Outstanding digital personal loan portfolios reached 5.99 Cr accounts and Rs 1.28 Lakh Cr as of Sept 2025, with portfolio quality improving to 2.1 per cent dpd 90 plus.

FinTech BizNews Service

Mumbai, 3 Dec 2025: The Fintech Association for Consumer Empowerment (FACE), the RBI-recognised Self-Regulatory Organisation in the FinTech Sector (SRO-FT), has released its latest Digital Personal Loans Market Report for H1 FY25–26. Drawing on data from CRIF High Mark, a credit bureau from Apr 2022 to Sep 2025, the report captures how Digital NBFCs are now central to India’s personal loan market, significantly contributing to the expansion of formal credit and deepening inclusion.

Digital Personal Loans remain critical to India’s credit landscape. In H1 FY25 26, 6.4 Cr digital

personal loans were sanctioned worth Rs 97,381 Cr, making up 80 per cent of all personal

loan volumes and 19 per cent of sanction value. The average sanctioned ticket size rose to

Rs 15,177.

Compared to the same period last year (H1 FY24 25), digital personal lending has expanded

both in scale and value. Sanction volumes grew from 5.9 Cr to 6.4 Cr, while sanctioned value

increased from Rs 78,084 Cr to Rs 97,381 Cr, signalling stronger demand and improved

underwriting quality. Ticket size growth from Rs 13,327 to Rs 15,177 also indicates a shift

toward higher value lending as borrowers build credit history and repayment performance

continues to improve.

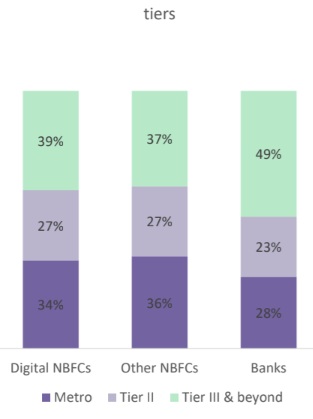

Outstanding digital personal loan portfolios reached 5.99 Cr accounts and Rs 1.28 Lakh Cr as

of Sept 2025, with portfolio quality improving to 2.1 per cent dpd 90 plus. Credit distribution

continues to widen, with 60 per cent of sanctioned value from borrowers under 35 years, 17

per cent sanctioned to women, and 53 per cent originating from Tier III and beyond,

demonstrating sustained expansion of formal credit access into young and emerging

segments.

Commenting on the report, Sugandh Saxena, CEO of FACE, said, “The FinTech lending

ecosystem is operating in sync with the public policy objective of digital financial inclusion for

inclusive growth and resilience. National Strategy for Financial Inclusion for 2025-30 released

this week is most timely and appropriate in recognising the role of small-value loans and

recommends, ‘to strengthen financial resilience of people, suitable and fair credit products

with easier documentation process and quick disbursals should be launched especially for

small ticket loans to prevent people from having to access informal sources of finance/

unauthorized digital lenders, etc. for small and urgent credit requirements.’ Access to formal,

suitable, convenient, and safe digital credit options is critical to support individuals and the

country’s consumption and resilience. India’s digital lending market is scaling sustainably on

the foundation of customer-protection, prudence, and risk management.

Key Highlights

▪ Digital NBFCs accounted for 80 per cent of personal loan sanction volume and 19 per cent

of value in H1 FY 25-26.

▪ 6.4 Cr digital personal loans worth Rs 97,381 Cr sanctioned in H1 FY 25- 26 .

▪ Outstanding digital personal loans reached Rs 1.28 lakh Cr across 5.99 Cr accounts as of

Sep 2025.

▪ DPD 90 plus improved to 2.1 per cent, reflecting improving portfolio quality.

▪ 60 per cent of the sanctioned value went to borrowers under 35 years and 17 per cent to

women.

▪ More than half of the sanction value went to Tier III and beyond, indicating a deeper

regional spread.

▪ Average ticket size increased to Rs 15,177 in H1 FY 25- 26.

Access the Report

The full report, titled ‘Digital Personal Loans – Sep 2025’, is available for download at:

https://faceofindia.org/wp-content/uploads/2025/12/Digital-Personal-Loans_-Sep-

2025_website.pdf