The Company has reported exponential growth in its Payments GMV, underpinned by robust user adoption, innovative product offerings, and an expanded merchant network; MobiKwik delivers all-time high Payments GMV of INR 1 Lakh Crore+ (1 Tn) with best-in-class Payments Margin of 13 bps

FinTech BizNews Service

Mumbai, May 20, 2025: One MobiKwik Systems Ltd. (MobiKwik) (NSE: MOBIKWIK/ BSE: 544305), India’s largest digital wallet**, announced its earnings results (standalone and consolidated) for the quarter and full year ended March 31, 2025. The Company has reported exponential growth in its Payments GMV, underpinned by robust user adoption, innovative product o erings, and an expanded merchant network.

Payments GMV: INR 1,159 Bn, up 203% YoY. Payment Gross margin remained best in class at over 20%, led by optimized direct costs for the payment gateway and user incentives

● Total Income: INR 11,925 Mn, up 34% YoY, driven by strong growth of 142% in the payments revenue

● Contribution margin (CM): Revenue mix tilted towards Payments leading to a lower CM of 30%; revenue from distribution of financial products lower amid sector headwinds for lending

● EBITDA: Loss of -6.7% due to lower contribution and slightly higher fixed costs YoY Key Financial Highlights FY25 FY25 vs FY24

The Company has reported exponential growth in its Payments GMV, underpinned by robust user adoption, innovative product o erings, and an expanded merchant network. Historically, the Company has demonstrated profitability in the quarters where its contribution margin exceeded 30%. The Company expects a revival of its contribution margin, systematically returning to profitability in the near term.

● Platform Growth:

User base: 176.4 Mn with 4.4 Mn new users onboarded in this quarter - Merchant base: 4.59 Mn with 76K new merchants added in this quarter

● Payments Business: - Payments GMV grew over 2.3x YoY in Q4FY25, reaching INR 331 Bn - Payments revenue grew 2x YoY in Q4FY25 to INR 2,116 Mn - Industry-leading Payments Gross Margin at 24%, up 26% QoQ With the strong increase in payments GMV and an uptick in financial services distribution, the Company remains confident in capitalizing on the operating leverage inherently built into its business model to drive value-accretive growth.

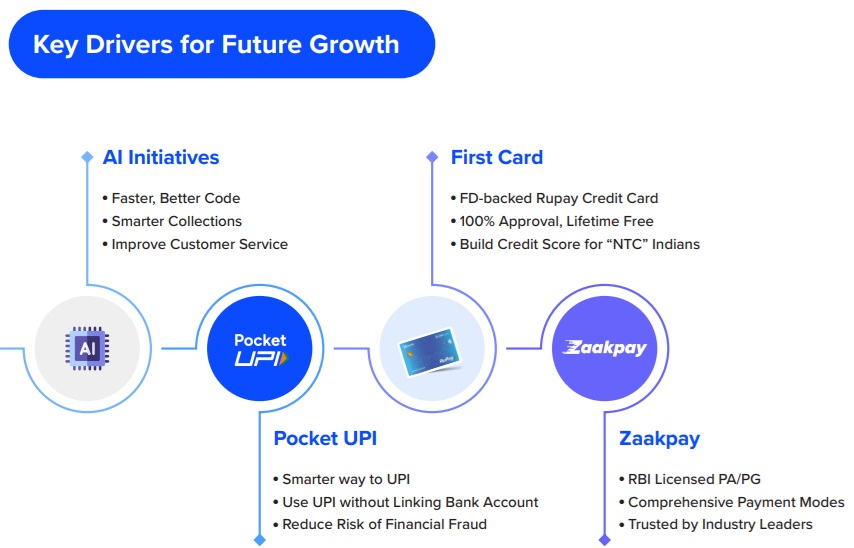

"Our Payments Business has shown remarkable strength, growing threefold year-over-year. Our focus for this year will be to leverage AI as a growth catalyst - to accelerate go-to-market, drive revenue growth, and expand margins through intelligent automation." Ms. Upasana Taku Executive Director, Co-founder & CFO One MobiKwik Systems Ltd.

● Financial Highlights:

Total Income: INR 2,785 Mn, up 2.6% from INR 2,716 Mn in Q4FY24 - EBITDA: loss of INR 458 Mn, due to lower contribution margins, even as the fixed costs reduced QoQ - Fixed Cost: 5.4% fixed cost reduction this quarter is driven by the Company’s focus on enhanced digital journeys, increasing scale benefits, and optimizing costs across all line items.

● The company's subsidiary Zaakpay received RBI approval in April 2025 to operate as an authorized Payment Aggregator/Payment Gateway.

● Partnered with Piramal Finance to o er personal loans ranging from INR 50,000 to INR 2,00,000.

● Upasana Taku, elected as Vice-President of Unified Fintech Forum (UFF), formerly Digital Lenders Association of India (DLAI)’s Executive Committee