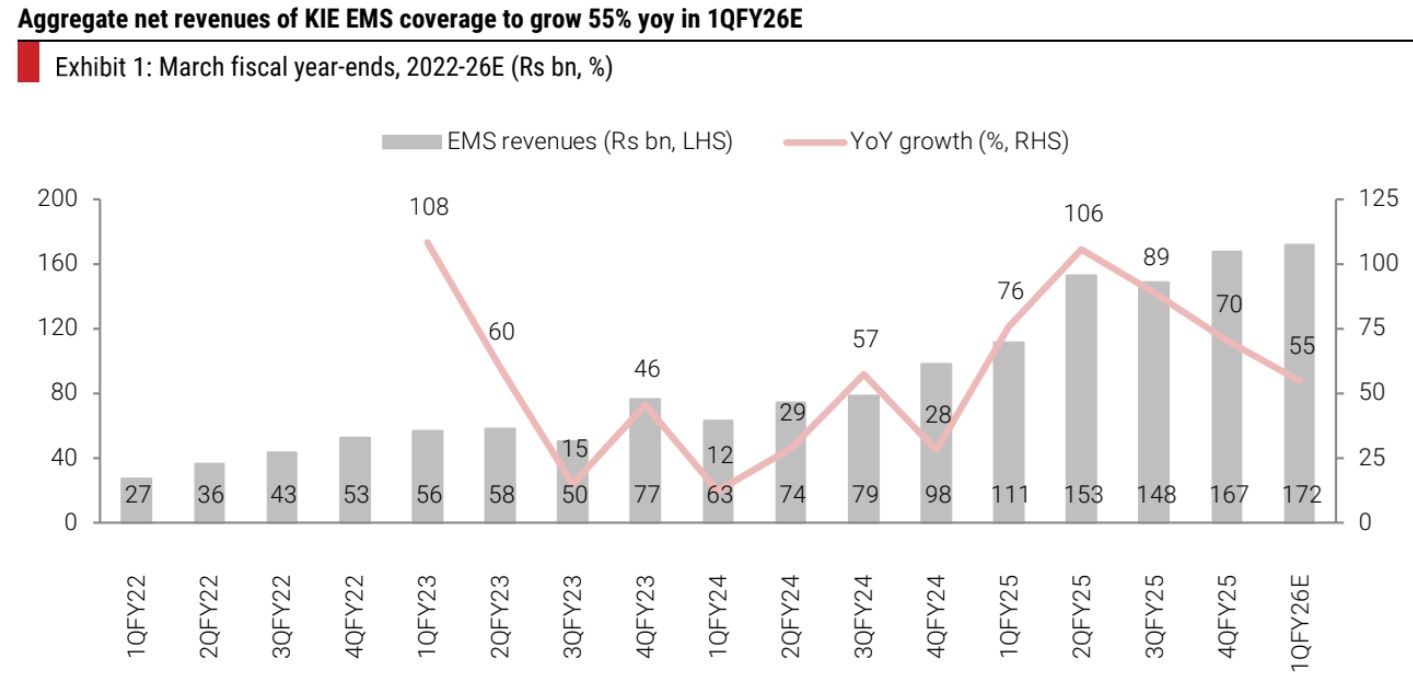

EMS: Sales expected to grow by 55% yoy and profitability remaining healthy

FinTech BizNews Service

Mumbai, July 3, 2025: Kotak Institutional Equities has come out with the latest report on Electronic Manufacturing Services Q1FY26 Earnings Preview.

Kotak Institutional Equities forecasts a strong start to FY2026 for its EMS coverage, with sales expected to grow by 55% yoy and profitability remaining healthy.

The KYI report on Electronic Manufacturing Services further states as follows:

1QFY26 preview: Execution-led growth

Among B2C players, Dixon is likely to deliver strong results, led by expanding exports and the scale-up of non-mobile segments. For Amber, we expect a modest growth despite a challenging summer.

On the B2B side, we believe that Kaynes will post a robust performance (up 53% yoy), driven by steady execution, a large orderbook and a robust demand environment. While Syrma may see moderate sequential growth, we expect a sharp improvement in profitability as the company reduces exposure to the low-margin consumer segment. Our preferred picks in the sector are Dixon, Amber and Syrma.

B2C segment: Dixon goes global, Amber shows resilience

1QFY26 has been a very weak season for AC manufacturers due to the early

onset of monsoon and unseasonal rains. We expect the industry to see a 25%

decline in RAC sales, yet Amber seems to have remained immune, supported

by the customer mix, exposure to components and the addition of new

customers. On the back of the above-mentioned factor, we forecast Amber to

grow 5% yoy in 1QFY26 and margins to see a 20 bps moderation due to an

increasing contribution from the electronics segment. Dixon, on the other hand, should continue to grow at a brisk pace (up 86% yoy), with mobile phone

volumes likely reaching 9.5 mn, led by (1) an increase in domestic sales and (2)

Motorola export volumes. Profitability will likely see some pressure (-7 bps yoy)

this quarter, as the share of the low-margin Mobile and EMS increases.

B2B segment: Kaynes continues to shine

Domestic demand remains robust, providing a strong tailwind for players such

as Kaynes and Syrma. We expect Kaynes to deliver over 53% yoy growth,

underpinned by a healthy demand environment, a sizable order book and

consistent execution. In addition, we anticipate a 120-bps margin expansion,

driven by the rising contribution from high-margin segments such

as aerospace and medical. Syrma, meanwhile, is poised for sequential growth,

supported by strength in the auto and industrial segments, although yoy may

decline due to a high base. In contrast, Cyient DLM is likely to post muted

results, impacted by a weak order book and the completion of the BEL

contract—however, order inflow remains a critical monitorable going forward.

EMS: Execution led growth

While overall we expect a strong 1QFY26 (+55% yoy) for our EMS coverage, the growth will be dominated by two large names, Dixon (+86%) and Kaynes (+53%); the rest of the companies are likely to see steady growth in the quarter. Within B2C stocks, we expect Amber too see 5% growth despite a weak summer season (which saw industry decline by 25%) due to its multi-brand exposure. Among the B2B stocks under coverage, steady domestic demand (Kaynes) and a favorable base (Avalon) should aid earnings this quarter. For Syrma, we expect a decline in revenue on a yoy basis as the company moves away from the low-margin consumer segment (high base); however, we expect a sharp yoy improvement in margins.

We forecast flat yoy for Cyient DLM on organic business; however, on a consolidated basis, the company should see a 30%+ yoy growth due to the Altek acquisition. With the completion of the BEL business, we expect the company’s dependence on export to further increase to 80%+, making it vulnerable to US policy uncertainty. Looking ahead, momentum in Auto and Industrial sectors remains key for the likes of Kaynes/Syrma and US policy outlook should drive revenue growth for Avalon/Cyient DLM

Dixon Technologies: We expect an 86% yoy growth (19% qoq) in revenues on the back of volume-led growth in mobile and rising contribution from telecom and IT hardware business. We forecast smartphone sales to be nearly 9.5 mn in Q1FY26, driven by (1) motorola export volumes (2) higher domestic sales. We model EBITDA margin at 3.7% (-7/-61 bps qoq/yoy basis), driven by a mix shift toward lower-margin Mobile and EMS segment.

Amber Enterprises: We expect 5% yoy growth despite a weak summer season—we estimate India volumes to decline 25% yoy for 1QFY26. However, we believe Amber will remain less impacted than most of the industry due to its (1) pan-India presence (2) multi-brand exposure. Additionally, Amber's other business, electronics and railways, should see steady growth this quarter. We model EBITDA margin at 8% (-20 bps yoy). A slight moderation in margins due to increasing contribution from the low-margin electronics segment.

Kaynes Technologies: We expect 53% yoy growth, driven by strong growth in auto, EV and industrial sectors. We model EBITDA margin of 14.5%, up 120 bps on a yoy basis, led by higher contribution from high-margin aerospace and medical segments.

Avalon Technology: We expect 32% yoy growth in revenues, driven by a rebound in the US and domestic operations, and also aided by a favorable base. We model EBITDA margin at 9.0% (+683bps yoy). The margin improvement was largely driven by positive operating leverage, as execution picks up.

Syrma SGS Technology: We expect a 14% yoy decline (+8% qoq) on account of a high base (higher consumer revenue in the base quarter). The strong growth in the auto and industrial segments partly makes up for the decline in the share of the consumer business. We model an EBITDA margin at 8.0% (+410 bps yoy). The improvement in the margin profile is driven by a lower contribution of consumer segment.

Cyient DLM: We expect 34% yoy growth, led by the contribution from the Altek acquisition. We are baking in flat revenues from the organic business and approx. US$10 mn from Altek. We model EBITDA margin at 8.5% (+74 bps yoy), driven by higher gross margin. As the low-margin BEL orders come to a close, we expect a large jump in gross margins; however, the translation to EBITDA will likely be lower, given the higher cost structure of Altek and low growth.