India's Unified Payments Interface, i.e. UPI, is now performing a new responsibility - Uniting Partners with India": "India's policy is 'Neighborhood First'. Our maritime vision is SAGAR i.e. Security And Growth for All in the Region": Narendra Modi

FinTech BizNews Service

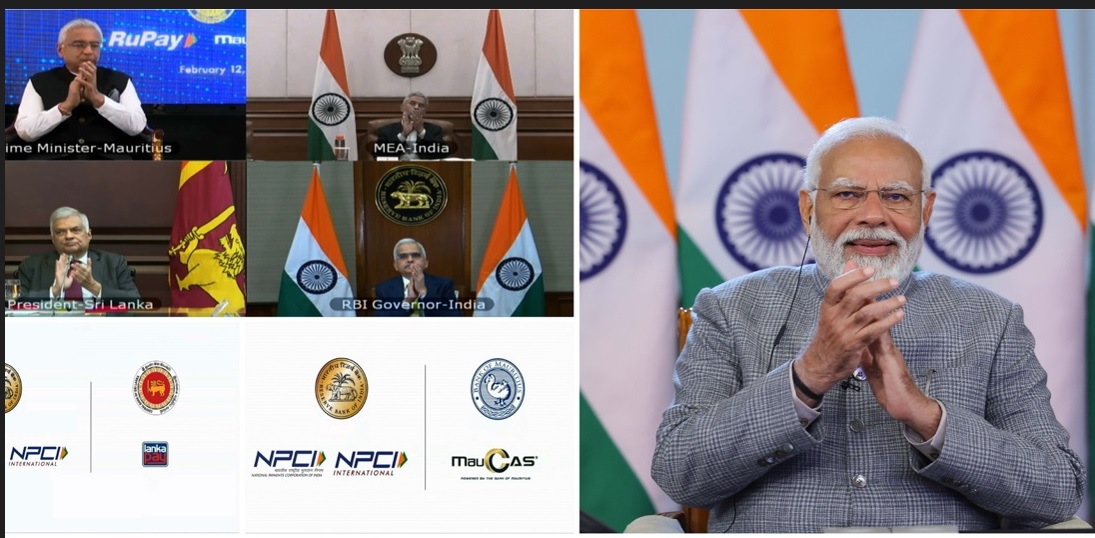

Mumbai, February 12, 2024: The Prime Minister, Shri Narendra Modi today along with the President of Sri Lanka, Mr Ranil Wickremesinghe and the Prime Minister of Mauritius, Mr Pravind Jugnauth jointly inaugurated the launch of Unified Payment Interface (UPI) services in Sri Lanka and Mauritius, and also RuPay card services in Mauritius via video conferencing.

Prime Minister of Mauritius, Mr Pravind Jugnauth informed that co-branded Rupay card will be designated as domestic card in Mauritius. Today’s launch, the Prime Minister said, will greatly facilitate the citizens of both countries.

President of Sri Lanka Mr Ranil Wickremesinghe congratulated the Prime Minister for the consecration of Shri Ram Mandir at the Ayodhya Dham. He also emphasized the centuries-old economic relations. The President hoped to maintain the momentum of connectivity and deepening of the relationship between the two countries.

Addressing the occasion, the Prime Minister said that today marks a special day for three friendly nations of India, Sri Lanka and Mauritius when their historic connections take the form of modern digital connect. He said that it is proof of the government’s commitment towards the development of the people. The Prime Minister underlined fintech connectivity will further strengthen cross-border transactions and connections. “India’s UPI or United Payments Interface comes in a new role today - Uniting Partners with India”, the Prime Minister emphasized.

The Prime Minister underlined that digital public infrastructure has brought about a revolutionary change in India, where the smallest of vendors in the remotest of villages are transacting via UPI and making digital payments. Speaking about the convenience and speed of UPI transactions, the Prime Minister informed that more than 100 billion transactions took place via UPI last year worth Rs 2 lakh crores or 8 trillion Sri Lankan rupees or 1 trillion Mauritius rupees. The Prime Minister also mentioned making last-mile delivery through the GEM Trinity of bank accounts, Aadhar and mobile phones where Rs 34 lakh crores or 400 billion US dollars has been transferred into the bank accounts of beneficiaries. The Prime Minister informed that with CoWin Platform India conducted the world's biggest vaccination programme. “Use of technology is promoting transparency, reducing corruption and increasing inclusivity in society”, the Prime Minister said.

Reserve Bank of India Governor, Shri Shaktikanta Das, Bank of Mauritius Governor, Mr. Harvesh Seegolam, and Central Bank of Sri Lanka Governor, Dr. P. Nandalal Weerasinghe were also present on the occasion.

With this connectivity, an Indian traveller to Mauritius will be able to pay a merchant in Mauritius using UPI. Similarly, a Mauritian traveller will be able to do the same in India using the Instant Payment System (IPS) app of Mauritius. Further, with the adoption of RuPay technology, the MauCAS card scheme of Mauritius will enable banks in Mauritius to issue RuPay cards domestically. Such cards can be used at ATMs and PoS terminals locally in Mauritius as well as in India. With this, Mauritius becomes the first country outside Asia to issue cards using RuPay technology. Indian RuPay cards would also be accepted at ATMs and PoS terminals in Mauritius.

The digital payments connectivity with Sri Lanka will enable Indian travellers to make QR code-based payments at merchant locations in Sri Lanka using their UPI apps.

These projects have been developed and executed by NPCI International Payments Limited (NIPL) along with partner banks / non-banks from Mauritius and Sri Lanka, under the guidance and support of Reserve Bank of India. The Bank of Mauritius and the Central Bank of Sri Lanka have also played an important role in making these possible. The above facilities have been made operational through select banks / non-banks / Third Party Application Providers in India, Mauritius and Sri Lanka. Going forward, these facilities will be scaled up.

The collaborations on India's digital payments connectivity with Mauritius and Sri Lanka through UPI and RuPay will deepen financial integration and strengthen the long historical, cultural, and economic relations of India with Mauritius and Sri Lanka.

The Prime Minister stressed that “India’s policy is ‘Neighborhood First’. Our maritime vision is SAGAR i.e. Security and growth for all in the region. India does not see its development separately from its neighbors.”

Referring to the Vision Document that was adopted during the last visit of the Sri Lankan President, the Prime Minister highlighted the strengthening financial connectivity as its key component. With Prime Minister Pravind Jugnauth also, these discussions were conducted as he was the special guest during the G20 Summit.

The Prime Minister expressed the confidence that connection with UPI will benefit Sri Lanka and Mauritius and digital transformation will get a boost, local economies will witness positive change and tourism will be promoted. “I am confident that Indian tourists will give priority to destinations with UPI. People of Indian origin living in Sri Lanka and Mauritius and students studying there will also get special benefits from it”, the Prime Minister added. PM Modi expressed delight that after Nepal, Bhutan, Singapore and UAE in the Gulf in Asia, now from Mauritius RuPay card is being launched in Africa. This will also facilitate the people coming to India from Mauritius. The need to buy hard currency will also reduce. The UPI and RuPay card system will enable real-time, cost-effective and convenient payments in our own currency. In the coming time, we can move towards cross-border remittances i.e. Person to Person (P2P) payment facility, the Prime Minister added.

The Prime Minister underlined that today's launch symbolizes the success of Global South cooperation. “Our relations are not just about transactions, it is a historical relation”, PM Modi emphasized highlighting the strength of people-to-people relations between the three nations. Drawing attention to India supporting its neighboring friends in the last ten years, the Prime Minister said that India stands up for its friends in every hour of crisis, be it natural disasters, health-related issues, economic or support on the international stage. “India has been the first responder and will continue to be so”, the Prime Minister underlined. PM Modi also highlighted the special attention towards the concerns of the Global South Even during India’s G20 presidency. He mentioned setting up a Social Impact Fund to extend the benefits of India’s digital public infrastructure to countries in the Global South.

Concluding the address, the Prime Minister extended his heartfelt gratitude towards President Ranil Wickremesinghe and Prime Minister Pravind Jugnauth who played a vital role in today’s launch. He also thanked the central banks and agencies of the three countries for making this launch successful.

Background

India has emerged as a leader in Fintech innovation and Digital Public Infrastructure. The Prime Minister has strongly emphasized sharing our development experiences and innovation with partner countries. Given India’s robust cultural and people-to-people linkages with Sri Lanka and Mauritius, the launch will benefit a wide cross-section of people through a faster and seamless digital transaction experience and enhance digital connectivity between the countries.

The launch will enable the availability of UPI settlement services for Indian nationals travelling to Sri Lanka and Mauritius as well as for Mauritian nationals travelling to India. The extension of RuPay card services in Mauritius will enable Mauritian banks to issue cards based on RuPay mechanism in Mauritius and facilitate usage of RuPay Card for settlements in India and Mauritius.