the B30 markets is now fortified with the digital power of RIAs resulting in overall throughput from these markets, which has more than doubled from 2 years ago.

Banks have a greater opportunity with access to captive franchise.

Investor Base Growth Trend

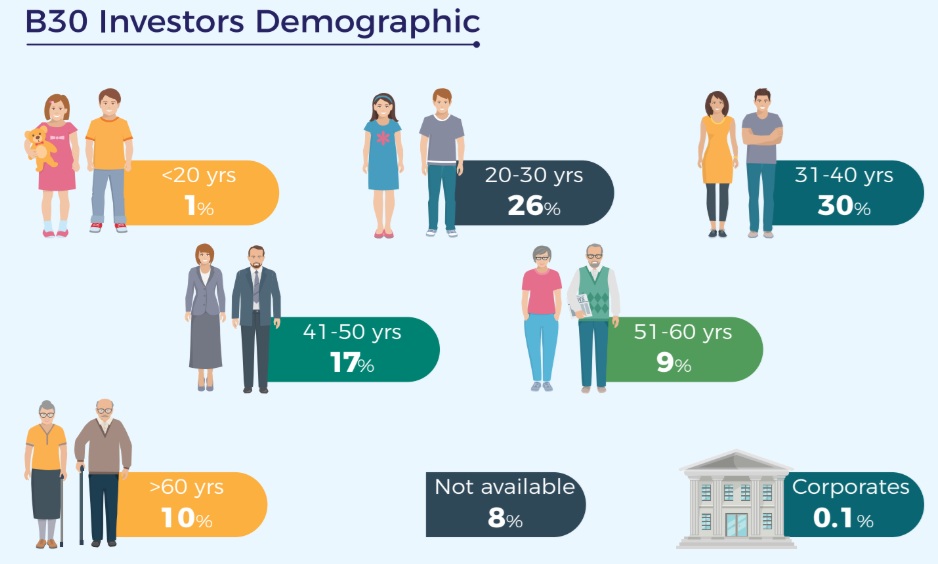

Investor base of B30 locations at 2 Cr. Has grown at a faster clip than T30 locations, sustaining the trend that began post Covid. 58% share points to the vast potential of these locations.

20-30 age group investors emerging as the fastest growing segment augurs well for the industry.

B30 Investors AuM holding

AuM holding at investor level points to about a third of the base having less than

Rs.10,000. The investor base in this band has perhaps increased with new investors

entering the MF arena with a smaller sum.

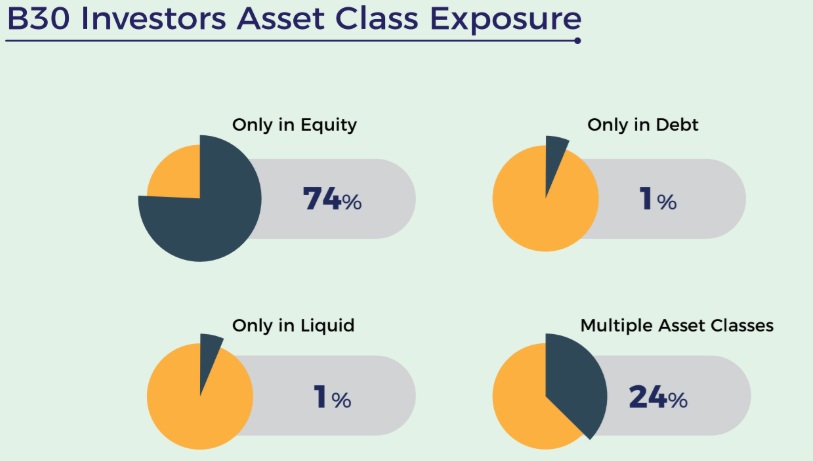

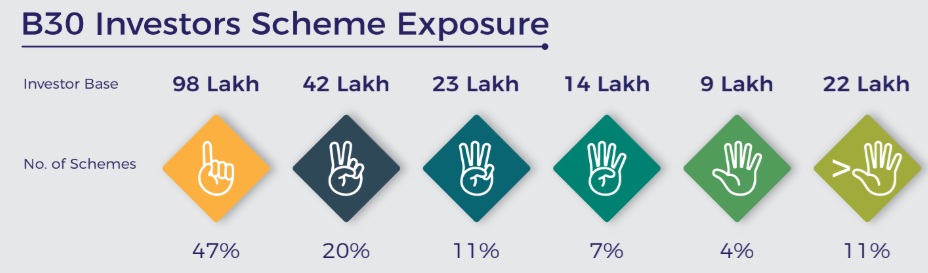

B30 Investors Scheme Exposure

Investors with exposure to more than 4 schemes has nudged up from 20% in March 2023 to 22% in January 2025.

Investor diversification of their investments to 2nd and 3rd fund houses is on an upward trend.

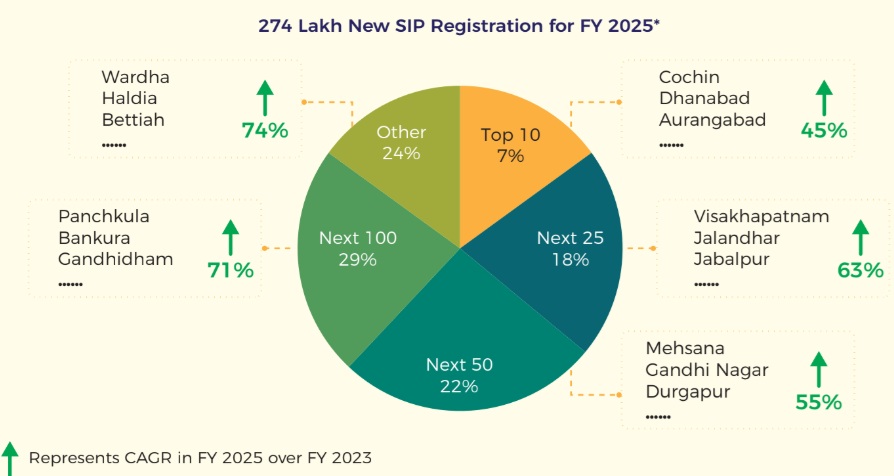

New SIP Registration Trend

At a staggering CAGR of 64%, new SIP registrations in B30 locations has seen significant share gain to touch 56% of new SIPs registered. (Share % is significant even if we discount a third of the volumes as investors based out of larger metros with KYC address in B30).

B30 New SIP Registrations by Location

Similar to AuM growth, B30 locations beyond Top10 are on a faster growth path evidencing broadening awareness of MF. (Lower net registration in FY’25 can be partially attributed to the clean-up exercise of past discontinued SIPs).

RIAs (registered investment advisors) have been on an overdrive recording nearly 4x volumes over FY’23 in gross SIP registrations.