Vishal Goenka: The yields on government securities will remain range bound and RBI is likely close to end of rate hike cycle

FinTech BizNews Service

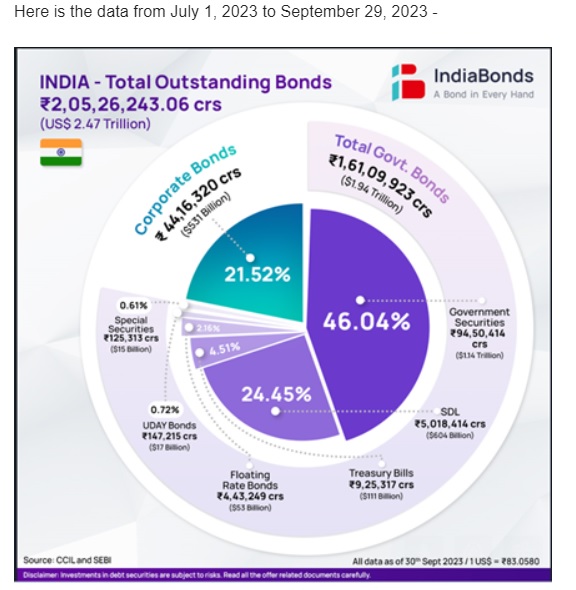

Mumbai, December 12, 2023: IndiaBonds.com has collated data of India’s total outstanding bonds (source: Clearing Corporation of India Limited (CCIL) and Securities and Exchange Board of India SEBI). The total outstanding bonds data is from July 1, 2023 to September 29, 2023. Also, the data from January to March 2023 and from April to June 2023 are attached and appended.

Vishal Goenka, Co-founder, IndiaBonds.com, updates: “The total outstanding government securities market stood at INR 161.1 trillion (source: RBI) which is an increase of 7.1% in FY 23-24 from INR 150.4 trillion as of 31 March 2023. The composition of the outstanding government bonds is worth observing. The yields on government securities will remain range bound and RBI is likely close to end of rate hike cycle. We think that short-end segment up to 3 years offers good value to retail investors as interest rates moved most in this segment and up by about 3.00% from Covid lows in 2020.”