Trends in remittances

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, June 28, 2024: India has retained its position as the world leader in remittance inflows in 2023 as well. Over the last

decade, remittance inflows into India have seen a steady increase due to the presence of a wide

diaspora of foreign residents spread across the World. The Gulf Cooperation Countries and the USA

remain the biggest sources of remittance to India, followed by the UK.

There has also been a sharp pickup in remittance outflows under the RBI’s liberalized remittance

scheme (LRS). The increase is majorly driven by higher remittance outflow towards travel, while

maintenance of close relatives also retains its significance.

We expect a further pickup in both remittance inflows as well as outflows in FY25, with the former

likely to grow at a faster pace due to a recovery in global growth. This should help keep the current

account deficit contained at 1-1.5% of GDP in FY25.

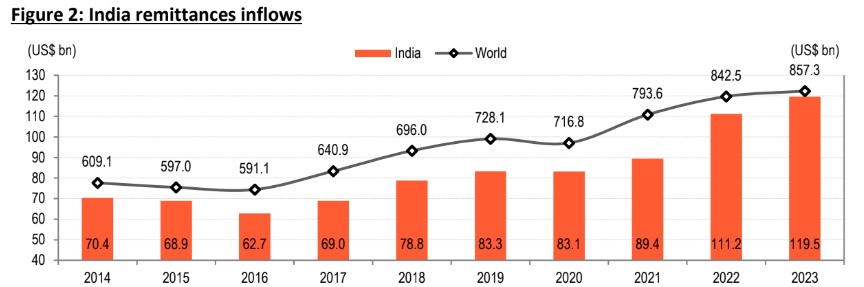

Global picture of remittance inflows:

Global remittance inflows have seen a steady increase in the last few years. From just US$ 580.6bn in

2013, remittance inflows have risen to US$ 857.3bn as per World Bank estimates. Country wise, India

is the highest recipient of these inflows at US$ 119.5bn in 2023, accounting for a share of 13.9% of

total inflows. India’s dominance in global remittance inflows can be gauged from the fact that inflows

into Mexico, which is the second highest recipient of remittances, is almost half of the amount

remitted into India. China received the third highest remittances in 2023 at US$ 49.5bn, accounting

for 5.8% of total global remittance inflows. Other South-Asian countries such as Pakistan and

Bangladesh also feature in the list of the top 10 highest remittance receiving countries.

Remittance inflows into India:

Remittance inflows into India have increased steadily over the years. In fact, India has retained its

place at the top of the table with respect to remittance inflows in each of the last 10 years. From about

US$ 70bn in 2013, remittance inflows into India have increased to US$ 119.5bn in 2023, at a CAGR of

5.5%. In comparison, global remittance inflows have increased by 4% in the same period. Within the

top 10 remittance receiving countries, only Mexico registered a higher growth in remittances than

India, at 10.7% in the last 10 years. On the other hand, there has been a decline of 1.8% in remittances

to China. In fact, while Mexico ranked 5th amongst the top 10 in 2013, and gradually replaced China at

the second place in 2023.

In terms of sources of remittance inflows, globally, the US is the largest source of remittance to the

world and accounted for over 25% of total remittance inflows in the world in 2021. This was followed

by the Gulf Cooperation Countries (GCC) which accounted for another 17%. Apart from these,

Germany, the UK and Russia are also important contributor to global remittance flows.

For India, GCC countries accounted for over 40% of total remittance inflows in 2021, led by United

Arab Emirates. USA with a share of close to 17% and UK with a share of 5% are other important

contributors.

Further, results of RBI survey indicate that over 40% of remittances inflows into India in 2020-21 were

for family maintenance, followed by deposits in banks which accounted for close to 35% of total

inflows.

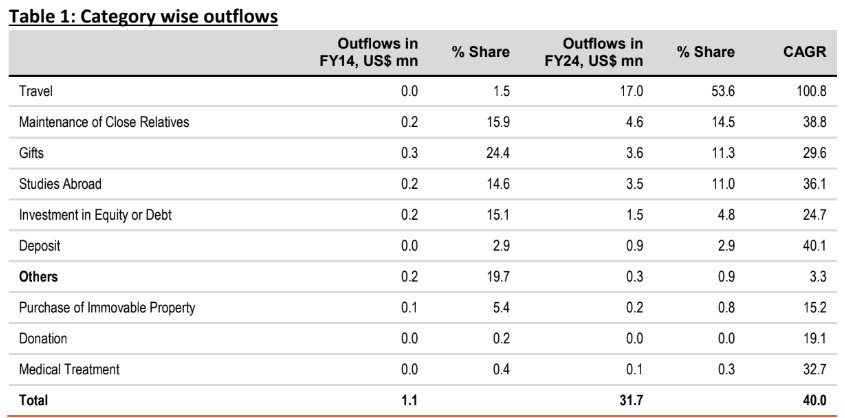

Outward remittances from India:

There has also been a commensurate increase in India’s outward remittance in the last 10 years. From

just US$ 1.1bn in FY14, remittance outflows increased to US$ 31.7bn in FY24. This translates into a

CAGR of over 40%, which is much higher than the CAGR of remittance inflows in the same period.

Barring FY21, which was marked by the Covid-19 pandemic, remittance outflows from India have

shown a clear upward trend.

Looking at the granular data, some interesting facts emerge. Over the last 10 years, there has been a

significant change in the nature of outward remittances. Purpose wise, ‘gifts’ had the highest share in

India’s outward remittance in FY14, followed by ‘others’. Maintenance of close relatives and

investment in equity/debt were the other major heads. On the other hand, their share has declined

significantly in subsequent years. Travel has emerged as the primary source of remittance outflow

from India, accounting for 53.6% of total outflows in FY24 from just 1.5% share in FY14. An increase in

disposable income and growth of aspirational middle class in the country, there has been an increase

in foreign travel. This trend gained further traction after travel restrictions due to the Covid-19

pandemic were lifted. The share of maintenance of close relative has remained around 15% over the

last 10 years. However, there has been a sharp decline in the share of gifts and education in this period.

Concluding remarks:

Remittances play an important role in a country’s balance of payment position. This is especially true

for countries like India which consistently run a deficit on the current account due to an unfavorable

trade balance position. In India, the current account deficit has averaged a little over 1% of GDP in the

last 10 years, while the merchandise trade deficit has been much higher at over 6% of GDP. Support

to the current account has stemmed from services and remittance receipts. At 3% of GDP in FY24, net

remittances have helped ease the pressure on the current account and thus improve the country’s

external stability.