FUND FOLIO (June 2024) report by Motilal Oswal Financial Services: Equity inflows accelerate amid volatilities, supported by higher NFOs ; The month saw notable changes in the sector and stock allocation of funds. On a MoM basis, the weights of Capital Goods, Automobiles, Telecom, Metals, Consumer Durables, Real Estate, and Infrastructure increased

FinTech BizNews Service

Mumbai, June 13, 2024: Motilal Oswal Financial Services has released its FUND FOLIO (June 2024) report today.

Key observations

- The Nifty, after scaling a new high of 23,111 in May’24, ended its three-month winning streak. The index oscillated 1,290 points before closing 74 points (or 0.3%) lower MoM at 22,531. DIIs recorded the tenth consecutive month of inflows in May’24 at USD6.7b, while FIIs reported outflows of USD3b.

- Equity AUM for domestic MFs (including ELSS and index funds) increased 2.7% MoM to INR27.7t in May’24 despite a weak market sentiment (with Nifty marginally declining 0.3% MoM). This rise in equity AUM was due to higher NFOs launched by mutual fund houses vs. the previous month, which led to an increase in equity scheme sales (up 20.4% MoM to INR788b). At the same time, redemptions decreased 1% MoM to INR396b. Consequently, net inflows rose significantly to INR392b in May’24 from INR254b in Apr’24.

- Total AUM of the MF industry rose 2.9% MoM to INR58.9t in May’24, driven by a MoM increase in AUM for equities (INR721b), liquid (INR382b), other ETFs (INR153b), income (INR150b), and arbitrage (INR144b) funds.

- Investors continued to park their money in mutual funds, with inflows and contributions in systematic investment plans (SIPs) reaching a new peak of INR209b in May’24 (up 2.6% MoM and 41.7% YoY).

Some interesting facts

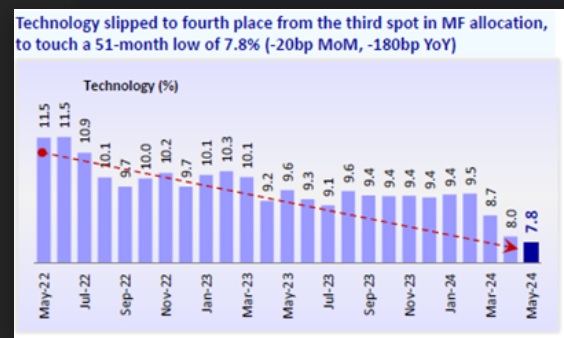

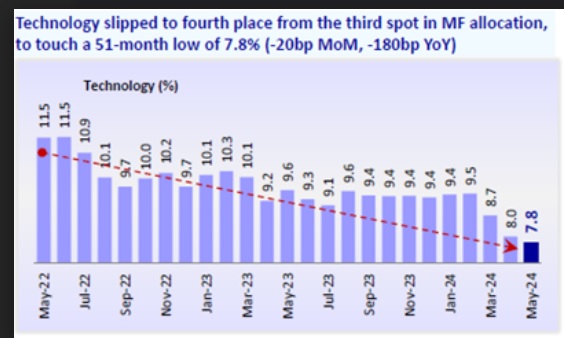

- The month saw notable changes in the sector and stock allocation of funds. On a MoM basis, the weights of Capital Goods, Automobiles, Telecom, Metals, Consumer Durables, Real Estate, and Infrastructure increased, while those of Technology, Oil & Gas, NBFCs, Healthcare, PSU Banks, Retail, and Chemicals moderated.

- Capital Goods’ weight increased to an eight and half-year high of 8.5% (+60bp MoM and +160bp YoY) in May’24. The sector now ranks third in mutual fund allocation – it was in the fourth position a month back and sixth a year back.

- Automobiles’ weight rose to a 68-month high of 8.7% (+40bp MoM, +80bp YoY) in May’24.

- Technology slipped to the fourth place from the third spot in MF allocation, with weights declining for the third consecutive month to touch a 51-month low of 7.8% (-20bp MoM, -180bp YoY).

- In terms of value increase MoM, divergent interests were visible within sectors: The top 5 stocks that saw a maximum rise in value were HDFC Bank (+INR92.2b), Bharat Electronics (+INR57.3b), M&M (+INR56.8b), Kotak Mah. Bank (+INR51.3b), and L&T (+INR40.1b).